Comment Request for Form 1041 T 2024

What is the Comment Request For Form 1041 T

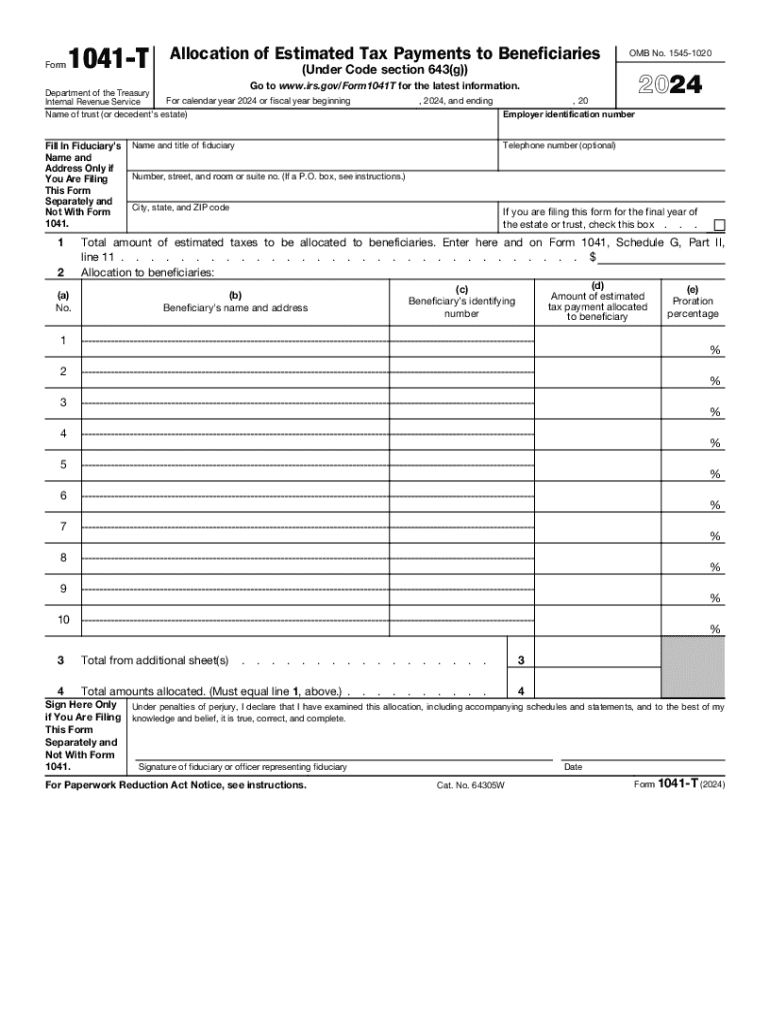

The Comment Request for Form 1041 T is a document used by the IRS to gather feedback regarding the allocation of estimated tax payments made by estates and trusts. This form is essential for beneficiaries as it helps clarify how estimated payments are distributed among them. Understanding this form is crucial for ensuring compliance with tax obligations and for the accurate reporting of income received from estates or trusts.

How to use the Comment Request For Form 1041 T

To effectively use the Comment Request for Form 1041 T, beneficiaries should first familiarize themselves with the requirements outlined by the IRS. The form allows for the submission of comments or requests for clarification regarding the allocation of estimated tax payments. Beneficiaries can provide insights into how these payments impact their tax liabilities and seek adjustments if necessary. Properly completing this form can help ensure that all parties involved understand their tax responsibilities.

Steps to complete the Comment Request For Form 1041 T

Completing the Comment Request for Form 1041 T involves several key steps:

- Obtain the form from the IRS website or through other official channels.

- Fill in the required information, including details about the estate or trust and the beneficiaries involved.

- Clearly articulate any comments or requests for clarification regarding the allocation of estimated tax payments.

- Review the completed form for accuracy and completeness.

- Submit the form according to the instructions provided, either online or via mail.

IRS Guidelines

The IRS provides specific guidelines for completing the Comment Request for Form 1041 T. These guidelines include instructions on how to report estimated payments, deadlines for submission, and the necessary documentation required to support any claims made in the comments. It is important for beneficiaries to adhere closely to these guidelines to avoid potential penalties or issues with their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Comment Request for Form 1041 T are typically aligned with the tax year for which the estimated payments are made. Beneficiaries should be aware of the key dates relevant to their situation, such as the due date for the estate or trust's tax return. Staying informed about these deadlines is essential to ensure timely submission and compliance with IRS regulations.

Required Documents

When completing the Comment Request for Form 1041 T, certain documents may be required to support the comments or requests made. These documents can include:

- Copies of the estate or trust tax returns.

- Records of estimated tax payments made on behalf of the beneficiaries.

- Any correspondence from the IRS regarding previous allocations.

Having these documents readily available can facilitate a smoother process when submitting the form.

Create this form in 5 minutes or less

Find and fill out the correct comment request for form 1041 t

Create this form in 5 minutes!

How to create an eSignature for the comment request for form 1041 t

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1041 t form and how can airSlate SignNow help with it?

The 1041 t form is used for reporting income for estates and trusts. airSlate SignNow simplifies the process by allowing users to easily send, sign, and manage their 1041 t documents electronically, ensuring compliance and efficiency.

-

How much does it cost to use airSlate SignNow for 1041 t forms?

airSlate SignNow offers competitive pricing plans that cater to various business needs. Users can choose a plan that fits their budget while efficiently managing their 1041 t forms without incurring excessive costs.

-

What features does airSlate SignNow provide for managing 1041 t documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically designed for 1041 t forms. These features enhance the user experience and streamline the document management process.

-

Can I integrate airSlate SignNow with other software for 1041 t processing?

Yes, airSlate SignNow offers integrations with various software applications, making it easy to manage your 1041 t forms alongside your existing tools. This flexibility allows for a seamless workflow and improved productivity.

-

What are the benefits of using airSlate SignNow for 1041 t forms?

Using airSlate SignNow for 1041 t forms provides numerous benefits, including time savings, reduced paperwork, and enhanced security. The platform ensures that your documents are handled efficiently and securely, giving you peace of mind.

-

Is airSlate SignNow user-friendly for filing 1041 t forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and manage their 1041 t forms. The intuitive interface allows users to complete their tasks quickly and efficiently.

-

How does airSlate SignNow ensure the security of my 1041 t documents?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your 1041 t documents. This commitment to security ensures that your sensitive information remains confidential and safe.

Get more for Comment Request For Form 1041 T

Find out other Comment Request For Form 1041 T

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement