940 Pr Form 2013

What is the 940 Pr Form

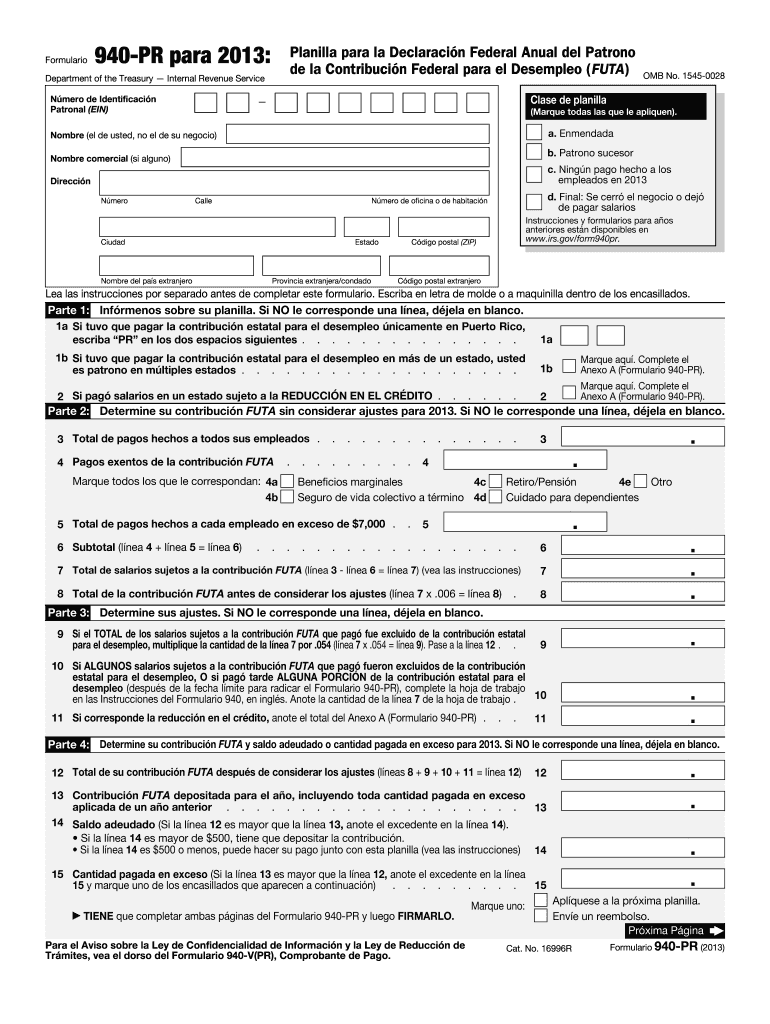

The 940 Pr Form is a specific tax form used by employers in the United States to report annual unemployment taxes. This form is essential for businesses that are liable for federal unemployment tax (FUTA). The information provided on the 940 Pr Form helps the Internal Revenue Service (IRS) determine the employer's tax liability and ensures compliance with federal regulations. Understanding this form is crucial for employers to maintain accurate records and fulfill their tax obligations.

How to use the 940 Pr Form

Using the 940 Pr Form involves several key steps. First, employers must gather all necessary financial information related to their payroll for the tax year. This includes total wages paid, the number of employees, and any applicable credits. Once the data is collected, employers can fill out the form, ensuring that all sections are completed accurately. After completing the form, it must be submitted to the IRS by the designated deadline, along with any required payments. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form securely.

Steps to complete the 940 Pr Form

Completing the 940 Pr Form requires careful attention to detail. Here are the essential steps:

- Gather payroll records for the tax year, including total wages and employee counts.

- Fill out the form with accurate information, including employer details and tax calculations.

- Review the form for any errors or omissions to ensure accuracy.

- Submit the completed form to the IRS by the deadline, either electronically or by mail.

Following these steps helps ensure compliance and reduces the risk of penalties.

