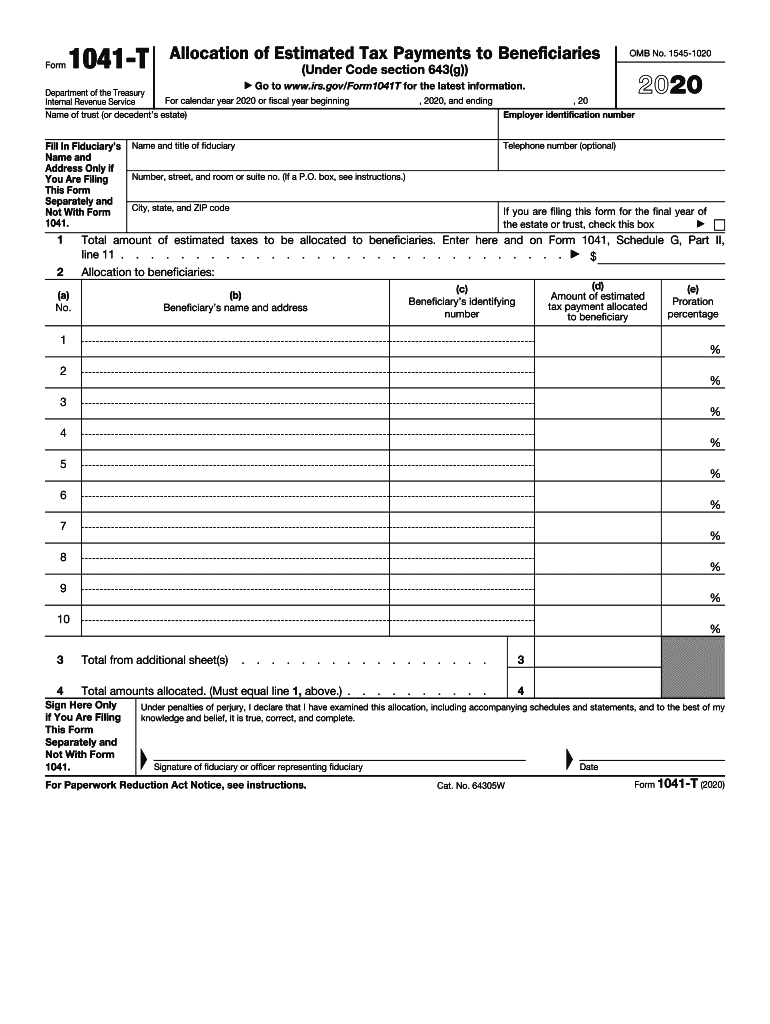

1041 Form 1041 T Allocation of Estimated Tax Payments to 2020

What is the 1041 estimated tax form?

The 1041 estimated tax form is a crucial document used by estates and trusts to report income and calculate estimated tax payments. This form is specifically designed for fiduciaries who manage estates or trusts that generate income. It allows them to estimate their tax liabilities and ensure compliance with federal tax regulations. By filing this form, fiduciaries can make timely estimated tax payments throughout the year, which helps avoid penalties for underpayment when the final tax return is filed.

Key elements of the 1041 estimated tax form

The 1041 estimated tax form includes several key elements that fiduciaries must complete to accurately report income and calculate taxes owed. These elements typically include:

- Income Reporting: Fiduciaries must report all income generated by the estate or trust, including interest, dividends, and capital gains.

- Estimated Tax Calculation: The form provides a method to calculate the estimated tax based on the reported income.

- Payment Schedule: Fiduciaries can specify the dates for making estimated tax payments, ensuring they meet IRS deadlines.

- Signature Requirement: The form must be signed by the fiduciary, affirming that the information provided is accurate and complete.

Steps to complete the 1041 estimated tax form

Completing the 1041 estimated tax form involves several steps to ensure accuracy and compliance. Here’s a general outline of the process:

- Gather Financial Information: Collect all relevant financial documents, including income statements and prior tax returns.

- Calculate Total Income: Determine the total income generated by the estate or trust during the year.

- Estimate Tax Liability: Use the IRS tax tables or tax software to estimate the total tax liability based on the income.

- Complete the Form: Fill out the 1041 estimated tax form, ensuring all sections are accurately completed.

- Review and Sign: Review the completed form for accuracy and sign it to validate the submission.

- Submit Payments: Make the estimated tax payments according to the schedule outlined in the form.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 estimated tax form are critical to avoid penalties. Generally, estimated tax payments are due on specific dates throughout the year. The IRS typically sets these dates as follows:

- First payment: April 15

- Second payment: June 15

- Third payment: September 15

- Fourth payment: January 15 of the following year

It is essential to adhere to these deadlines to ensure compliance and avoid interest or penalties for late payments.

Form Submission Methods

The 1041 estimated tax form can be submitted through various methods, providing flexibility for fiduciaries. The available submission methods include:

- Online Filing: Fiduciaries can use IRS e-file options to submit the form electronically, which is often faster and more efficient.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address, ensuring it is postmarked by the due date.

- In-Person Submission: In some cases, fiduciaries may choose to deliver the form directly to an IRS office, although this is less common.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the 1041 estimated tax form. It is important for fiduciaries to familiarize themselves with these guidelines to ensure compliance. Key points include:

- Understanding eligibility criteria for filing the form.

- Following the instructions for calculating estimated payments accurately.

- Maintaining records of all income and payments for future reference and audits.

By adhering to IRS guidelines, fiduciaries can effectively manage their tax obligations and avoid potential issues.

Quick guide on how to complete 1041 form 1041 t allocation of estimated tax payments to

Effortlessly Prepare 1041 Form 1041 T Allocation Of Estimated Tax Payments To on Any Device

Digital document management has gained popularity among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents swiftly without any delays. Manage 1041 Form 1041 T Allocation Of Estimated Tax Payments To on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Most Efficient Way to Edit and Electronically Sign 1041 Form 1041 T Allocation Of Estimated Tax Payments To with Ease

- Locate 1041 Form 1041 T Allocation Of Estimated Tax Payments To and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which only takes a few seconds and holds the same legal authority as a standard wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, and errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1041 Form 1041 T Allocation Of Estimated Tax Payments To to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1041 form 1041 t allocation of estimated tax payments to

Create this form in 5 minutes!

How to create an eSignature for the 1041 form 1041 t allocation of estimated tax payments to

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the 1041 estimated tax form?

The 1041 estimated tax form is used by estates and trusts to report their income and for making estimated tax payments. This form ensures that the IRS receives timely payments on taxable income, which can help avoid penalties. Understanding how to complete the 1041 estimated tax form is crucial for proper tax planning.

-

How can airSlate SignNow assist with the 1041 estimated tax form?

airSlate SignNow provides a user-friendly platform that simplifies the signing and submission process for the 1041 estimated tax form. With features such as secure eSigning and document management, users can easily collaborate and ensure all necessary documents are signed promptly. This streamlines tax preparation, reducing the stress often associated with tax season.

-

Is there a cost associated with using airSlate SignNow for the 1041 estimated tax form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, ensuring an affordable solution for managing documents like the 1041 estimated tax form. Depending on the plan you choose, you can access features that enhance your overall tax filing experience. A cost-effective approach helps you save both time and money when filing necessary forms.

-

What features does airSlate SignNow offer for handling 1041 estimated tax forms?

airSlate SignNow offers features such as templates, cloud storage, and audit trails specifically designed for documents like the 1041 estimated tax form. With these tools, users can create, store, and track their forms effortlessly, ensuring compliance with IRS regulations. These features enhance accuracy and efficiency in the tax filing process.

-

Can I integrate other software with airSlate SignNow for 1041 estimated tax form processing?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easy to manage the 1041 estimated tax form alongside your other financial documents. This integration facilitates a smooth workflow and enhances productivity, ensuring that all your tax-related tasks are streamlined and efficient.

-

How secure is airSlate SignNow for handling the 1041 estimated tax form?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption methods to protect sensitive information within the 1041 estimated tax form and other documents. This ensures that your data remains confidential and secure throughout the signing and submission process.

-

What benefits does eSigning the 1041 estimated tax form provide?

eSigning the 1041 estimated tax form offers numerous benefits, such as faster processing times and reduced paper waste. By using airSlate SignNow's eSignature capabilities, you can quickly get your forms signed and submitted, which is especially beneficial during tax season. Additionally, it helps in maintaining a digital record for future reference.

Get more for 1041 Form 1041 T Allocation Of Estimated Tax Payments To

Find out other 1041 Form 1041 T Allocation Of Estimated Tax Payments To

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement