Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version 2020

What is the Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version

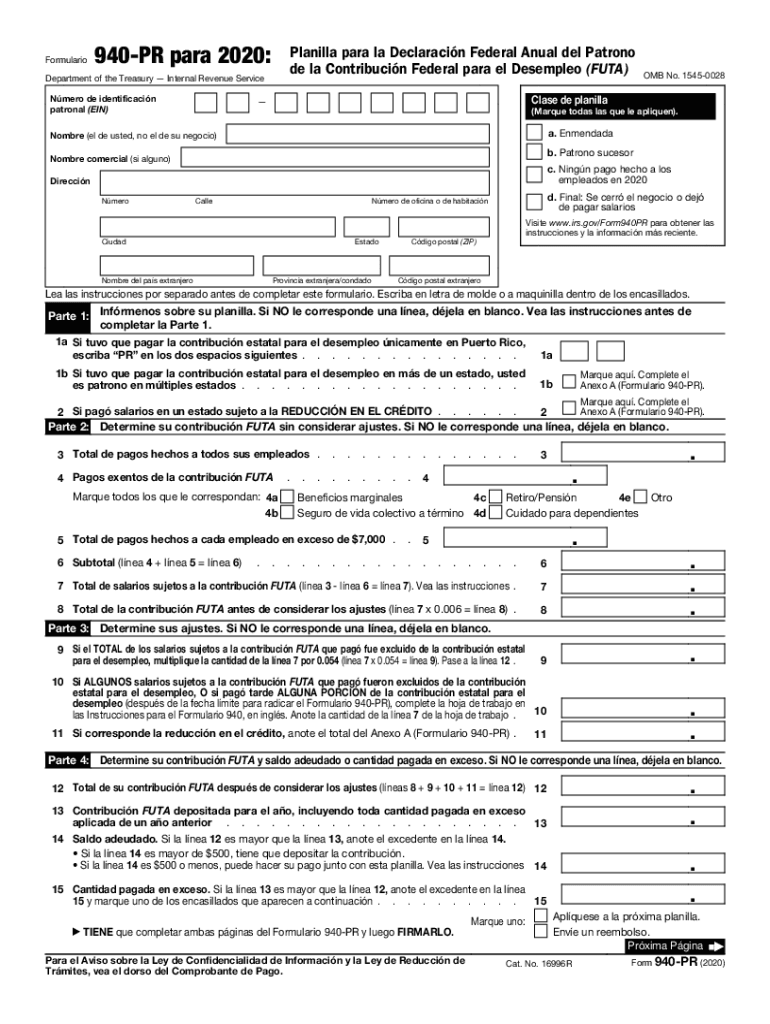

The Form 940 PR is a specialized version of the federal Form 940, designed specifically for employers in Puerto Rico. This form is used to report and pay the Federal Unemployment Tax Act (FUTA) taxes for employees working in Puerto Rico. Employers are required to file this form annually, detailing the wages paid to employees and the corresponding unemployment tax owed. It is crucial for compliance with federal tax regulations, ensuring that employers contribute to the unemployment fund that provides benefits to eligible workers in Puerto Rico.

Steps to complete the Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version

Completing the Form 940 PR involves several key steps:

- Gather all necessary information, including total wages paid to employees, and any adjustments related to unemployment taxes.

- Fill out the form accurately, ensuring that all sections are completed. This includes employer identification information and the total FUTA tax calculation.

- Review the completed form for any errors or omissions, as inaccuracies can lead to penalties.

- Submit the form by the designated deadline, either electronically or via mail, depending on your preference and compliance requirements.

Legal use of the Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version

The legal use of the Form 940 PR is governed by federal regulations concerning unemployment taxes. Employers must file this form to remain compliant with the law, as it ensures that contributions are made to the unemployment insurance system. Failure to file or inaccuracies in reporting can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their obligations under the law to avoid potential legal issues.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 940 PR. The annual deadline for submitting this form is typically January 31 of the following year. If January 31 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for employers to mark their calendars and ensure timely submission to avoid penalties for late filing.

Form Submission Methods (Online / Mail / In-Person)

The Form 940 PR can be submitted through various methods. Employers have the option to file electronically via the IRS e-file system, which is often the most efficient and secure method. Alternatively, the form can be mailed to the appropriate IRS address designated for Puerto Rico submissions. In-person submissions are generally not available for this form. It is advisable to keep a copy of the submitted form and any confirmation of submission for your records.

Key elements of the Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version

The Form 940 PR includes several key elements that employers must complete:

- Employer Information: This section requires the employer's name, address, and Employer Identification Number (EIN).

- Wages Paid: Employers must report the total wages subject to FUTA tax.

- Tax Calculation: This section outlines how to calculate the total FUTA tax owed based on reported wages.

- Signature: The form must be signed by an authorized representative of the business, affirming that the information provided is accurate.

Quick guide on how to complete 2020 form 940 pr employers annual federal unemployment futa tax return puerto rican version

Complete Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without interruptions. Manage Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version effortlessly

- Acquire Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version and then click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or errors necessitating the printing of new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Edit and eSign Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 940 pr employers annual federal unemployment futa tax return puerto rican version

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 940 pr employers annual federal unemployment futa tax return puerto rican version

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the pr 2017 form and why do I need it?

The pr 2017 form is a tax-related document that individuals or businesses must complete for accurate reporting. Understanding how to properly fill out the pr 2017 form ensures compliance with tax regulations and can prevent potential penalties. Utilizing airSlate SignNow simplifies the eSigning process for this document, making it easy to complete and submit.

-

How does airSlate SignNow help with the pr 2017 form?

airSlate SignNow streamlines the signing process for your pr 2017 form, allowing multiple parties to eSign efficiently. Its user-friendly interface ensures that you can quickly navigate through the form and make necessary edits before sending it out. Additionally, airSlate SignNow provides secure document storage for your completed forms.

-

Is there a cost associated with using airSlate SignNow for the pr 2017 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, whether you're an individual or a large enterprise. The cost-effective solution allows you to manage all your forms, including the pr 2017 form, without breaking the bank. It's worth exploring the free trial to see if it's the right fit for you.

-

Can I integrate airSlate SignNow with other tools for handling the pr 2017 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications and software to enhance your workflow. You can link it with cloud storage services, CRM systems, and other essential tools to efficiently manage the pr 2017 form within your existing infrastructure.

-

What are the benefits of using airSlate SignNow for eSigning the pr 2017 form?

Using airSlate SignNow for the pr 2017 form provides several benefits including time savings, increased efficiency, and enhanced security. The platform ensures that your document is accurately signed and tracked, reducing the likelihood of errors. Plus, electronic signatures are legally recognized, making airSlate SignNow a reliable choice.

-

Is it safe to use airSlate SignNow for my pr 2017 form?

Yes, airSlate SignNow prioritizes security with encryption protocols and compliance with industry standards. Your pr 2017 form and other documents are safeguarded against unauthorized access, ensuring that your sensitive information remains confidential. With audit trails and secure storage, you can trust airSlate SignNow for your document needs.

-

Can I track the status of my pr 2017 form once sent for eSigning?

Yes, airSlate SignNow allows you to track the status of your pr 2017 form in real-time after sending it for eSigning. You will receive notifications as the document progresses through the signing process, giving you peace of mind and the ability to follow up if necessary. This feature ensures a seamless workflow.

Get more for Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version

- Notice of default for past due payments in connection with contract for deed wyoming form

- Final notice of default for past due payments in connection with contract for deed wyoming form

- Assignment of contract for deed by seller wyoming form

- Notice of assignment of contract for deed wyoming form

- Wyoming agreement form

- Buyers home inspection checklist wyoming form

- Sellers information for appraiser provided to buyer wyoming

- Legallife multistate guide and handbook for selling or buying real estate wyoming form

Find out other Form 940 PR Employer's Annual Federal Unemployment FUTA Tax Return Puerto Rican Version

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure