8865 Form 2015

What is the 8865 Form

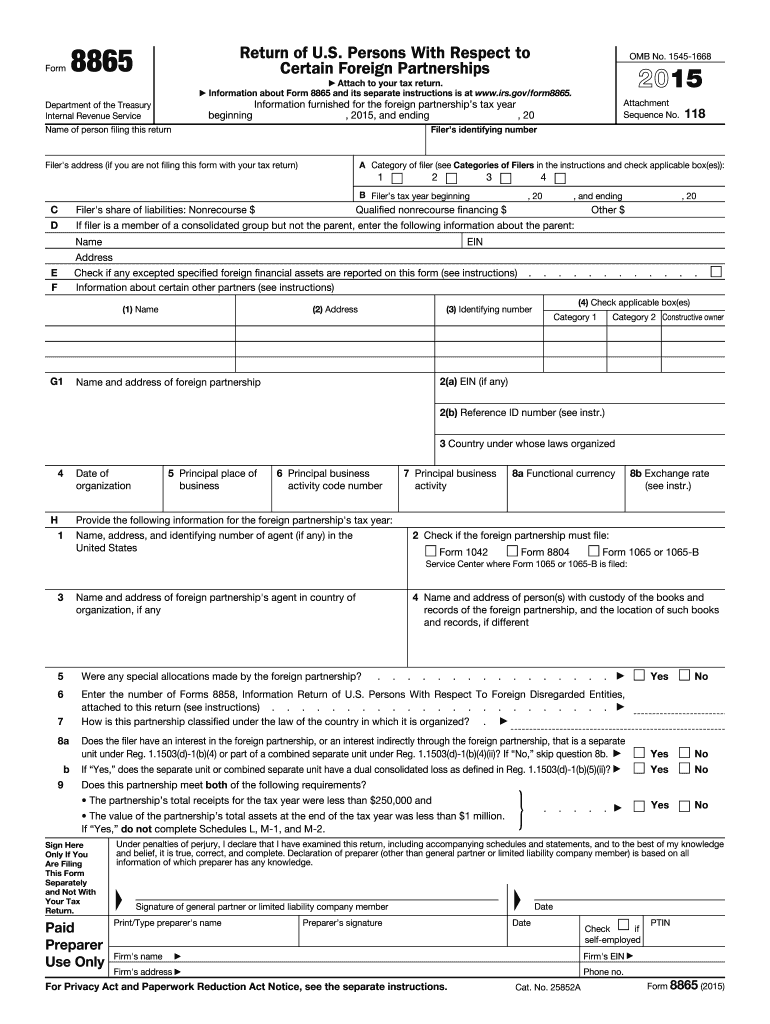

The 8865 Form is a tax document used by U.S. taxpayers to report information regarding certain foreign partnerships. Specifically, it is required for U.S. persons who own an interest in a foreign partnership and must disclose their share of the partnership's income, deductions, and credits. This form is essential for compliance with U.S. tax laws and helps the Internal Revenue Service (IRS) track foreign income and ensure proper taxation.

How to use the 8865 Form

To effectively use the 8865 Form, taxpayers must first determine if they meet the criteria for filing. This includes owning a direct or indirect interest in a foreign partnership. Once eligibility is established, the form should be filled out with accurate information regarding the partnership's financials, including income, expenses, and distributions. It is crucial to follow the IRS guidelines closely to ensure all required information is included, as incomplete submissions may lead to penalties.

Steps to complete the 8865 Form

Completing the 8865 Form involves several key steps:

- Gather necessary documentation, including partnership agreements and financial statements.

- Identify your ownership percentage in the partnership and any relevant transactions.

- Fill out the form, ensuring all sections are completed accurately, including income and deductions.

- Review the form for accuracy and completeness before submission.

- Submit the form by the appropriate deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 8865 Form typically align with the tax return deadlines for U.S. taxpayers. Generally, the form is due on the same date as the taxpayer's income tax return, which is usually April 15. However, if an extension is filed for the tax return, the deadline for the 8865 Form may also be extended. It is important to stay informed about any changes to filing dates to ensure timely submission.

Penalties for Non-Compliance

Failing to file the 8865 Form or submitting it incorrectly can result in significant penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, taxpayers may face scrutiny during audits if they do not report their foreign partnership interests properly. Understanding these penalties underscores the importance of accurate and timely filing.

Required Documents

To complete the 8865 Form accurately, several documents are typically required:

- Partnership agreements that outline ownership interests.

- Financial statements from the partnership, including profit and loss statements.

- Records of any distributions received from the partnership.

- Any relevant correspondence with the IRS regarding previous filings.

Quick guide on how to complete 2015 8865 form

Effortlessly Prepare 8865 Form on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly, without hindrances. Manage 8865 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign 8865 Form effortlessly

- Find 8865 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as an old-fashioned ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 8865 Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8865 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8865 form

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the 8865 Form and why is it important?

The 8865 Form is used by U.S. taxpayers to report their interests in foreign partnerships. Filing the 8865 Form is crucial for compliance with IRS regulations and to avoid penalties. Understanding its requirements can help you manage your tax obligations effectively.

-

How can airSlate SignNow help me with the 8865 Form?

airSlate SignNow simplifies the process of filling out and electronically signing the 8865 Form. With our intuitive platform, you can easily upload, edit, and securely send your documents for eSignature, ensuring a smooth filing process.

-

Is there a cost associated with using airSlate SignNow for the 8865 Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for managing the 8865 Form. Our plans are designed to be cost-effective while providing robust features for document management and eSigning.

-

What features does airSlate SignNow offer that are beneficial for the 8865 Form?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which enhance the efficiency of managing the 8865 Form. These features allow you to streamline your document processes and ensure compliance.

-

Can I integrate airSlate SignNow with other software for the 8865 Form?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software. This ensures that you can easily manage your 8865 Form alongside your other financial documents, enhancing overall productivity.

-

How secure is my information when using airSlate SignNow for the 8865 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance with industry standards to protect your data while you fill out and send the 8865 Form, ensuring your information remains confidential and secure.

-

Is there customer support available for help with the 8865 Form?

Absolutely! airSlate SignNow provides dedicated customer support to assist you with any questions regarding the 8865 Form. Our team is available via chat, email, or phone to ensure you receive the help you need.

Get more for 8865 Form

- Hcc conflict of interest disclosure statementaffidavit hccfl form

- Grambling application form

- University of southern maine transcript request form

- Forms ampamp resourcescsusb

- International student undergraduate admissions application form

- Occupational therapy assistant program application form

- Application information for international f 1 cpccedu

- Housing and residence life minor waiver university of dayton form

Find out other 8865 Form

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure