Form 8865 2016

What is the Form 8865

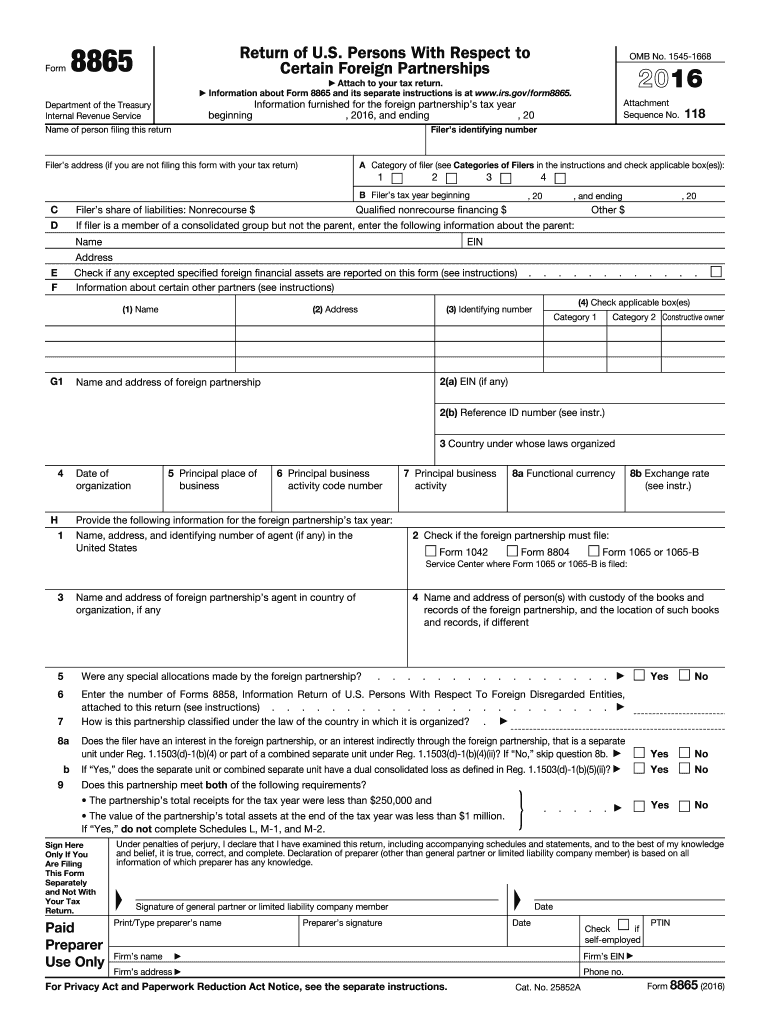

The Form 8865 is a tax form used by U.S. taxpayers to report information about certain foreign partnerships. It is primarily required for individuals and entities that have control over a foreign partnership or own a significant interest in one. This form is crucial for ensuring compliance with U.S. tax laws and reporting requirements, especially for those involved in international business activities. Failure to file this form can result in substantial penalties, making it essential for eligible taxpayers to understand its implications.

How to use the Form 8865

Using the Form 8865 involves several steps. First, determine if you are required to file based on your ownership interest in a foreign partnership. If you meet the criteria, gather the necessary information about the partnership, including financial statements and ownership details. Complete the form accurately, ensuring all required sections are filled out. After completing the form, submit it along with your tax return to the Internal Revenue Service (IRS). It is advisable to keep copies of all documents for your records.

Steps to complete the Form 8865

Completing the Form 8865 involves a systematic approach:

- Identify your filing category: Determine if you are a controlled foreign partnership or a partner in a foreign partnership.

- Gather required information: Collect data on the partnership's income, expenses, assets, and liabilities.

- Fill out the form: Complete all relevant sections, including identifying information and financial details.

- Review for accuracy: Ensure all information is correct and complete to avoid delays or penalties.

- Submit the form: File it with your annual tax return by the designated deadline.

Legal use of the Form 8865

The legal use of the Form 8865 is governed by IRS regulations. This form must be filed accurately to comply with U.S. tax laws. It is essential for reporting income from foreign partnerships and ensuring that all tax obligations are met. The information provided on this form can be subject to audit by the IRS, making it critical to maintain accurate records and documentation supporting the reported figures.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8865 align with the due dates for your tax return. Typically, this form must be submitted by the same deadline as your annual tax return, which is usually April 15 for individuals. If you require an extension, you may file for an extension for your tax return, which also extends the deadline for the Form 8865. It is important to stay informed about any changes to deadlines that the IRS may announce, especially for international taxpayers.

Penalties for Non-Compliance

Non-compliance with the Form 8865 filing requirements can lead to significant penalties. If you fail to file the form when required, the IRS may impose a penalty of up to $10,000 per form, with additional penalties for continued failure to comply. Additionally, if the IRS determines that the failure to file was intentional, the penalties can be much more severe. It is crucial to understand these risks and ensure timely and accurate filing to avoid financial repercussions.

Quick guide on how to complete 2016 form 8865

Effortlessly prepare Form 8865 on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents swiftly and without delays. Manage Form 8865 on any platform with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form 8865 seamlessly

- Locate Form 8865 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Choose your preferred method of sending your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form navigation, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Adjust and eSign Form 8865 to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 8865

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 8865

How to generate an eSignature for your 2016 Form 8865 online

How to generate an electronic signature for the 2016 Form 8865 in Chrome

How to make an eSignature for putting it on the 2016 Form 8865 in Gmail

How to make an electronic signature for the 2016 Form 8865 straight from your smartphone

How to generate an electronic signature for the 2016 Form 8865 on iOS

How to create an electronic signature for the 2016 Form 8865 on Android

People also ask

-

What is Form 8865 and why do I need it?

Form 8865 is a tax form required by the IRS for certain U.S. persons who own a stake in a foreign partnership. This form is crucial for reporting income, deductions, and credits associated with the partnership. Understanding how to complete Form 8865 correctly can help ensure compliance and avoid penalties.

-

How can airSlate SignNow help me with Form 8865?

airSlate SignNow provides a seamless platform to prepare and eSign Form 8865 digitally. With our user-friendly interface, you can quickly fill out the necessary fields and securely send the form for signatures. This streamlines the process, making it easier to manage your tax documentation.

-

Is there a cost associated with using airSlate SignNow for Form 8865?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. While there are costs associated with using our platform, the efficiency gained in managing documents like Form 8865 can lead to signNow time and cost savings for your business.

-

What features does airSlate SignNow offer for managing Form 8865?

airSlate SignNow includes features such as customizable templates, automated reminders, and document tracking to enhance the management of Form 8865. These tools help ensure that your form is filled out correctly and submitted on time, reducing the risk of errors.

-

Can I integrate airSlate SignNow with other software for Form 8865 processing?

Absolutely! airSlate SignNow offers integrations with popular accounting software and cloud storage solutions, making it easier to manage Form 8865 alongside your other financial documents. This flexibility helps streamline your workflow and improves overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 8865?

Using airSlate SignNow for Form 8865 provides several benefits, including enhanced security for sensitive information, the ability to eSign documents from anywhere, and automated workflows to save time. This ensures that your tax documentation is handled efficiently and securely.

-

How secure is airSlate SignNow when handling Form 8865?

airSlate SignNow prioritizes security with advanced encryption protocols to protect your data while you complete and submit Form 8865. Our platform is compliant with industry standards, ensuring that your confidential information remains safe throughout the signing process.

Get more for Form 8865

- Printable renewal application for naeyc form

- Illinois form hearing

- Nc uniform application

- Nikah nama form in bangla

- Sba form 1031 portfolio financing report 2007

- City of chicago finance form

- Texas motor vehicle seller financed sales tax andor surcharge report form

- Tech data sheets bulk online version form

Find out other Form 8865

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure