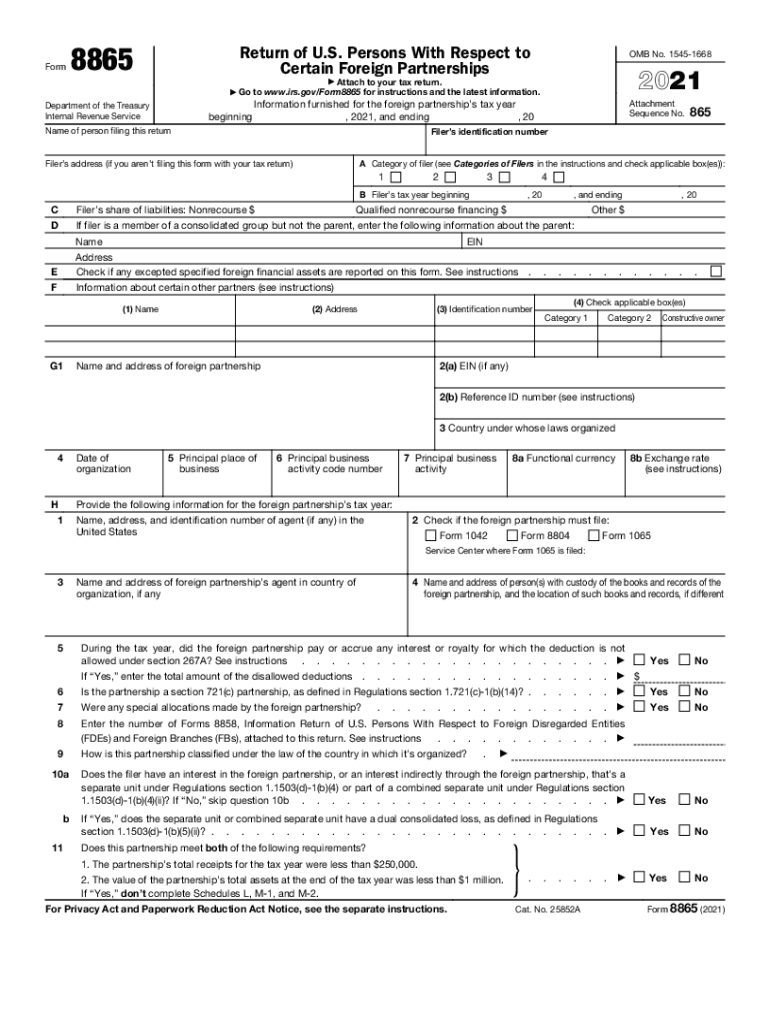

Form 8865 Return of US Persons with Respect to Certain 2021

What is the Form 8865 Return of US Persons With Respect to Certain Foreign Partnerships?

The Form 8865 is a tax document required by the IRS for U.S. persons who have certain interests in foreign partnerships. This form is essential for reporting the activities and financial information of these partnerships, ensuring compliance with U.S. tax laws. It is particularly relevant for individuals who own a stake in foreign partnerships or are involved in transactions with them. Failure to file this form can lead to significant penalties, making it crucial for eligible taxpayers to understand its requirements and implications.

Steps to Complete the Form 8865 Return of US Persons With Respect to Certain Foreign Partnerships

Completing the Form 8865 involves several key steps to ensure accurate reporting. Begin by gathering all necessary information regarding the foreign partnership, including its name, address, and tax identification number. Next, determine your ownership percentage and the type of partnership interest you hold. Fill out the form by providing details about the partnership's income, deductions, and other relevant financial data. Ensure that all information is complete and accurate to avoid delays or penalties. After completing the form, review it carefully before submission.

Legal Use of the Form 8865 Return of US Persons With Respect to Certain Foreign Partnerships

The legal use of Form 8865 is governed by IRS regulations, which stipulate that U.S. persons must report their interests in foreign partnerships. This form is legally binding and must be filed to comply with U.S. tax laws. It serves as a declaration of ownership and financial involvement in foreign entities, helping to prevent tax evasion and ensure transparency. Adhering to the legal requirements associated with this form is essential for maintaining compliance and avoiding potential legal repercussions.

Filing Deadlines / Important Dates for Form 8865

Filing deadlines for Form 8865 are typically aligned with the tax return deadlines for U.S. taxpayers. Generally, the form is due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships that operate on a calendar year, this means the form is due by April 15. If additional time is needed, taxpayers can file for an extension, but it is crucial to ensure that the extension is filed on time to avoid penalties. Staying informed about these deadlines is vital for compliance.

Penalties for Non-Compliance with Form 8865

Failure to file Form 8865 or inaccuracies in reporting can result in substantial penalties. The IRS imposes a penalty of up to $10,000 for each failure to file, with additional penalties for continued non-compliance. Moreover, if the IRS deems the failure to be intentional, the penalties can increase significantly. It is essential for U.S. persons with interests in foreign partnerships to understand these risks and ensure timely and accurate filing to avoid financial consequences.

Required Documents for Form 8865

When preparing to file Form 8865, certain documents are necessary to provide complete and accurate information. These documents typically include partnership agreements, financial statements, and records of transactions involving the partnership. Additionally, any documentation that supports the ownership percentage and type of interest held should be included. Having these documents on hand will facilitate the completion of the form and help ensure compliance with IRS requirements.

Quick guide on how to complete form 8865 return of us persons with respect to certain

Complete Form 8865 Return Of US Persons With Respect To Certain effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Form 8865 Return Of US Persons With Respect To Certain on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and eSign Form 8865 Return Of US Persons With Respect To Certain without hassle

- Find Form 8865 Return Of US Persons With Respect To Certain and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring document searches, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your preference. Edit and eSign Form 8865 Return Of US Persons With Respect To Certain and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8865 return of us persons with respect to certain

Create this form in 5 minutes!

How to create an eSignature for the form 8865 return of us persons with respect to certain

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an e-signature straight from your mobile device

How to make an e-signature for a PDF file on iOS

The best way to generate an e-signature for a PDF document on Android devices

People also ask

-

What is form 8865 and why is it important?

Form 8865 is a tax form that U.S. persons must file to report information about controlled foreign partnerships. Understanding form 8865 is crucial for compliance with IRS regulations and can help avoid penalties. Utilizing tools like airSlate SignNow can simplify the completion and signing of form 8865.

-

How can airSlate SignNow help with filling out form 8865?

airSlate SignNow provides an easy-to-use platform for creating, filling, and eSigning documents, including form 8865. With our template library, users can quickly access the necessary resources and streamline the form completion process. This efficiency helps ensure accuracy and timely submission.

-

What features does airSlate SignNow offer for form 8865 processing?

airSlate SignNow offers features like customizable templates, secure eSigning, and document tracking for form 8865. Users can collaborate in real-time, making it easier to ensure all necessary information is included before submission. Our platform also enhances document management efficiency for tax-related paperwork.

-

Is there a pricing plan for using airSlate SignNow with form 8865?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, all optimized for form 8865 processing. Our plans are designed to be cost-effective, making it accessible for individuals and businesses alike. Explore our pricing options on our website to find the best fit for you.

-

Can I integrate airSlate SignNow with other software while processing form 8865?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easier to manage form 8865 alongside your existing systems. Whether you use accounting software or document management tools, our platform can seamlessly fit into your workflow.

-

What are the benefits of using airSlate SignNow for form 8865?

Using airSlate SignNow for form 8865 improves efficiency and reduces the risk of errors in document handling. Our secure eSigning feature ensures that your submissions are legally binding and compliant with IRS standards. Additionally, our platform saves time by streamlining the entire process, allowing you to focus on your core business tasks.

-

How secure is my data when using airSlate SignNow for form 8865?

Security is a top priority at airSlate SignNow. When handling form 8865, all user data is encrypted and stored securely, ensuring protection against unauthorized access. Our platform complies with legal standards to safeguard sensitive information, providing peace of mind for all your document signing needs.

Get more for Form 8865 Return Of US Persons With Respect To Certain

- Excavator contract for contractor connecticut form

- Renovation contract for contractor connecticut form

- Concrete mason contract for contractor connecticut form

- Demolition contract for contractor connecticut form

- Framing contract for contractor connecticut form

- Security contract for contractor connecticut form

- Insulation contract for contractor connecticut form

- Paving contract for contractor connecticut form

Find out other Form 8865 Return Of US Persons With Respect To Certain

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself