Form 1041 T Allocation of Estimated Tax Payments to Beneficiaries under Code Section 643g Irs 2016

What is the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

The Form 1041 T is specifically designed for estates and trusts to allocate estimated tax payments to beneficiaries under Code Section 643(g) of the Internal Revenue Code. This allocation allows beneficiaries to receive a portion of the estimated tax payments made by the estate or trust, which can reduce their individual tax liabilities. The form is crucial for ensuring that beneficiaries can accurately report their share of the estate's or trust's tax payments on their personal tax returns.

How to use the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

To use the Form 1041 T, the fiduciary of the estate or trust must first complete the form by providing the necessary details about the estimated tax payments made. This includes identifying the beneficiaries and the amounts allocated to each. Once the form is filled out, it should be provided to each beneficiary and included with the estate's or trust's tax return. Beneficiaries will then use the information from the form to claim their allocated share of the estimated tax payments on their own tax returns.

Steps to complete the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

Completing the Form 1041 T involves several key steps:

- Gather necessary information about the estate or trust, including the total estimated tax payments made.

- Identify each beneficiary who is entitled to receive a portion of these payments.

- Determine the specific amount of estimated tax payments to allocate to each beneficiary based on their share of the estate or trust.

- Fill out the form accurately, ensuring all required information is included.

- Distribute copies of the completed form to each beneficiary and retain a copy for your records.

Legal use of the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

The legal use of Form 1041 T is governed by the Internal Revenue Code, specifically Section 643(g). This section allows estates and trusts to allocate estimated tax payments to beneficiaries, which can be beneficial for tax reporting purposes. Proper completion and distribution of the form ensure compliance with IRS regulations, allowing beneficiaries to claim their allocated payments without facing penalties or issues during tax filing.

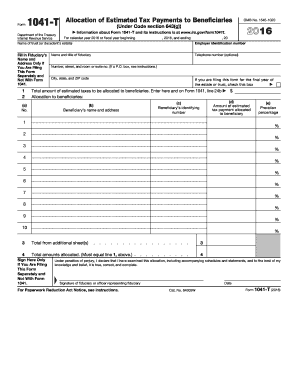

Key elements of the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

Key elements of the Form 1041 T include:

- The name and identification number of the estate or trust.

- The names and identification numbers of the beneficiaries.

- The total amount of estimated tax payments made by the estate or trust.

- The specific amounts allocated to each beneficiary.

- Signature of the fiduciary certifying the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 T typically align with the deadlines for the estate or trust's income tax return. Generally, the return is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the return is due by April fifteenth. It is important to be aware of any extensions that may apply, as well as any specific state requirements that may affect filing deadlines.

Quick guide on how to complete 2016 form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g irs

Effortlessly Prepare Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs on any platform with airSlate SignNow's Android or iOS applications and streamline any document-driven task today.

The Easiest Method to Edit and Electronically Sign Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

- Find Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of your documents or blackout confidential information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your changes.

- Choose your preferred method of delivery for your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1041 t allocation of estimated tax payments to beneficiaries under code section 643g irs

How to create an electronic signature for the 2016 Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs in the online mode

How to create an electronic signature for the 2016 Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs in Google Chrome

How to generate an electronic signature for putting it on the 2016 Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs in Gmail

How to make an eSignature for the 2016 Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs straight from your mobile device

How to make an electronic signature for the 2016 Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs on iOS devices

How to make an electronic signature for the 2016 Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs on Android OS

People also ask

-

What is the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs?

The Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs is a tax form that allows fiduciaries to allocate estimated tax payments made on behalf of a trust to its beneficiaries. This process helps ensure that beneficiaries can accurately report their share of the trust's income on their individual tax returns.

-

How does airSlate SignNow help with Form 1041 T processing?

airSlate SignNow provides an easy-to-use platform for sending, signing, and managing tax documents, including the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs. Our solution simplifies the process by allowing users to eSign and quickly share documents with clients and beneficiaries.

-

What features are included for handling Form 1041 T in airSlate SignNow?

Features for managing the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs in airSlate SignNow include customizable templates, secure eSignature capabilities, document tracking, and integration with popular accounting and tax software. These tools enhance the efficiency and accuracy of tax document management.

-

Is airSlate SignNow cost-effective for small businesses managing Form 1041 T?

Yes, airSlate SignNow offers a cost-effective solution for small businesses, enabling them to efficiently manage the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs without incurring high overhead costs. Our pricing plans are designed to fit budgets of varying sizes, ensuring accessibility for all businesses.

-

Can I track the status of my Form 1041 T documents in airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of your Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs documents. Our platform provides real-time updates on who has signed the document and alerts you when actions are required, keeping the process organized and transparent.

-

What integrations does airSlate SignNow offer for tax document management?

airSlate SignNow integrates seamlessly with a variety of popular applications, including accounting and tax software, enabling users to streamline their Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs processes. This integration ensures a smooth workflow and maximizes productivity.

-

How secure is airSlate SignNow for handling sensitive tax documents like Form 1041 T?

Security is a top priority for airSlate SignNow. We implement advanced encryption and compliance protocols to safeguard your sensitive information, including the Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs. You can trust that your tax documents are handled with the utmost care and confidentiality.

Get more for Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

- Pdfflorida beneficiary deed form

- Sales contract virginia form

- Quash writ garnishment form

- Colorado correction form

- Maryland warranty deed from two individuals and trustee to three individuals form

- Legal forms last will and testament

- Ms form

- New mexico legal last will and testament form for widow or widower with minor children

Find out other Form 1041 T Allocation Of Estimated Tax Payments To Beneficiaries Under Code Section 643g Irs

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile