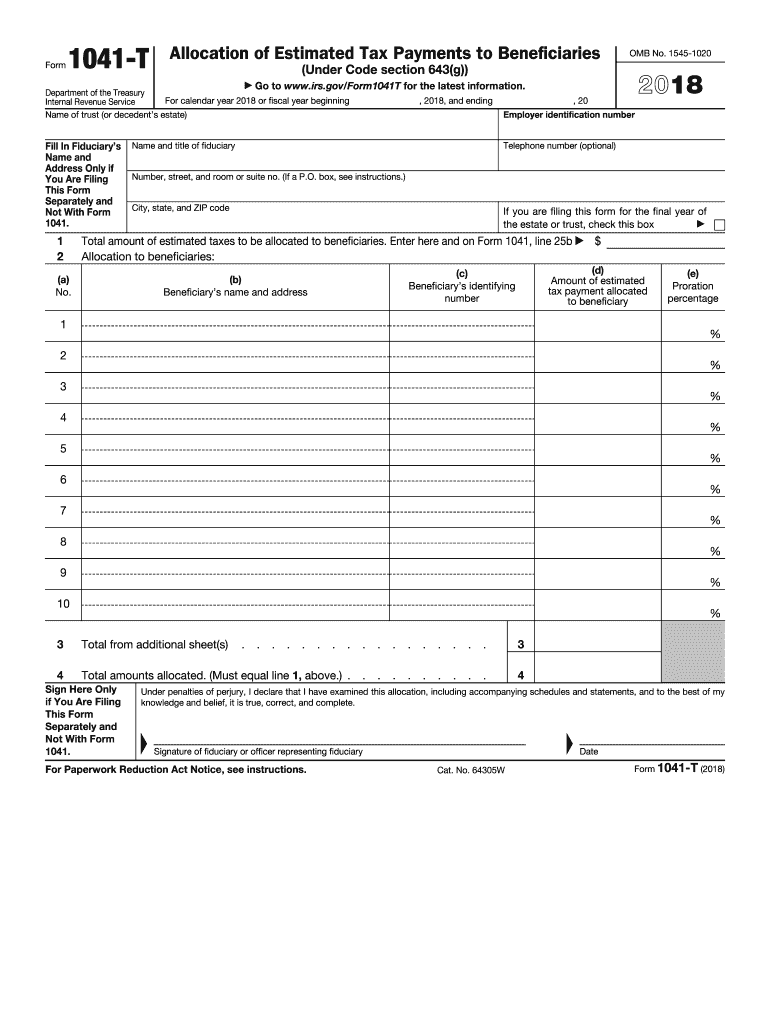

Tax Form 1041 T 2018

What is the Tax Form 1041 T

The Tax Form 1041 T is specifically designed for estates and trusts to report income, deductions, gains, and losses. This form allows fiduciaries to report the income generated by the trust or estate and to allocate distributions to beneficiaries. Understanding the purpose of this form is crucial for compliance with IRS regulations and for ensuring that beneficiaries receive their rightful shares of income. The 1041 T helps in accurately calculating the tax obligations of the estate or trust, which can have significant implications for both the fiduciary and the beneficiaries.

How to use the Tax Form 1041 T

Using the Tax Form 1041 T involves several key steps to ensure accurate reporting. First, gather all necessary financial documents related to the trust or estate, including income statements, deduction records, and any prior year tax returns. Next, fill out the form by providing detailed information about the trust or estate, including its name, address, and taxpayer identification number. It's essential to accurately report income and deductions to avoid penalties. After completing the form, ensure that all required signatures are in place before submission. Utilizing software designed for form 1041 trust tax return software can streamline this process and minimize errors.

Steps to complete the Tax Form 1041 T

Completing the Tax Form 1041 T involves a systematic approach:

- Collect all relevant financial information, including income and expenses related to the trust or estate.

- Fill out the identification section with the trust or estate's name, address, and taxpayer identification number.

- Report all income received by the trust or estate, including dividends, interest, and capital gains.

- Detail any deductions that the trust or estate is eligible for, such as administrative expenses and distributions to beneficiaries.

- Complete the allocation of distributions to beneficiaries, ensuring compliance with IRS guidelines.

- Review the form for accuracy, ensuring all calculations are correct and that all required fields are completed.

- Sign and date the form before submitting it to the IRS by the appropriate deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Form 1041 T are critical to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Additionally, fiduciaries may request an automatic six-month extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete the Tax Form 1041 T accurately, several documents are necessary:

- Income statements for the trust or estate, including interest, dividends, and capital gains.

- Records of deductions, such as administrative expenses and distributions to beneficiaries.

- Prior year tax returns, if applicable, to reference previous income and deductions.

- Any supporting documentation for claims made on the form, such as receipts or invoices.

IRS Guidelines

Adhering to IRS guidelines is essential when completing the Tax Form 1041 T. The IRS provides comprehensive instructions that outline how to fill out the form, what information is required, and the specific rules regarding distributions and deductions. It's important to stay updated on any changes to tax laws that may affect how the form is completed. Consulting the IRS website or a tax professional can provide additional clarity on compliance and best practices for filing.

Quick guide on how to complete 1041 t 2018 2019 form

Uncover the easiest method to complete and endorse your Tax Form 1041 T

Are you still spending time preparing your official paperwork on paper instead of doing it online? airSlate SignNow provides a superior alternative to complete and endorse your Tax Form 1041 T and similar forms for public services. Our intelligent electronic signature solution equips you with all the tools necessary to manage documents swiftly and in compliance with official standards - robust PDF editing, handling, securing, signing, and sharing options readily available within an intuitive interface.

There are merely a few steps needed to accomplish filling out and signing your Tax Form 1041 T:

- Upload the editable template to the editor using the Get Form button.

- Verify what details you need to include in your Tax Form 1041 T.

- Navigate through the fields using the Next feature to ensure nothing is overlooked.

- Utilize Text, Check, and Cross options to complete the gaps with your information.

- Enhance the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Conceal fields that are no longer relevant.

- Select Sign to create a legally valid electronic signature using any method that you prefer.

- Insert the Date beside your signature and finalize your task with the Done button.

Store your finalized Tax Form 1041 T in the Documents section within your profile, download it, or transfer it to your preferred cloud storage. Our solution also provides adaptable file sharing. There’s no need to print your forms when you can send them to the relevant public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct 1041 t 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 1041 t 2018 2019 form

How to make an electronic signature for your 1041 T 2018 2019 Form online

How to generate an eSignature for the 1041 T 2018 2019 Form in Google Chrome

How to create an eSignature for signing the 1041 T 2018 2019 Form in Gmail

How to make an eSignature for the 1041 T 2018 2019 Form right from your smartphone

How to generate an eSignature for the 1041 T 2018 2019 Form on iOS

How to create an eSignature for the 1041 T 2018 2019 Form on Android

People also ask

-

What is Tax Form 1041 T?

Tax Form 1041 T is a tax document used to report the income of estates and trusts. It is essential for fiduciaries to accurately report income, deductions, and credits associated with the estate. airSlate SignNow offers tools to easily eSign and send Tax Form 1041 T securely.

-

How can airSlate SignNow help with Tax Form 1041 T?

airSlate SignNow provides an easy-to-use platform for sending and eSigning your Tax Form 1041 T. With our solution, you can streamline the signing process, ensuring that all necessary signatures are collected efficiently. This helps you manage your tax forms with confidence and ease.

-

Is airSlate SignNow compliant with IRS regulations for Tax Form 1041 T?

Yes, airSlate SignNow complies with IRS regulations for electronic signatures on Tax Form 1041 T. Our platform ensures that all eSigned documents meet legal standards, giving you peace of mind that your tax forms are handled correctly.

-

What are the pricing options for airSlate SignNow when managing Tax Form 1041 T?

airSlate SignNow offers flexible pricing plans that cater to different needs, whether you're an individual or a business managing Tax Form 1041 T. Our cost-effective solutions allow you to choose a plan that best fits your eSigning needs without breaking the bank.

-

Can I integrate airSlate SignNow with accounting software for Tax Form 1041 T?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, making it easier to manage your Tax Form 1041 T. This integration allows you to streamline your workflow, ensuring that your eSigned documents are automatically updated in your records.

-

What features does airSlate SignNow offer for handling Tax Form 1041 T?

airSlate SignNow offers a range of features for managing Tax Form 1041 T, including customizable templates, secure document storage, and real-time tracking of signatures. These features simplify the process of preparing and eSigning your tax forms, making it more efficient.

-

How can I ensure the security of my Tax Form 1041 T with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Tax Form 1041 T and sensitive information. You can trust that your documents are safe while using our eSigning platform.

Get more for Tax Form 1041 T

- England netball age banding application form netballnorthwest org

- Allianz pre authorisation form

- Bccu applicant affidavit washington state department of form

- Vaf4a application form

- Lesson 8 exit ticket 4 1 form

- Kingston amp st andrew corporation form

- Self determination checklist form

- Medication administration observation checklist form

Find out other Tax Form 1041 T

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors