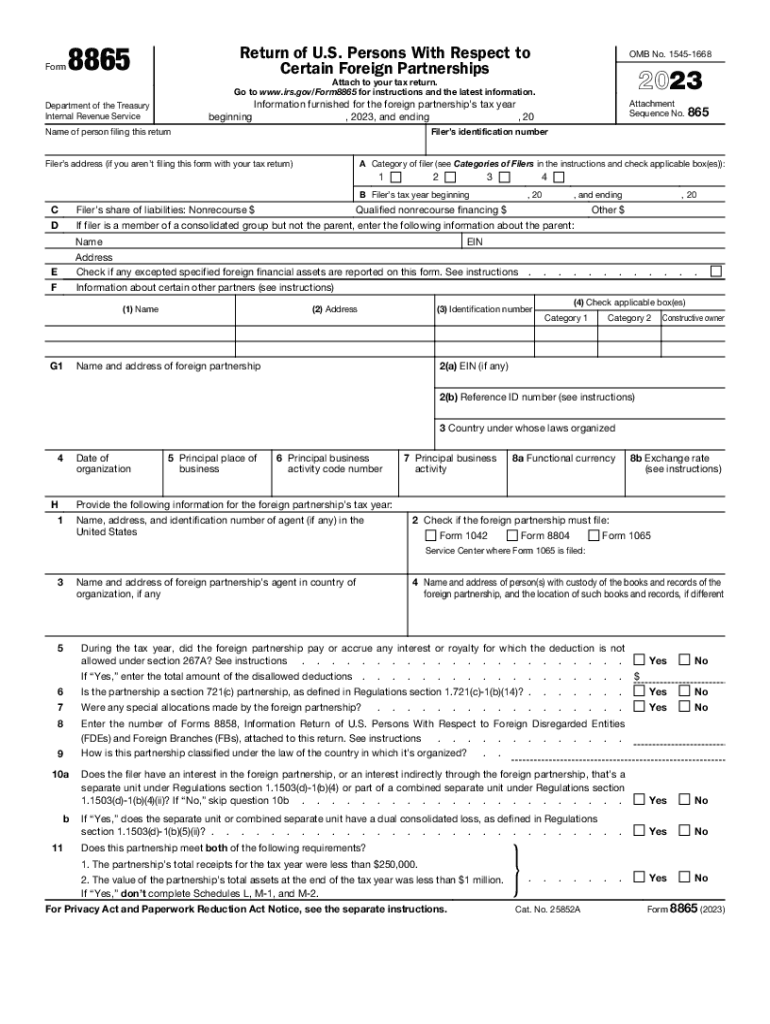

Irs Official Site Forms 2023

Understanding IRS Publication 559

IRS Publication 559 provides essential information for individuals dealing with the estate of a deceased taxpayer. It outlines the tax responsibilities and procedures that must be followed when handling the financial affairs of a decedent. This publication is particularly useful for executors, administrators, and beneficiaries who need to understand their obligations regarding income tax, estate tax, and the filing of necessary forms.

Key Elements of IRS Publication 559

This publication covers several critical topics, including:

- Tax obligations for estates and beneficiaries

- Filing requirements for the final tax return of the deceased

- Information on income in respect of a decedent

- Guidance on the estate tax return and filing deadlines

Steps to Complete IRS Forms Related to Publication 559

When dealing with the estate of a deceased taxpayer, it is important to follow these steps:

- Gather all necessary documents, including the deceased's final tax return and any relevant financial records.

- Determine if you need to file a final return for the deceased or an estate tax return.

- Complete the appropriate forms, such as IRS Form 706 for estate tax or Form 1040 for the final income tax return.

- Submit the forms by the specified deadlines to avoid penalties.

Filing Deadlines for IRS Publication 559

Understanding the deadlines for filing is crucial to ensure compliance. Generally, the final income tax return for a deceased taxpayer is due on the same date as it would have been if they were alive, typically April 15 of the following year. If an estate tax return is required, it must be filed within nine months of the date of death, although a six-month extension may be requested.

Legal Use of IRS Publication 559

IRS Publication 559 serves as an authoritative guide for legal and tax professionals navigating the complexities of estate taxation. It provides the necessary legal framework for understanding the rights and responsibilities of those managing a deceased individual's estate. Adhering to the guidelines in this publication helps ensure compliance with federal tax laws.

Examples of Situations Requiring IRS Publication 559

There are various scenarios where IRS Publication 559 is applicable, including:

- Handling the estate of a recently deceased family member

- Managing a trust that receives income after the grantor's death

- Filing taxes for a decedent who had multiple sources of income

Quick guide on how to complete irs official site forms

Complete Irs Official Site Forms effortlessly on any device

Web-based document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Official Site Forms on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The optimal method to modify and eSign Irs Official Site Forms effortlessly

- Locate Irs Official Site Forms and then click Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or displaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choosing. Modify and eSign Irs Official Site Forms and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs official site forms

Create this form in 5 minutes!

How to create an eSignature for the irs official site forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Publication 559?

IRS Publication 559 is a resource provided by the Internal Revenue Service that details tax information for individuals dealing with a decedent's estate. It outlines what taxpayers need to know about income in respect of a decedent and how to file estates and trusts. Understanding IRS Publication 559 is essential for accurate tax compliance.

-

How does airSlate SignNow help with IRS Publication 559 related documents?

AirSlate SignNow streamlines the eSigning and document management process for any IRS Publication 559 related forms or documents. Our platform enables users to create, send, and sign documents securely and efficiently, ensuring compliance and easy access to tax-related paperwork. With airSlate SignNow, managing your documents becomes hassle-free.

-

What features does airSlate SignNow offer for IRS Publication 559 compliance?

AirSlate SignNow offers robust features such as customizable templates, audit trails, and in-app notifications to ensure your IRS Publication 559 documentation is compliant and well-organized. Additionally, eSignature capabilities help speed up the process of gathering necessary approvals, making tax filing easier. These tools empower businesses to maintain compliance efficiently.

-

What are the pricing options for airSlate SignNow?

AirSlate SignNow provides flexible pricing plans tailored to meet various business needs, starting from a basic plan to more advanced options. Our pricing is cost-effective, especially for those managing IRS Publication 559 related documents regularly. Explore our plans to find the best fit for your document signing requirements.

-

Can airSlate SignNow integrate with accounting software for IRS Publication 559 forms?

Yes, airSlate SignNow integrates seamlessly with various accounting software to streamline the management of IRS Publication 559 forms. This integration enhances workflow efficiency by allowing users to import necessary documents directly from their accounting tools. Simplifying these processes ensures timely and accurate submission of tax-related documents.

-

How does airSlate SignNow enhance security for IRS Publication 559 documents?

AirSlate SignNow prioritizes the security of your documents, including those related to IRS Publication 559. We implement advanced encryption technologies, secure storage solutions, and strict user authentication to protect sensitive information. With airSlate SignNow, you can trust that your documents are safe and compliant.

-

Is airSlate SignNow suitable for individual taxpayers dealing with IRS Publication 559?

Absolutely! AirSlate SignNow is designed to be user-friendly for individuals managing their IRS Publication 559 paperwork. Whether you are an estate administrator or an individual taxpayer, our platform simplifies the eSigning process, allowing for convenient and straightforward document handling.

Get more for Irs Official Site Forms

- Sui northern gas pipelines limited form

- City of new york office of central processing form

- Corporation of the city of kingston certificate of insurance form

- Wc 240 easyfillforms com

- Test frida gratis form

- Taxpayer identification number form

- La baby crib certificate of compliance form

- Dv dash risk assessment and referral form oct equation org

Find out other Irs Official Site Forms

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple