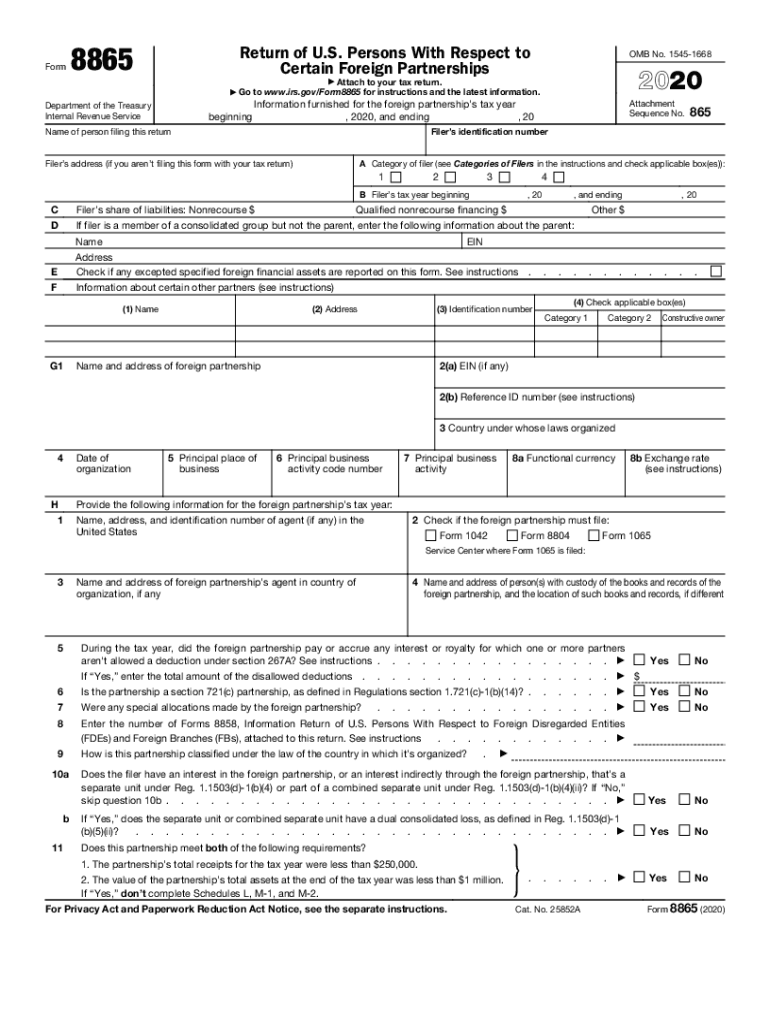

Instructions for Form 8865 Internal Revenue Service 2020

What is the 2017 Form 5471?

The 2017 Form 5471 is a tax form used by U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations. This form is essential for reporting information about foreign corporations in which U.S. taxpayers have an ownership interest. The purpose of Form 5471 is to ensure compliance with U.S. tax laws and to provide the Internal Revenue Service (IRS) with detailed information regarding foreign entities, including their financial activities and ownership structure.

Key elements of the 2017 Form 5471

The 2017 Form 5471 consists of several key components that must be completed accurately. These include:

- Identifying Information: This section requires details about the filer, including name, address, and taxpayer identification number.

- Ownership Structure: Taxpayers must disclose their percentage of ownership in the foreign corporation and any changes during the tax year.

- Financial Information: This includes reporting the foreign corporation's income, expenses, and balance sheet items.

- Income and Deductions: Taxpayers must report the foreign corporation's income and any deductions claimed.

- Additional Schedules: Depending on the ownership percentage and the nature of the foreign corporation, additional schedules may be required to provide further details.

Steps to complete the 2017 Form 5471

Completing the 2017 Form 5471 involves several steps to ensure that all necessary information is accurately reported. Here are the general steps:

- Gather all relevant financial documents related to the foreign corporation.

- Complete the identifying information section accurately.

- Determine your ownership percentage and any changes that occurred during the year.

- Fill out the financial information section, including income and expenses.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

The filing deadline for the 2017 Form 5471 typically aligns with the due date of the taxpayer's income tax return. For most individuals, this means the form is due on April 15, 2018, unless an extension is filed. It is crucial to adhere to these deadlines to avoid potential penalties.

Penalties for Non-Compliance

Failure to file the 2017 Form 5471 or filing it inaccurately can result in significant penalties. The IRS imposes a penalty of $10,000 for each foreign corporation that is not reported. Additionally, continued failure to file can lead to further penalties, including the potential for criminal charges in severe cases. It is essential to ensure compliance to avoid these consequences.

Who Issues the Form

The 2017 Form 5471 is issued by the Internal Revenue Service (IRS), which is the U.S. government agency responsible for tax collection and tax law enforcement. The IRS provides guidelines and instructions for completing the form, which can be accessed through their official publications.

Quick guide on how to complete 2019 instructions for form 8865 internal revenue service

Effortlessly Prepare Instructions For Form 8865 Internal Revenue Service on Any Device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without complications. Manage Instructions For Form 8865 Internal Revenue Service on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign Instructions For Form 8865 Internal Revenue Service with Ease

- Locate Instructions For Form 8865 Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form 8865 Internal Revenue Service and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 instructions for form 8865 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 8865 internal revenue service

The best way to make an electronic signature for a PDF online

The best way to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the 2017 Form 5471 and why is it important?

The 2017 Form 5471 is an essential IRS form that U.S. citizens and residents must file to report certain information about foreign corporations they have an interest in. It's crucial for compliance with U.S. tax laws and helps avoid penalties associated with failure to file. Understanding this form is key for individuals or businesses engaged in international transactions.

-

How does airSlate SignNow assist with filing the 2017 Form 5471?

airSlate SignNow streamlines the process of completing and submitting the 2017 Form 5471 by providing an intuitive eSignature solution. Our platform allows users to easily sign and send documents securely, ensuring that you can meet your filing deadlines without hassle. This efficiency is especially beneficial for busy professionals managing multiple forms.

-

What features does airSlate SignNow offer for managing the 2017 Form 5471?

airSlate SignNow offers robust features such as document templates, electronic signatures, and secure storage specifically designed to simplify the management of the 2017 Form 5471. The user-friendly interface ensures that you can easily navigate the process from document creation to submission. These tools enhance productivity and accuracy.

-

Is airSlate SignNow cost-effective for filing the 2017 Form 5471?

Yes, airSlate SignNow provides a cost-effective solution for filing the 2017 Form 5471 compared to traditional methods. Our competitive pricing plans cater to various business sizes, ensuring that you get value for your investment. Additionally, the time saved can further reduce costs associated with compliance.

-

Can I integrate airSlate SignNow with other software for handling the 2017 Form 5471?

Absolutely! airSlate SignNow seamlessly integrates with numerous accounting and CRM software, making it easier to manage the 2017 Form 5471 within your existing workflow. This integration streamlines data transfer and reduces the risk of errors, ultimately improving productivity for your team.

-

What are the benefits of using airSlate SignNow for the 2017 Form 5471?

Using airSlate SignNow for the 2017 Form 5471 offers numerous benefits, such as enhanced security, compliance assurance, and ease of use. Our platform helps mitigate the risks of manual errors and enhances the speed of document processing. Furthermore, you can access your documents anytime, making it convenient for busy professionals.

-

How can I ensure compliance when using airSlate SignNow for my 2017 Form 5471?

To ensure compliance while using airSlate SignNow for the 2017 Form 5471, our platform provides features like secure electronic signatures and a comprehensive audit trail. These aspects help validate the authenticity of your filings and keep a record of all actions taken. Staying informed about IRS regulations is also important when using our software.

Get more for Instructions For Form 8865 Internal Revenue Service

- Wyoming limited partnership form

- Legal last will and testament form for single person with no children wyoming

- Legal last will and testament form for a single person with minor children wyoming

- Legal last will and testament form for single person with adult and minor children wyoming

- Legal last will and testament form for single person with adult children wyoming

- Legal last will and testament for married person with minor children from prior marriage wyoming form

- Legal last will and testament form for married person with adult children from prior marriage wyoming

- Legal last will and testament form for divorced person not remarried with adult children wyoming

Find out other Instructions For Form 8865 Internal Revenue Service

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation