Form 8865 Overview Who, What, and How 2024

What is Form 8865?

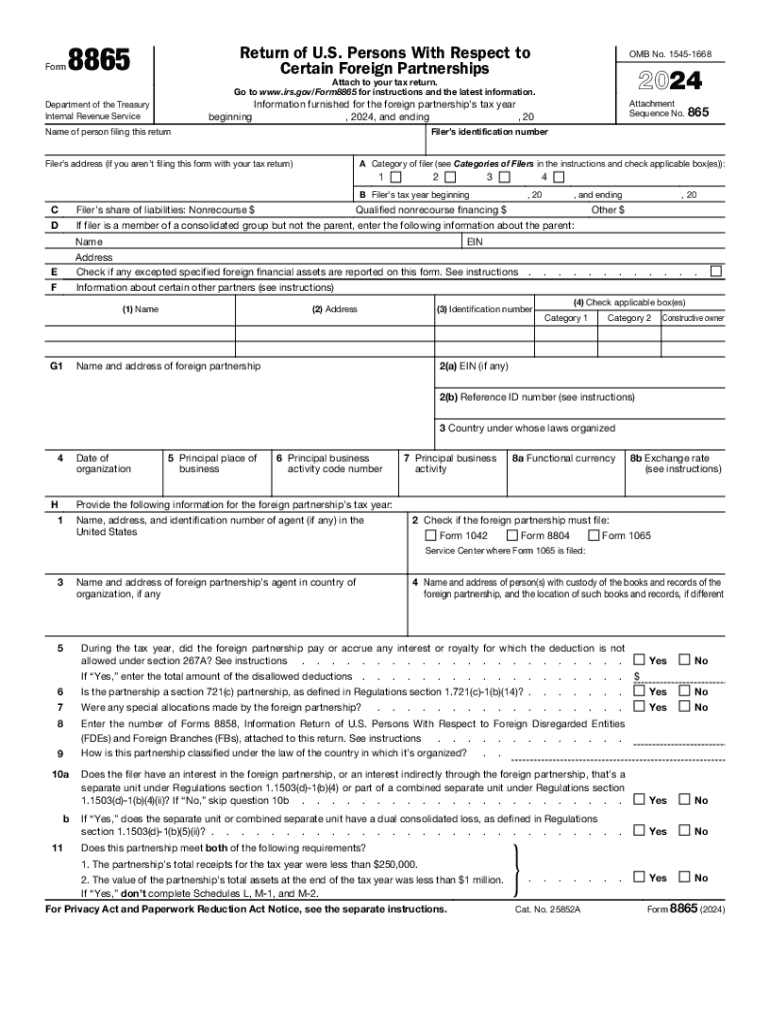

Form 8865 is a tax document used by U.S. taxpayers who are partners in a foreign partnership or who have an interest in a foreign partnership. This form is essential for reporting the income, deductions, and credits associated with the foreign partnership to the Internal Revenue Service (IRS). It helps ensure compliance with U.S. tax laws and provides the IRS with necessary information regarding foreign investments.

The form is particularly relevant for individuals and entities that have made investments in foreign partnerships, as it outlines the taxpayer's share of the partnership's income, gains, losses, and other tax-related information. Understanding how to properly complete and file Form 8865 is crucial for avoiding penalties and ensuring accurate tax reporting.

Steps to Complete Form 8865

Completing Form 8865 involves several key steps to ensure accurate reporting. First, gather all necessary information about the foreign partnership, including its name, address, and Employer Identification Number (EIN). Next, determine your ownership percentage in the partnership, as this will impact the information you report.

Once you have the required details, fill out the form by providing information about your share of the partnership's income, deductions, and credits. Be sure to include any relevant schedules, such as Schedule K-1, which provides additional details about your share of the partnership's income. Review the completed form for accuracy before submission, as errors can lead to compliance issues.

IRS Guidelines for Form 8865

The IRS has established specific guidelines for completing and filing Form 8865. These guidelines include instructions on who must file the form, the deadlines for submission, and the penalties for non-compliance. Taxpayers should familiarize themselves with IRS Publication 8865, which provides detailed instructions and examples to assist in the completion of the form.

Key points include understanding the different categories of filers, as each category has distinct reporting requirements. For instance, Category 1 filers must report their share of the partnership's income, while Category 3 filers may have different obligations. Adhering to these guidelines is essential for maintaining compliance with U.S. tax laws.

Filing Deadlines for Form 8865

Filing deadlines for Form 8865 are critical for taxpayers to avoid penalties. Generally, the form is due on the same date as the taxpayer's income tax return. For most individuals, this means the form is due on April 15 of each year. However, if an extension is filed for the tax return, the deadline for Form 8865 may also be extended.

It is important to note that late filings can result in significant penalties, which can accumulate over time. Therefore, taxpayers should mark their calendars and ensure that they submit the form by the appropriate deadlines to avoid unnecessary financial consequences.

Required Documents for Form 8865

To complete Form 8865 accurately, several documents are required. Taxpayers should gather financial statements from the foreign partnership, including profit and loss statements, balance sheets, and any other relevant financial records. Additionally, any prior year tax returns that include information about the partnership may be helpful.

Taxpayers may also need to provide documentation that verifies their ownership interest in the partnership, such as partnership agreements or contracts. Having these documents organized and readily available will facilitate the completion of Form 8865 and ensure that all necessary information is reported accurately.

Penalties for Non-Compliance with Form 8865

Failure to file Form 8865 or inaccuracies in the information reported can lead to significant penalties. The IRS imposes a penalty of $10,000 for each failure to file, which can increase if the form is not submitted after receiving a notice from the IRS. Additionally, taxpayers may face further penalties if they provide incorrect information that results in an understatement of tax liability.

Understanding the potential consequences of non-compliance emphasizes the importance of accurately completing and timely filing Form 8865. Taxpayers should take these obligations seriously to avoid financial repercussions and ensure adherence to U.S. tax laws.

Create this form in 5 minutes or less

Find and fill out the correct form 8865 overview who what and how

Create this form in 5 minutes!

How to create an eSignature for the form 8865 overview who what and how

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8865 and why is it important?

Form 8865 is a tax form used by U.S. persons who own interests in foreign partnerships. It is important because it helps ensure compliance with IRS regulations regarding foreign income and partnerships. Properly filing form 8865 can help avoid penalties and ensure accurate reporting of foreign financial interests.

-

How can airSlate SignNow help with form 8865?

airSlate SignNow provides an efficient platform for preparing and signing form 8865 electronically. With its user-friendly interface, you can easily fill out the form, gather necessary signatures, and store documents securely. This streamlines the process and reduces the risk of errors in your tax filings.

-

What are the pricing options for using airSlate SignNow for form 8865?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Each plan provides access to features that simplify the completion and signing of form 8865. You can choose a plan that fits your budget while ensuring compliance with tax regulations.

-

Are there any integrations available for airSlate SignNow when handling form 8865?

Yes, airSlate SignNow integrates seamlessly with various applications, including cloud storage services and accounting software. This allows you to easily access and manage your documents related to form 8865. Integrations enhance productivity by enabling you to work within your preferred tools.

-

What features does airSlate SignNow offer for managing form 8865?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure storage for managing form 8865. These tools help streamline the preparation and submission process, ensuring that your form is completed accurately and efficiently. Additionally, you can track the status of your documents in real-time.

-

Can I use airSlate SignNow on mobile devices for form 8865?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to manage form 8865 on the go. Whether you need to fill out the form, collect signatures, or review documents, you can do it all from your smartphone or tablet. This flexibility ensures you can stay productive wherever you are.

-

What are the benefits of using airSlate SignNow for form 8865?

Using airSlate SignNow for form 8865 offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform simplifies the document workflow, reducing the chances of errors and delays. Additionally, electronic signatures are legally binding, making your submissions valid and secure.

Get more for Form 8865 Overview Who, What, And How

Find out other Form 8865 Overview Who, What, And How

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer