940 Pr Form 2011

What is the 940 Pr Form

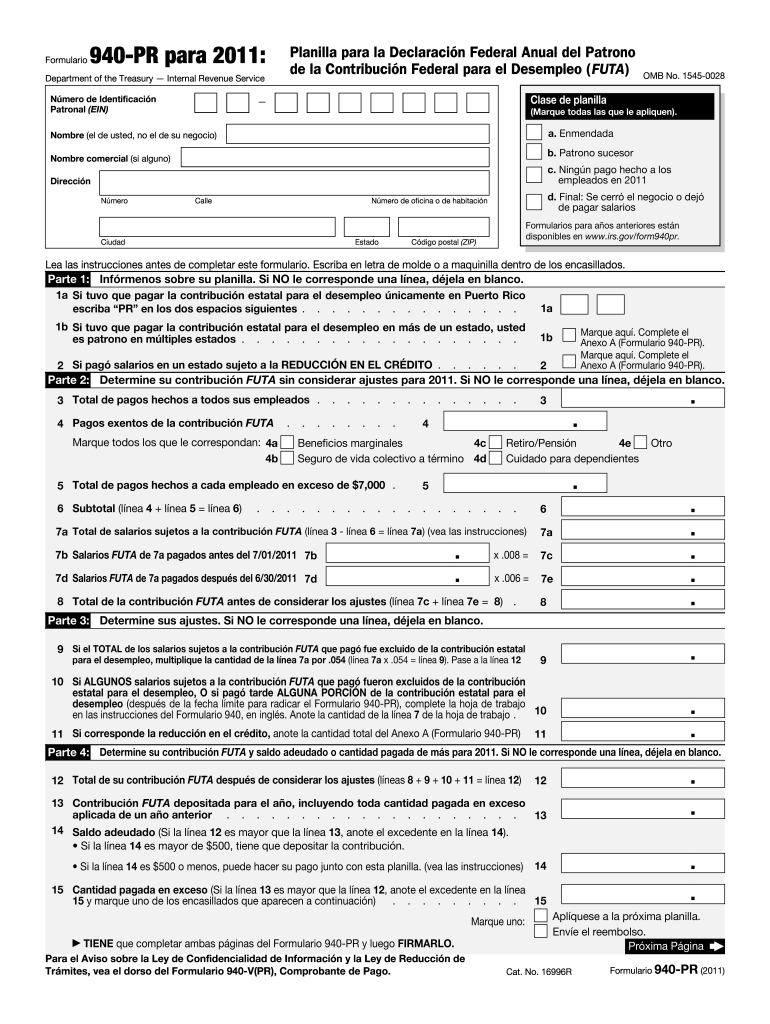

The 940 Pr Form is a tax document used by employers in the United States to report annual Federal Unemployment Tax Act (FUTA) taxes. This form is essential for businesses that pay unemployment taxes, as it summarizes the amount of tax owed based on employee wages. The form is typically filed once a year and is a crucial component of the overall tax compliance process for employers.

How to use the 940 Pr Form

Using the 940 Pr Form involves several steps to ensure accurate reporting of unemployment taxes. Employers must first gather relevant financial data, including total wages paid to employees and any adjustments for state unemployment taxes. After completing the form, it should be submitted to the Internal Revenue Service (IRS) by the designated deadline. Proper use of this form helps maintain compliance with federal tax regulations.

Steps to complete the 940 Pr Form

Completing the 940 Pr Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including total wages paid and state unemployment tax credits.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors or omissions.

- Sign and date the form to certify its accuracy.

- Submit the form to the IRS by the deadline, either electronically or via mail.

Legal use of the 940 Pr Form

The legal use of the 940 Pr Form requires compliance with IRS regulations. Employers must ensure that the information reported is truthful and complete to avoid penalties. The form serves as a legal document that can be audited by the IRS, so maintaining accurate records and documentation is essential for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 940 Pr Form are crucial for employers to remember. Typically, the form must be filed by January 31 of the following year for the previous calendar year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Staying informed about these dates helps avoid late filing penalties.

Form Submission Methods (Online / Mail / In-Person)

The 940 Pr Form can be submitted in various ways, providing flexibility for employers. Options include:

- Online submission through the IRS e-file system, which is often faster and more efficient.

- Mailing a paper copy of the form to the appropriate IRS address, ensuring it is postmarked by the deadline.

- In-person submission at designated IRS offices, if necessary.

Penalties for Non-Compliance

Failure to comply with the requirements of the 940 Pr Form can result in significant penalties. Employers may face fines for late submissions, inaccuracies, or failure to file altogether. Understanding these penalties emphasizes the importance of timely and accurate reporting to avoid financial repercussions.

Quick guide on how to complete 940 pr 2011 form

Complete 940 Pr Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage 940 Pr Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign 940 Pr Form with ease

- Obtain 940 Pr Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with resources that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choosing. Edit and eSign 940 Pr Form and ensure excellent communication at any stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 940 pr 2011 form

Create this form in 5 minutes!

How to create an eSignature for the 940 pr 2011 form

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What is the 940 Pr Form?

The 940 Pr Form is a tax document used by employers to report annual unemployment taxes. This form is crucial for compliance with state regulations and helps organizations ensure they are making the appropriate contributions. Understanding the 940 Pr Form is essential for effective payroll management.

-

How can airSlate SignNow help with the 940 Pr Form?

airSlate SignNow simplifies the process of completing and eSigning the 940 Pr Form. With our intuitive platform, you can easily fill out, review, and send this important document without hassle. The solution is designed to streamline your workflow and ensure compliance with tax regulations.

-

Is there a cost associated with using airSlate SignNow for the 940 Pr Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for easy eSigning of the 940 Pr Form. Whether you are a small business or a large corporation, our pricing is designed to be cost-effective. Check our website for the latest pricing details and features.

-

What features does airSlate SignNow offer for the 940 Pr Form?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and secure storage for the 940 Pr Form. Our platform allows users to easily eSign and send documents, enhancing collaboration and speeding up the approval process. Additional features include integration with various tools for a seamless experience.

-

Can I integrate other software with airSlate SignNow for handling the 940 Pr Form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easy to handle the 940 Pr Form. This integration helps streamline both document management and compliance, allowing you to synchronize data efficiently and reduce manual errors.

-

What are the benefits of using airSlate SignNow for the 940 Pr Form?

Using airSlate SignNow for your 940 Pr Form offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security for sensitive documents. Additionally, our platform helps ensure compliance with tax regulations while providing a user-friendly experience. You can focus on your core business while we handle your document needs.

-

Is the 940 Pr Form editable within airSlate SignNow?

Yes, the 940 Pr Form can be easily edited within airSlate SignNow. Our platform allows users to fill out necessary details digitally, ensuring that all information is accurate before sending for eSignature. This feature helps minimize errors and ensures your documents are correctly completed.

Get more for 940 Pr Form

Find out other 940 Pr Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors