Blank 1099 Form 2016

What is the Blank 1099 Form

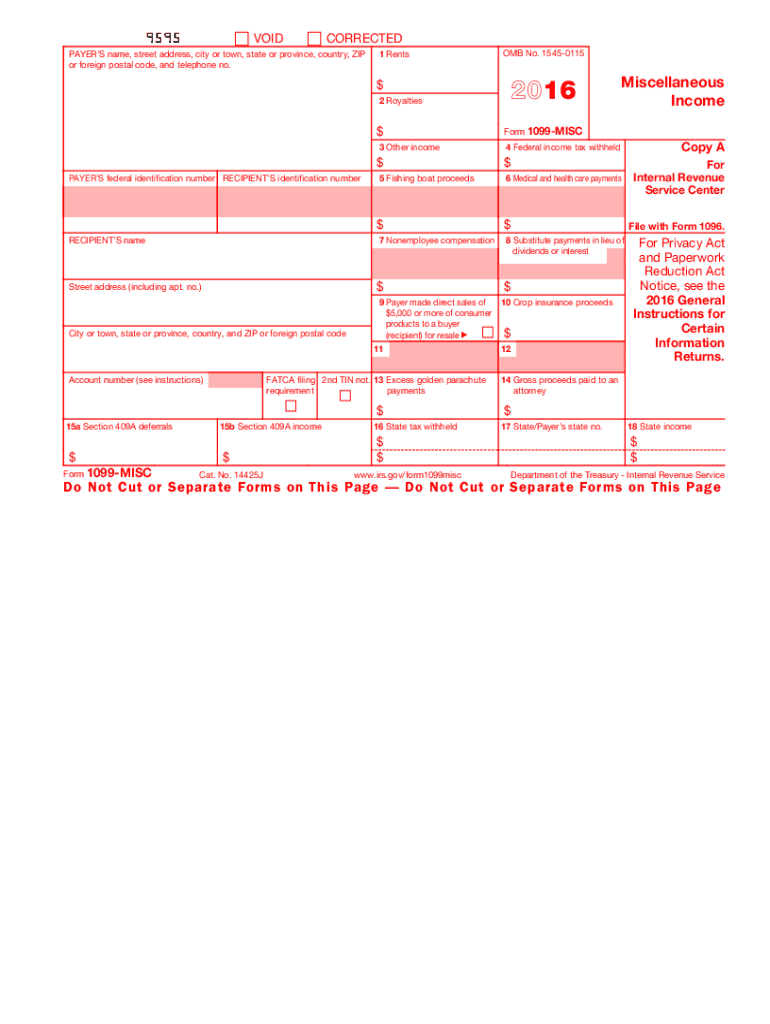

The Blank 1099 Form is a crucial tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses and individuals who have made payments to non-employees, such as independent contractors or freelancers. The 1099 series includes several variations, but the most commonly referenced is the 1099-MISC, which reports miscellaneous income. Understanding the purpose and function of the Blank 1099 Form is essential for compliance with IRS regulations and ensuring accurate tax reporting.

How to use the Blank 1099 Form

Using the Blank 1099 Form involves several key steps to ensure that all necessary information is accurately reported. First, gather the required information about the recipient, including their name, address, and taxpayer identification number (TIN). Next, determine the type of income being reported and enter the appropriate amount in the designated box on the form. It is important to ensure that the information is complete and accurate, as errors can lead to penalties or delays in processing. After completing the form, it must be submitted to the IRS and a copy provided to the recipient by the specified deadline.

Steps to complete the Blank 1099 Form

Completing the Blank 1099 Form requires careful attention to detail. Follow these steps:

- Obtain the correct version of the form, typically the 1099-MISC or 1099-NEC, depending on the type of income.

- Fill in your business name, address, and TIN in the payer section.

- Enter the recipient's name, address, and TIN in the payee section.

- Report the total amount paid to the recipient in the appropriate box.

- Include any additional information, such as federal income tax withheld, if applicable.

- Review the form for accuracy before submission.

Legal use of the Blank 1099 Form

The Blank 1099 Form is legally recognized as a valid means of reporting income to the IRS. To ensure compliance, it is essential to adhere to IRS guidelines regarding the information that must be reported. This includes accurately reporting all payments made to non-employees that meet or exceed the reporting threshold. Failure to issue a 1099 Form when required can result in penalties for the payer. Additionally, recipients must report the income received on their tax returns, making the accurate completion of this form vital for both parties involved.

Filing Deadlines / Important Dates

Filing deadlines for the Blank 1099 Form are critical for compliance with IRS regulations. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which the payments were made. If filing electronically, the deadline may extend to March second. Recipients must also receive their copies of the form by January thirty-first. It is important to mark these dates on your calendar to avoid late filing penalties.

Who Issues the Form

The Blank 1099 Form is typically issued by businesses or individuals who have made payments to non-employees. This includes a wide range of entities, such as corporations, partnerships, and sole proprietorships. If you are a business owner or freelancer who has received payments for services rendered, you may also be required to issue a 1099 Form to report your income. Understanding who issues the form helps clarify responsibilities for tax reporting and compliance.

Quick guide on how to complete blank 2016 1099 form

Effortlessly Prepare Blank 1099 Form on Any Device

Digital document management has gained popularity among enterprises and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, adjust, and eSign your documents quickly and efficiently. Manage Blank 1099 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Edit and eSign Blank 1099 Form with Ease

- Locate Blank 1099 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or a sharing link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your preference. Edit and eSign Blank 1099 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct blank 2016 1099 form

Create this form in 5 minutes!

How to create an eSignature for the blank 2016 1099 form

How to make an eSignature for your Blank 2016 1099 Form in the online mode

How to create an eSignature for your Blank 2016 1099 Form in Chrome

How to create an electronic signature for putting it on the Blank 2016 1099 Form in Gmail

How to make an electronic signature for the Blank 2016 1099 Form straight from your smartphone

How to generate an electronic signature for the Blank 2016 1099 Form on iOS devices

How to generate an electronic signature for the Blank 2016 1099 Form on Android OS

People also ask

-

What is a Blank 1099 Form and why do I need it?

A Blank 1099 Form is a tax document used to report various types of income other than wages, salaries, or tips. Businesses typically need it to report payments made to independent contractors or freelancers. By utilizing a Blank 1099 Form, you can ensure compliance with IRS regulations and avoid potential penalties.

-

How can airSlate SignNow help me with filling out a Blank 1099 Form?

airSlate SignNow offers an intuitive platform that allows you to easily fill out and eSign a Blank 1099 Form. With our user-friendly interface, you can quickly input necessary information and send the form securely to your recipients. This streamlines the process, ensuring you stay organized and compliant during tax season.

-

Is there a cost associated with using airSlate SignNow for Blank 1099 Forms?

Yes, airSlate SignNow provides various pricing plans that cater to different business needs. Our plans include features that allow you to create, send, and manage Blank 1099 Forms at a competitive price. We also offer a free trial so you can explore our services before committing.

-

Can I customize my Blank 1099 Form using airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your Blank 1099 Form to meet your specific requirements. You can add your company logo, adjust fields, and ensure the form captures all necessary data, making it tailored for your business needs.

-

What integrations does airSlate SignNow offer for managing Blank 1099 Forms?

airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems to enhance your workflow. This means you can easily access and manage your Blank 1099 Forms alongside your other business documents. Our integrations help streamline your processes and ensure all your data is in one place.

-

Is airSlate SignNow secure for handling Blank 1099 Forms?

Yes, airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your documents, including Blank 1099 Forms. We comply with industry standards and provide audit trails to track document activity, ensuring that your sensitive information remains safe and secure.

-

Can I send a Blank 1099 Form for signature through airSlate SignNow?

Definitely! airSlate SignNow allows you to send your Blank 1099 Form directly to recipients for electronic signatures. This feature simplifies the signing process, ensuring your documents are signed quickly and efficiently, which is particularly valuable during the busy tax season.

Get more for Blank 1099 Form

Find out other Blank 1099 Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online