8865 Form 2014

What is the 8865 Form

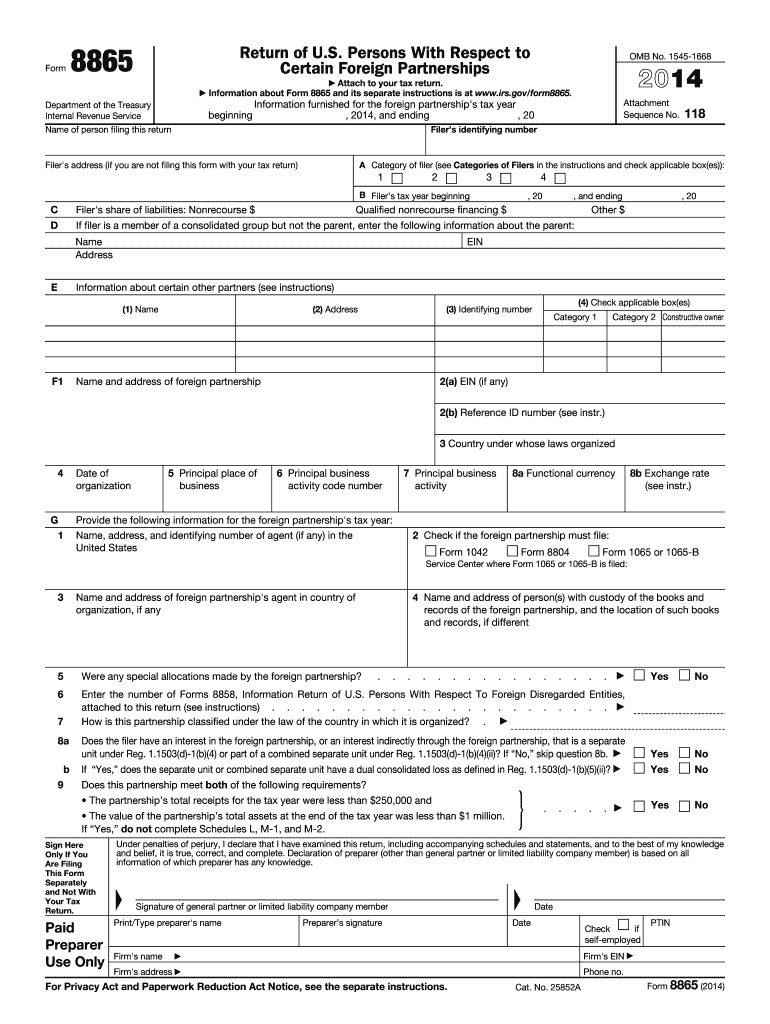

The 8865 Form, officially known as the Return of U.S. Persons With Respect to Certain Foreign Partnerships, is a tax form used by U.S. taxpayers to report their interests in foreign partnerships. This form is particularly relevant for individuals or entities that have a significant stake in foreign partnerships, ensuring compliance with U.S. tax laws. The 8865 Form serves to disclose income, deductions, and credits associated with these partnerships, helping the IRS assess tax liabilities accurately.

How to use the 8865 Form

Using the 8865 Form involves several steps to ensure accurate reporting of foreign partnership interests. Taxpayers must first determine their filing requirement based on the level of ownership in the foreign partnership. Once the necessity to file is established, individuals should gather relevant financial information about the partnership, including income statements and balance sheets. After completing the form, it should be submitted alongside the taxpayer's annual income tax return, ensuring all necessary schedules and attachments are included for a comprehensive submission.

Steps to complete the 8865 Form

Completing the 8865 Form requires careful attention to detail. Here are the essential steps:

- Identify your filing category: There are different categories based on ownership percentage and the type of partnership.

- Gather financial documents: Collect necessary financial statements and information from the foreign partnership.

- Fill out the form: Accurately enter information regarding the partnership's income, deductions, and other relevant data.

- Review for accuracy: Double-check all entries to avoid errors that could lead to penalties.

- Submit the form: File the completed form with your annual tax return by the designated deadline.

Legal use of the 8865 Form

The legal use of the 8865 Form is critical for compliance with U.S. tax regulations. Filing this form is mandatory for U.S. persons who meet specific criteria regarding their involvement with foreign partnerships. Failure to file can result in significant penalties, including fines and interest on unpaid taxes. The form must be completed accurately and submitted on time to ensure that taxpayers fulfill their legal obligations and avoid complications with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 8865 Form align with the annual tax return due dates. Typically, the form must be submitted by the 15th day of the fourth month following the close of the tax year. For taxpayers on a calendar year, this means the deadline is April 15. If an extension is filed for the tax return, the deadline for submitting the 8865 Form may also be extended. It is essential to stay informed about any changes to these deadlines to ensure timely compliance.

Required Documents

To complete the 8865 Form accurately, several documents are necessary. Taxpayers should prepare:

- Partnership financial statements, including income statements and balance sheets.

- Records of contributions and distributions from the partnership.

- Documentation of ownership percentages and any changes throughout the year.

- Previous years' tax returns, if applicable, for reference.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the 8865 Form can lead to severe penalties. The IRS imposes fines for failure to file, which can range from $10,000 to $50,000 depending on the circumstances. Additionally, interest may accrue on any unpaid taxes associated with the foreign partnership. It is crucial for taxpayers to understand these potential consequences and ensure timely and accurate filing to avoid financial repercussions.

Quick guide on how to complete 2014 8865 form

Effortlessly prepare 8865 Form on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage 8865 Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign 8865 Form with ease

- Obtain 8865 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from any device you prefer. Edit and eSign 8865 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 8865 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 8865 form

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the 8865 Form?

The 8865 Form is a tax document used by U.S. persons who have control in foreign partnerships. This form is essential for reporting specific information about your share in the partnership to the IRS. Understanding the 8865 Form is vital for compliance and tax reporting.

-

How can airSlate SignNow simplify the process of signing the 8865 Form?

airSlate SignNow streamlines the signing process for the 8865 Form by offering a user-friendly electronic signature platform. Users can fill out, sign, and send the form digitally, reducing paperwork and enhancing efficiency. This is especially beneficial for businesses dealing with international partnerships.

-

What features does airSlate SignNow offer for managing the 8865 Form?

airSlate SignNow provides advanced features like document templates, real-time collaboration, and secure storage for managing the 8865 Form. These tools allow users to customize their forms, track signature progress, and ensure document security. This makes the management of important tax documents more accessible and organized.

-

Is there a cost associated with using airSlate SignNow for the 8865 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those for managing the 8865 Form. The plans are structured to provide cost-effective solutions without compromising on features. Users can choose a plan that best suits their volume of document handling.

-

How does airSlate SignNow ensure the security of my 8865 Form?

airSlate SignNow prioritizes the security of your documents, including the 8865 Form, with robust encryption protocols and secure data storage. Additionally, the platform complies with industry standards and regulations to protect sensitive information. This ensures that your tax documents are safe throughout the signing process.

-

Can I integrate airSlate SignNow with other software for the 8865 Form?

Absolutely! airSlate SignNow offers versatile integrations with various software applications, enhancing the functionality around the 8865 Form. This allows you to sync your documents and streamline workflows with your favorite accounting or tax software seamlessly.

-

What are the benefits of using airSlate SignNow for the 8865 Form?

Using airSlate SignNow for the 8865 Form offers numerous benefits, including increased efficiency and reduced errors in document processing. The platform allows for quick sending and signing of documents, which accelerates the overall tax preparation process. Additionally, users enjoy the convenience of digital storage and easy access to their documents at any time.

Get more for 8865 Form

- Dor tax forms ingov 536231109

- Free form schedule m1w minnesota income tax withheld

- Pdf form mo crp 2018 certification of rent paid missouri

- Form e 6 nov 2020

- State tax filing guidance for coronavirus pandemic aicpa form

- Tax year 2020 form met 2 adj application for refund of maryland estate tax

- 2021 form 592 v payment voucher for resident and nonresident withholding

- 2021 form 592 resident and nonresident withholding statement 2021 form 592 resident and nonresident withholding statement

Find out other 8865 Form

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online