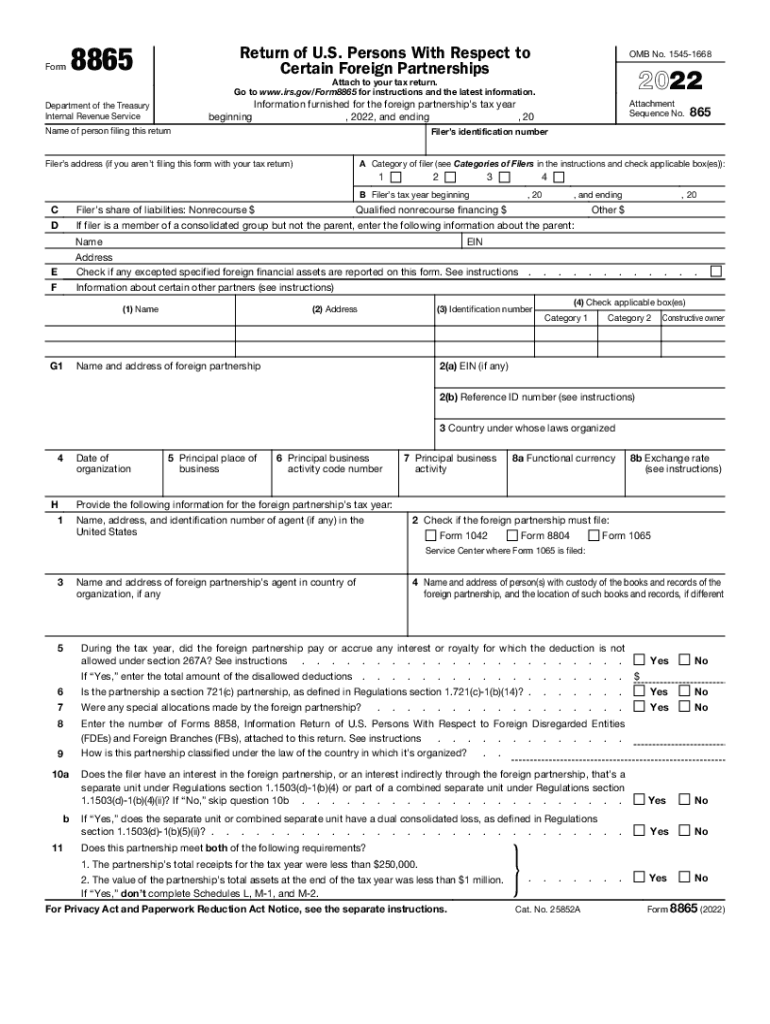

Form 8865 Return of U S Persons with Respect to Certain Foreign Partnerships 2022

What is the Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships

The Form 8865 is a tax form required by the Internal Revenue Service (IRS) for U.S. persons who have certain interests in foreign partnerships. This form is essential for reporting information about the partnership and the taxpayer's share of income, deductions, and credits. It is particularly relevant for individuals who are partners in foreign partnerships or who have ownership interests that meet specific thresholds set by the IRS. Understanding the requirements and implications of this form is crucial for compliance with U.S. tax laws.

How to use the Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships

Using Form 8865 involves several steps to ensure all necessary information is accurately reported. First, determine if you are required to file the form based on your ownership interest in a foreign partnership. Next, gather all relevant financial information regarding the partnership, including income, expenses, and distributions. Complete the form by providing details about the partnership, your ownership percentage, and any transactions that occurred during the tax year. Finally, ensure that the form is submitted by the designated deadline to avoid penalties.

Steps to complete the Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships

Completing Form 8865 requires careful attention to detail. Follow these steps:

- Identify your filing requirement based on your ownership interest.

- Collect financial records related to the foreign partnership.

- Fill out the form, ensuring that all sections are completed accurately.

- Report your share of partnership income, deductions, and credits.

- Review the form for accuracy before submission.

- Submit the form electronically or by mail, depending on your preference.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 8865. These guidelines include instructions on who must file, what information is required, and how to report various types of income and transactions. It is important to consult the latest IRS publications and instructions related to Form 8865 to ensure compliance with current tax laws and regulations. Following these guidelines helps avoid potential issues with the IRS and ensures that all necessary information is reported accurately.

Filing Deadlines / Important Dates

Filing deadlines for Form 8865 are crucial for compliance. Generally, the form is due on the same date as your tax return. If you are filing an extension for your tax return, the extension also applies to Form 8865. It is important to be aware of any changes to deadlines, especially if you are filing for a partnership that has a different fiscal year. Keeping track of these dates helps avoid penalties and ensures timely reporting of all required information.

Penalties for Non-Compliance

Failing to file Form 8865 or submitting it inaccurately can result in significant penalties. The IRS imposes penalties for late filings, which can accumulate quickly. Additionally, if the form is not filed when required, the IRS may impose fines that can reach thousands of dollars. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate reporting for those with interests in foreign partnerships.

Quick guide on how to complete 2022 form 8865 return of us persons with respect to certain foreign partnerships

Complete Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships effortlessly on any gadget

Web-based document handling has become increasingly favored among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely retain it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without delays. Manage Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships on any device with airSlate SignNow Android or iOS applications and enhance any document-driven activity today.

The simplest way to modify and eSign Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships without hassle

- Locate Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form 8865 return of us persons with respect to certain foreign partnerships

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it benefit 2018 return persons?

airSlate SignNow is an easy-to-use platform that empowers 2018 return persons to send and eSign documents efficiently. With its cost-effective solutions, users can streamline their document signing process, ensuring quick turnaround times and enhanced workflow management.

-

How does airSlate SignNow handle pricing for 2018 return persons?

The pricing structure of airSlate SignNow is designed to be budget-friendly for 2018 return persons. Various plans are available, catering to different needs, ensuring that users can choose an option that suits their size and requirements without overspending.

-

What features does airSlate SignNow offer that cater to 2018 return persons?

airSlate SignNow offers a range of features for 2018 return persons, including customizable templates, templates for tax documents, and secure cloud storage. These features make it easier for users to prepare, send, and manage various documents associated with their tax returns.

-

Can I integrate airSlate SignNow with other tools I use for 2018 return processes?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used by 2018 return persons, such as CRMs, project management tools, and accounting software. This integration simplifies the workflow for users and enhances overall productivity.

-

What security measures does airSlate SignNow have in place for 2018 return persons?

For 2018 return persons, airSlate SignNow implements robust security measures such as encryption, secure cloud storage, and compliance with industry regulations. This ensures that sensitive information related to tax returns remains safe and protected throughout the signing process.

-

How easy is it to get started with airSlate SignNow for 2018 return persons?

Getting started with airSlate SignNow is straightforward for 2018 return persons. The platform offers a user-friendly interface and guided tutorials, allowing users to create, send, and manage their documents without any technical expertise.

-

What benefits can 2018 return persons expect from using airSlate SignNow?

2018 return persons can expect numerous benefits from using airSlate SignNow, including increased efficiency in document handling, reduced turnaround times, and improved accuracy in signing processes. This leads to a smoother experience during the busy tax season.

Get more for Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships

- Tenant welcome letter ohio form

- Warning of default on commercial lease ohio form

- Warning of default on residential lease ohio form

- Landlord tenant closing statement to reconcile security deposit ohio form

- Oh name change form

- Name change notification form ohio

- Commercial building or space lease ohio form

- Ohio workers compensation form

Find out other Form 8865 Return Of U S Persons With Respect To Certain Foreign Partnerships

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT