About Form 1041 T, Allocation of Estimated Tax Payments to 2022

Understanding Form 1041 T and Estimated Tax Payments

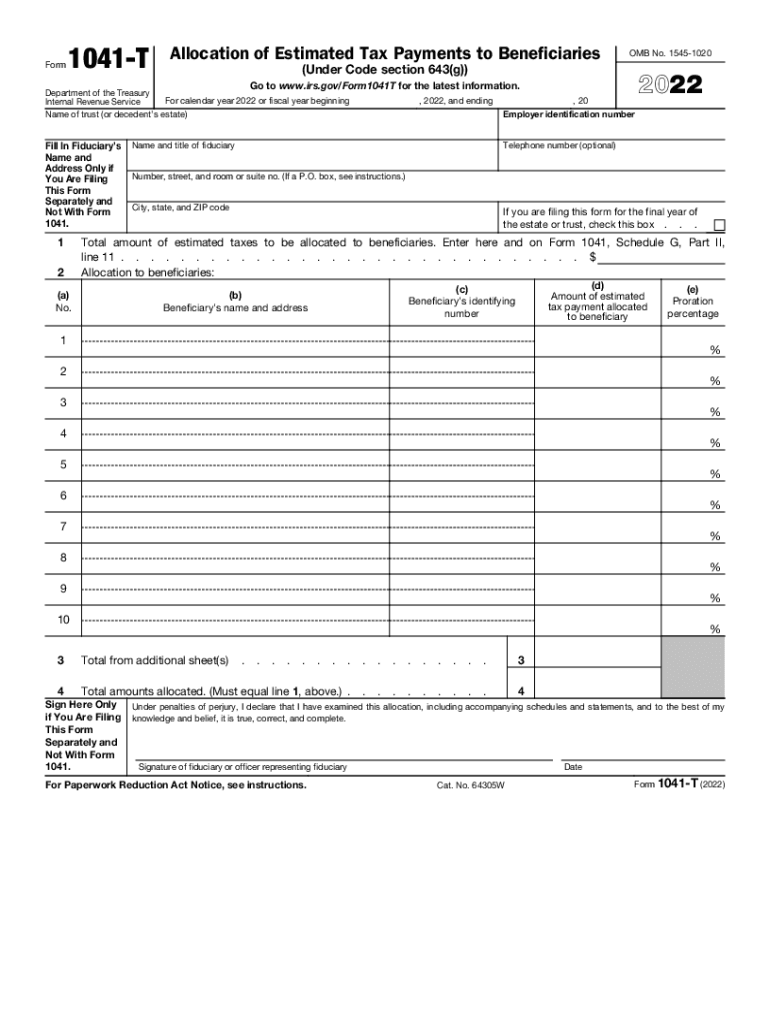

The Form 1041 T is specifically designed for estates and trusts to report income and calculate estimated tax payments. This form is crucial for fiduciaries who manage estates or trusts, as it helps allocate estimated tax payments among beneficiaries. Understanding the purpose of this form is essential for accurate tax reporting and compliance with IRS regulations.

Steps to Complete Form 1041 T for Estimated Tax Payments

Completing the Form 1041 T involves several key steps:

- Gather necessary information about the estate or trust, including income, deductions, and beneficiary details.

- Fill out the form accurately, ensuring that all income and deductions are reported correctly.

- Calculate the estimated tax payments based on the income reported.

- Allocate the estimated tax payments to the beneficiaries as per the trust or estate agreement.

- Review the completed form for accuracy before submission.

IRS Guidelines for Form 1041 T

The IRS provides specific guidelines for completing the Form 1041 T, which include instructions on reporting income, deductions, and estimated tax payments. It is important to adhere to these guidelines to avoid penalties and ensure compliance. The IRS also outlines eligibility criteria for using this form, which typically applies to estates and trusts with taxable income.

Filing Deadlines for Form 1041 T

Filing deadlines for the Form 1041 T are typically aligned with the tax year of the estate or trust. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts with a calendar year end, this means the form is due by April fifteenth. It is essential to be aware of these deadlines to avoid late filing penalties.

Legal Use of Form 1041 T

The Form 1041 T is legally binding when completed accurately and submitted in compliance with IRS regulations. It is crucial for fiduciaries to understand the legal implications of the form, especially regarding the allocation of estimated tax payments to beneficiaries. Proper use of this form ensures that all parties involved are compliant with tax obligations and can avoid potential legal issues.

Obtaining Form 1041 T

The Form 1041 T can be obtained directly from the IRS website or through tax preparation software that supports IRS forms. It is important to ensure that you are using the most current version of the form to comply with any updates or changes in tax laws. Keeping a digital copy of the form can facilitate easier completion and submission.

Quick guide on how to complete about form 1041 t allocation of estimated tax payments to

Complete About Form 1041 T, Allocation Of Estimated Tax Payments To effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely archive it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without complications. Handle About Form 1041 T, Allocation Of Estimated Tax Payments To on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to edit and electronically sign About Form 1041 T, Allocation Of Estimated Tax Payments To with ease

- Locate About Form 1041 T, Allocation Of Estimated Tax Payments To and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal weight as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign About Form 1041 T, Allocation Of Estimated Tax Payments To and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 1041 t allocation of estimated tax payments to

Create this form in 5 minutes!

People also ask

-

What are 1041 estimated tax payments?

1041 estimated tax payments refer to the prepayments that certain estates and trusts must submit to cover expected tax liability for the year. These payments are required to ensure that the estate or trust pays its share of taxes on income generated during the tax year. Understanding how 1041 estimated tax payments work is essential for managing the financial duties of an estate or trust.

-

How can airSlate SignNow help with 1041 estimated tax payments?

airSlate SignNow offers a streamlined process for managing important tax documentation related to 1041 estimated tax payments. Users can easily create, send, and eSign documents, ensuring that all necessary forms are accurate and submitted on time. This efficiency can signNowly reduce the administrative burden during tax season.

-

What features does airSlate SignNow provide for handling tax documents?

airSlate SignNow includes features like customizable templates, in-app eSigning, and robust document management tools that are perfect for handling 1041 estimated tax payments. These features not only simplify the creation of tax-related documents but also enhance compliance and reduce errors. With airSlate SignNow, tracking and managing tax documents becomes seamless.

-

Is airSlate SignNow cost-effective for tax preparers managing 1041 estimated tax payments?

Yes, airSlate SignNow provides a cost-effective solution for tax preparers handling 1041 estimated tax payments. With various pricing plans that cater to businesses of all sizes, users can benefit from a powerful platform without breaking the budget. This affordability, paired with its efficiency, makes it a preferred choice for tax professionals.

-

Can airSlate SignNow integrate with accounting software for 1041 estimated tax payments?

airSlate SignNow offers integrations with popular accounting software, making it easier to manage 1041 estimated tax payments. Users can seamlessly connect their accounting tools to streamline their workflow, ensuring that all financial documents are in sync. This integration fosters better collaboration and lessens the chances of errors during tax preparation.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents related to 1041 estimated tax payments. The platform employs advanced encryption methods and secure data storage to protect users' information. This commitment to security ensures that all tax documents are safe from unauthorized access.

-

What benefits does eSigning provide for 1041 estimated tax payments?

eSigning through airSlate SignNow expedites the process of executing 1041 estimated tax payments documents. With electronic signatures, tax professionals can obtain necessary approvals quickly, eliminating the delays associated with traditional signing methods. This faster turnaround can positively impact tax compliance and filing deadlines.

Get more for About Form 1041 T, Allocation Of Estimated Tax Payments To

- Transfer on death designation affidavit tod individual affiant to three individuals beneficiaries ohio form

- Small claim ohio form

- Transfer death designation beneficiary form

- Affidavit of confirmation ohio form

- Designation affidavit 497322193 form

- Ohio survivorship 497322194 form

- Transfer on death designation affidavit tod from individual to three individuals ohio form

- General warranty deed ohio form

Find out other About Form 1041 T, Allocation Of Estimated Tax Payments To

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now