940 Pr Form 2012

What is the 940 Pr Form

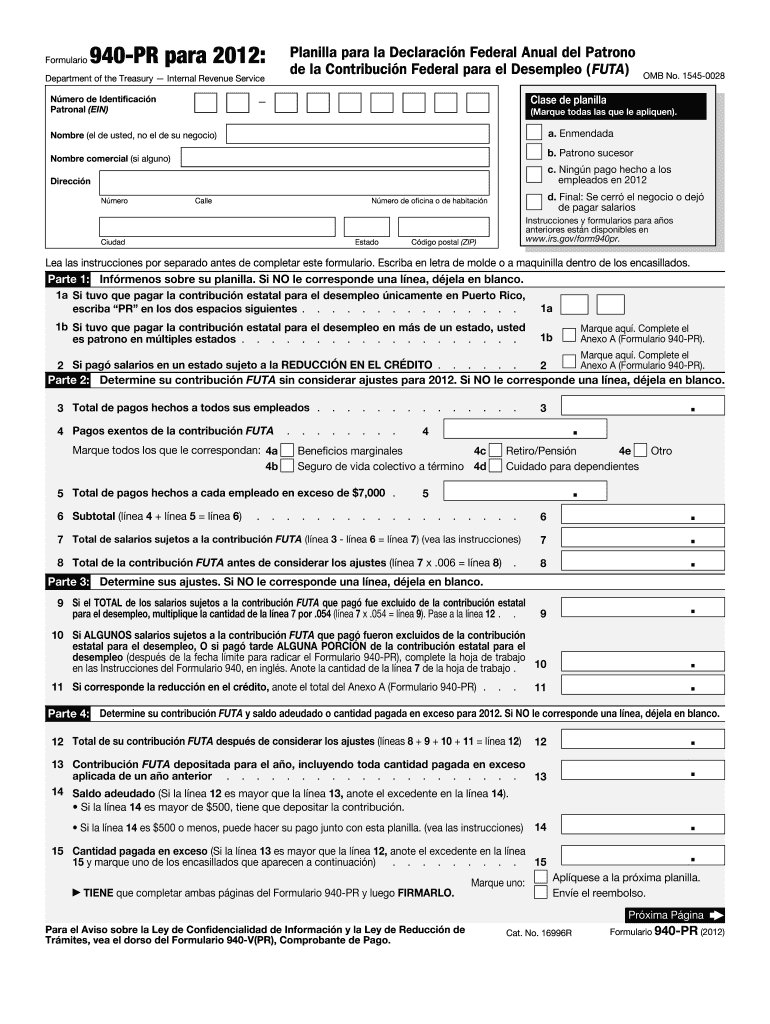

The 940 Pr Form, officially known as the Employer's Annual Federal Unemployment (FUTA) Tax Return, is a crucial document for employers in the United States. This form is used to report and pay federal unemployment taxes on behalf of their employees. It is essential for businesses to comply with federal regulations regarding unemployment tax obligations. The information provided on this form helps the IRS track the amount of unemployment tax owed and ensures that employers are meeting their responsibilities under the Federal Unemployment Tax Act (FUTA).

How to use the 940 Pr Form

Utilizing the 940 Pr Form involves several key steps. Employers must first gather necessary information, including total wages paid to employees and any state unemployment taxes already paid. The form requires accurate reporting of these figures to determine the correct amount of federal unemployment tax owed. Once filled out, the form can be submitted electronically or via mail, depending on the employer's preference. It is important to ensure that the form is completed accurately to avoid penalties and ensure compliance with federal tax laws.

Steps to complete the 940 Pr Form

Completing the 940 Pr Form involves a systematic approach:

- Gather all relevant payroll records for the tax year.

- Calculate the total wages paid to employees.

- Determine any state unemployment taxes that have been paid.

- Fill out the form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

- Submit the form electronically or by mail to the IRS by the designated deadline.

Legal use of the 940 Pr Form

The legal use of the 940 Pr Form is governed by federal tax laws. Employers are required to file this form annually to report their unemployment tax liabilities. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is crucial for employers to understand their obligations under the Federal Unemployment Tax Act (FUTA) and ensure compliance to avoid legal repercussions. Proper use of the form contributes to the integrity of the unemployment insurance system in the United States.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the 940 Pr Form. The form is typically due by January 31 of the following year for the previous tax year. If employers have deposited all FUTA tax owed on time, they may have until February 10 to file the form. It is essential for businesses to mark these dates on their calendars to ensure timely submission and avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The 940 Pr Form can be submitted through various methods, providing flexibility for employers. Options include:

- Online Submission: Employers can file electronically using the IRS e-file system, which is often more efficient and allows for quicker processing.

- Mail: The form can be printed and sent via postal mail to the appropriate IRS address, depending on the employer's location.

- In-Person: While less common, some employers may choose to deliver the form in person to their local IRS office.

Quick guide on how to complete 2012 940 pr form

Easily Prepare 940 Pr Form on Any Device

The management of online documents has gained popularity among both businesses and individuals. It serves as a great environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle 940 Pr Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven task today.

Edit and eSign 940 Pr Form Effortlessly

- Locate 940 Pr Form and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your modifications.

- Choose how you want to send your form, whether via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing fresh copies. airSlate SignNow meets all your document management requirements with just a few clicks from any device you prefer. Alter and eSign 940 Pr Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 940 pr form

Create this form in 5 minutes!

How to create an eSignature for the 2012 940 pr form

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a 940 Pr Form and why is it important?

The 940 Pr Form is a crucial document used for reporting annual unemployment taxes to the IRS. It's important for businesses to accurately complete this form to ensure compliance with federal regulations and avoid potential penalties. Using airSlate SignNow can streamline the process of preparing and signing your 940 Pr Form.

-

How does airSlate SignNow help with the 940 Pr Form?

airSlate SignNow provides an easy-to-use platform that allows you to prepare, send, and eSign your 940 Pr Form efficiently. Our solution ensures that all parties can collaborate and sign documents securely, reducing errors and saving time during tax season. Simplifying the 940 Pr Form process allows you to focus more on your business.

-

Is there a cost associated with using airSlate SignNow for the 940 Pr Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The pricing is competitive and reflects the comprehensive features available, including advanced security for your 940 Pr Form and other documents. Potential customers can explore affordable options without compromising quality.

-

Can I integrate airSlate SignNow with other software for handling the 940 Pr Form?

Absolutely! airSlate SignNow is designed to integrate seamlessly with numerous business applications, making it easier to manage your 940 Pr Form alongside your existing systems. Whether it's accounting software or HR platforms, our integrations enhance workflow efficiency for your tax documentation.

-

What features does airSlate SignNow offer for the 940 Pr Form?

airSlate SignNow includes features tailored for efficient document management, such as customizable templates for the 940 Pr Form, automated workflows, and secure cloud storage. Additionally, users benefit from real-time notifications and tracking, ensuring that every step of the signing process is documented and transparent.

-

How secure is the signing process for the 940 Pr Form with airSlate SignNow?

Security is a top priority for airSlate SignNow. Our platform employs industry-standard encryption and secure access controls to protect your 940 Pr Form and any sensitive information contained within it. We ensure that all signatures are legally binding, giving you peace of mind when handling important tax documents.

-

Can multiple people sign the 940 Pr Form through airSlate SignNow?

Yes, airSlate SignNow allows for multiple signers to eSign the 940 Pr Form easily. You can designate different individuals for different sections of the form, facilitating collaboration among your team. This feature streamlines the process and ensures that all required signatures are obtained efficiently.

Get more for 940 Pr Form

- Iowa corporation 497305117 form

- Iowa dissolution package to dissolve limited liability company llc iowa form

- Living trust for husband and wife with no children iowa form

- Living trust for individual who is single divorced or widow or widower with no children iowa form

- Living trust for individual who is single divorced or widow or widower with children iowa form

- Living trust for husband and wife with one child iowa form

- Living trust for husband and wife with minor and or adult children iowa form

- Amendment to living trust iowa form

Find out other 940 Pr Form

- eSign North Dakota LLC Operating Agreement Computer

- How To eSignature Louisiana Quitclaim Deed

- eSignature Maine Quitclaim Deed Now

- eSignature Maine Quitclaim Deed Myself

- eSignature Maine Quitclaim Deed Free

- eSignature Maine Quitclaim Deed Easy

- How Do I eSign South Carolina LLC Operating Agreement

- Can I eSign South Carolina LLC Operating Agreement

- How To eSignature Massachusetts Quitclaim Deed

- How To eSign Wyoming LLC Operating Agreement

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template