Legal use of the 940 Pr Form

The legal use of the 940 Pr Form is governed by federal tax laws. Employers must use this form to report their unemployment tax liabilities accurately. Failure to file the form or inaccuracies can result in penalties and interest charges. It is important for employers to understand the legal implications of submitting this form, as it affects their tax standing and compliance with federal regulations. Additionally, maintaining accurate records related to the information provided on the form is essential for any potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the 940 Pr Form are crucial for employers to adhere to in order to avoid penalties. The form is typically due by January 31 of the year following the tax year being reported. If the deadline falls on a weekend or holiday, the due date may be adjusted. Employers should also be aware of any state-specific deadlines that may apply. Keeping track of these dates ensures timely submission and compliance with federal tax requirements.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the 940 Pr Form. The form can be filed electronically through the IRS e-file system, which is a convenient and efficient method. Alternatively, employers may choose to mail the completed form to the appropriate IRS address. In-person submission is generally not an option for this form, as it is primarily processed through electronic or postal channels. Each method has its own advantages, and employers should select the one that best suits their needs.

Quick guide on how to complete 940 pr 2013 form

Effortlessly Prepare 940 Pr Form on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents quickly without delays. Handle 940 Pr Form on any platform using the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

How to Alter and Electronically Sign 940 Pr Form with Ease

- Obtain 940 Pr Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your selection. Edit and electronically sign 940 Pr Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 940 pr 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 940 pr 2013 form

The way to create an electronic signature for a PDF online

The way to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to make an eSignature right from your smartphone

The best way to create an eSignature for a PDF on iOS

The way to make an eSignature for a PDF on Android

People also ask

-

What is the 940 Pr Form and why is it important?

The 940 Pr Form is a crucial document used for annual unemployment tax reporting in the United States. It provides the IRS with information on the employer's total payroll and the contributions made towards unemployment tax. Completing the 940 Pr Form accurately is essential for compliance and avoiding potential penalties.

-

How can airSlate SignNow help with the 940 Pr Form?

airSlate SignNow simplifies the eSigning and document management process for the 940 Pr Form. With its user-friendly interface, businesses can easily prepare, send, and securely sign the form online, ensuring the submission is timely and hassle-free. This streamlines the annual tax reporting process for employers.

-

Is there a cost associated with using airSlate SignNow for the 940 Pr Form?

Yes, there are various pricing plans available for using airSlate SignNow that cater to different business needs. The pricing is competitive, offering cost-effective solutions for eSigning and document sharing, including for the 940 Pr Form. Businesses can choose a plan that best fits their size and usage requirements.

-

What features does airSlate SignNow offer for managing the 940 Pr Form?

airSlate SignNow provides features such as templates, real-time tracking, and reminders for the 940 Pr Form. These features help businesses manage their documents more efficiently, ensuring that forms are completed correctly and on time. Additionally, the platform's security measures protect sensitive information throughout the process.

-

Can I integrate airSlate SignNow with other applications to assist with the 940 Pr Form?

Yes, airSlate SignNow offers integration capabilities with various applications, enhancing your workflow for the 940 Pr Form. You can connect it with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. This allows for a seamless experience when preparing and signing the form.

-

What are the benefits of using airSlate SignNow for the 940 Pr Form?

Using airSlate SignNow for the 940 Pr Form offers numerous benefits, including increased efficiency and reduced processing time. The platform enables businesses to eliminate paperwork, reduce errors, and ensure compliance with tax regulations. Furthermore, airSlate SignNow's cost-effectiveness makes it an attractive option for businesses of all sizes.

-

How secure is airSlate SignNow when handling the 940 Pr Form?

airSlate SignNow prioritizes security, employing advanced encryption technologies to protect your data while handling the 940 Pr Form. The platform complies with industry standards and regulations, ensuring that sensitive information remains confidential. This commitment to security gives businesses peace of mind when managing important documents.

Get more for 940 Pr Form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497304833 form

- Iowa corporation form

- Iowa pre incorporation agreement shareholders agreement and confidentiality agreement iowa form

- Iowa corporation 497304836 form

- Ia corporation form

- Corporate records maintenance package for existing corporations iowa form

- Iowa corporation 497304839 form

- Iowa limited liability company llc formation package iowa

Find out other 940 Pr Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT