Tax Form 940pr Fill in and Calculate Online 2022-2026

Understanding IRS Form 940 Instructions

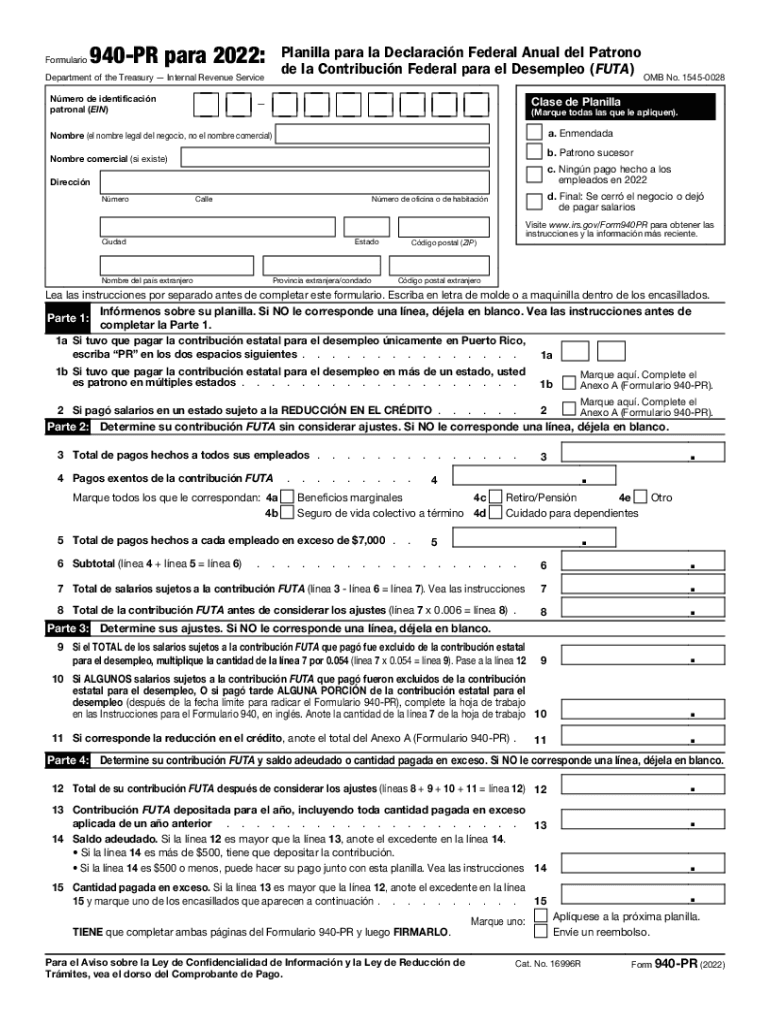

IRS Form 940 is essential for employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This form allows businesses to calculate their FUTA tax liability and ensure compliance with federal regulations. The instructions for Form 940 guide users through the necessary steps to accurately complete the form, including how to report wages paid, calculate the tax owed, and determine any credits that may apply.

Steps to Complete IRS Form 940

Completing IRS Form 940 involves several key steps. First, gather all relevant payroll records, as these will provide the necessary information about wages paid to employees. Next, follow these steps:

- Enter your business information, including the employer identification number (EIN).

- Report the total wages subject to FUTA tax.

- Calculate the FUTA tax based on the wages reported.

- Apply any credits for state unemployment taxes paid.

- Sign and date the form before submission.

Legal Use of IRS Form 940

IRS Form 940 serves a legal purpose in the context of federal employment taxes. It is used to report and pay the FUTA tax, which is crucial for funding unemployment benefits for workers. Employers must ensure that they file this form annually to avoid penalties and maintain compliance with federal tax laws.

Filing Deadlines for IRS Form 940

The filing deadline for IRS Form 940 is January 31 of the year following the tax year being reported. If employers have deposited all FUTA tax due on time, they may have until February 10 to file the form. It is essential to be aware of these deadlines to avoid late fees and interest charges.

Form Submission Methods for IRS Form 940

IRS Form 940 can be submitted in various ways. Employers have the option to file electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. It is important to ensure that the form is sent to the correct address to avoid delays in processing.

Key Elements of IRS Form 940

Several key elements must be included when completing IRS Form 940. These include:

- Employer identification number (EIN)

- Total wages subject to FUTA tax

- FUTA tax calculation

- State unemployment tax credits

- Signature and date

Examples of Using IRS Form 940

Employers may encounter various scenarios when using IRS Form 940. For instance, a business that has employees in multiple states must accurately report wages and tax liabilities for each state. Additionally, a company that has paid state unemployment taxes may be eligible for a credit against their FUTA tax, which needs to be documented on the form. Understanding these examples helps ensure accurate reporting and compliance.

Quick guide on how to complete tax form 940pr fill in and calculate online

Effortlessly Prepare Tax Form 940pr Fill In And Calculate Online on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right format and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Tax Form 940pr Fill In And Calculate Online on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The Simplest Way to Modify and eSign Tax Form 940pr Fill In And Calculate Online Effortlessly

- Locate Tax Form 940pr Fill In And Calculate Online and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Tax Form 940pr Fill In And Calculate Online to ensure efficient communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax form 940pr fill in and calculate online

Create this form in 5 minutes!

People also ask

-

What are the IRS Form 940 instructions?

The IRS Form 940 instructions provide guidance on how businesses should fill out and submit the annual Federal Unemployment Tax Return (FUTA). This includes detailed information on eligibility, tax rates, and reporting requirements necessary for compliance.

-

How can airSlate SignNow assist with IRS Form 940 instructions?

airSlate SignNow offers a streamlined e-signature solution that enables you to easily fill out and sign your IRS Form 940. With our platform, you can access templates and pre-fill fields to ensure you follow the correct IRS Form 940 instructions.

-

What features does airSlate SignNow offer for handling IRS Form 940 instructions?

Our platform provides features such as customizable templates, secure storage, and real-time collaboration, making the process of completing IRS Form 940 instructions straightforward and efficient. You can also track document status and send reminders for timely submissions.

-

Are there any costs associated with using airSlate SignNow for IRS Form 940 instructions?

Yes, while airSlate SignNow offers various pricing plans, the costs can vary based on the features you utilize for handling IRS Form 940 instructions. We provide cost-effective solutions that cater to businesses of all sizes, ensuring you only pay for what you need.

-

Can airSlate SignNow integrate with other software for filing IRS Form 940 instructions?

Absolutely, airSlate SignNow seamlessly integrates with many accounting and payroll software systems. This integration allows for a smooth workflow when managing IRS Form 940 instructions, simplifying data transfer and ensuring accuracy during tax season.

-

What benefits does using airSlate SignNow provide when following IRS Form 940 instructions?

Utilizing airSlate SignNow simplifies the process of adhering to IRS Form 940 instructions by providing an easy-to-navigate interface and assistance with document management. This reduces the risk of errors and helps you maintain compliance with federal regulations.

-

Is customer support available for questions regarding IRS Form 940 instructions?

Yes, our customer support team is available to provide assistance with any queries related to IRS Form 940 instructions. Whether you need help with the e-signing process or specific instructions, our team is here to help you navigate through any challenges.

Get more for Tax Form 940pr Fill In And Calculate Online

- Name change notification form nevada

- Commercial building or space lease nevada form

- Nevada caretaker form

- Nv guardian form

- Bankruptcy chapters 7 497320807 form

- Bill of sale with warranty by individual seller nevada form

- Bill of sale with warranty for corporate seller nevada form

- Bill of sale without warranty by individual seller nevada form

Find out other Tax Form 940pr Fill In And Calculate Online

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors