Fill in Fiduciarys Irs 2012

What is the Fill In Fiduciarys Irs

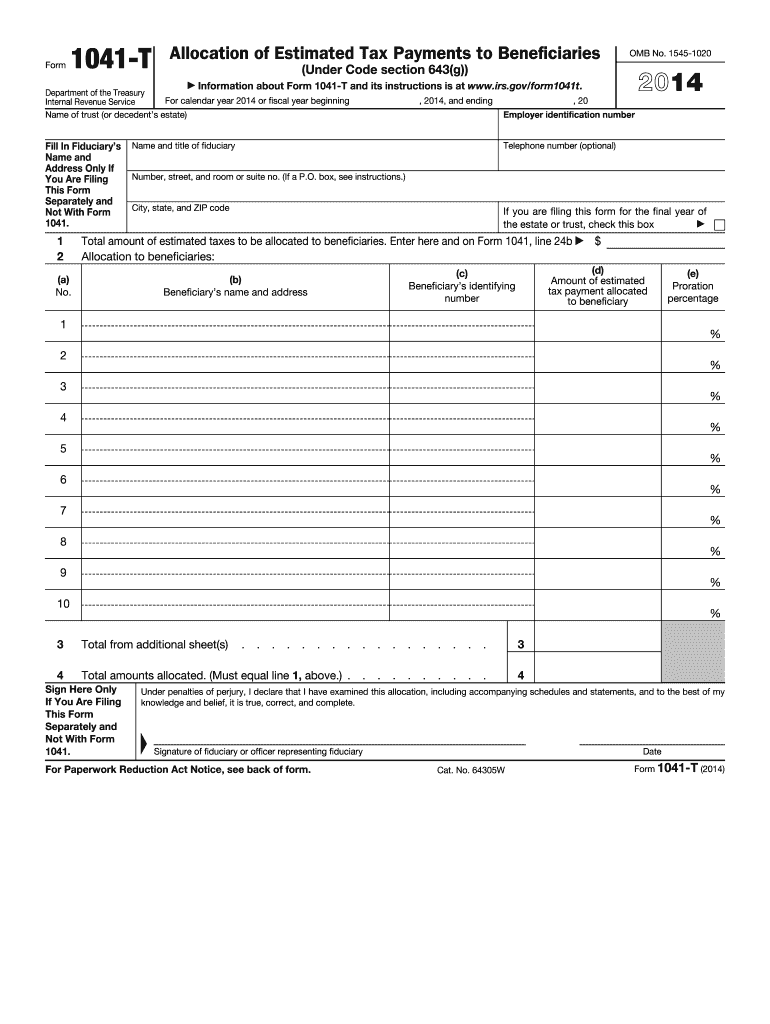

The Fill In Fiduciarys IRS form is a crucial document used by fiduciaries to report income, deductions, and credits related to estates or trusts. This form ensures that fiduciaries comply with federal tax regulations while managing the financial responsibilities of the entities they oversee. It is essential for maintaining transparency and accountability in the handling of assets and income generated by the estate or trust.

How to use the Fill In Fiduciarys Irs

Using the Fill In Fiduciarys IRS form involves several steps to ensure accurate completion and compliance with IRS guidelines. First, gather all necessary financial information related to the estate or trust, including income statements, expenses, and any applicable deductions. Next, access the form through the IRS website or other authorized sources. Fill in the required fields with accurate data, ensuring that all calculations are correct. Finally, review the form for completeness before submitting it to the IRS.

Steps to complete the Fill In Fiduciarys Irs

Completing the Fill In Fiduciarys IRS form requires careful attention to detail. Follow these steps:

- Gather financial documents related to the estate or trust.

- Obtain the correct version of the form from the IRS.

- Fill in the identification information for the fiduciary and the estate or trust.

- Report all income earned by the estate or trust.

- Detail any deductions that apply, such as administrative expenses.

- Calculate the total tax liability based on the reported income and deductions.

- Review the completed form for accuracy before submission.

Legal use of the Fill In Fiduciarys Irs

The legal use of the Fill In Fiduciarys IRS form is essential for ensuring compliance with federal tax laws. This form must be filed accurately and on time to avoid penalties. It serves as a formal declaration of the financial activities of the estate or trust, and failure to file or incorrect filing can lead to legal repercussions. Proper use of this form also helps maintain the fiduciary's credibility and protects the interests of the beneficiaries.

IRS Guidelines

The IRS provides specific guidelines for completing the Fill In Fiduciarys IRS form. These guidelines outline the necessary information to include, the deadlines for submission, and the consequences of non-compliance. It is important to refer to the latest IRS publications and resources to ensure that the form is filled out in accordance with current regulations. Adhering to these guidelines helps prevent errors and ensures that the fiduciary meets all legal obligations.

Form Submission Methods

The Fill In Fiduciarys IRS form can be submitted through various methods, including online filing, mail, or in-person submission at designated IRS offices. Online filing is often the most efficient method, allowing for quicker processing and confirmation of receipt. When submitting by mail, it is advisable to use certified mail to ensure that the form reaches the IRS securely. In-person submissions may be necessary in certain situations, such as when immediate assistance is required.

Quick guide on how to complete fill in fiduciarys irs

Effortlessly prepare Fill In Fiduciarys Irs on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Fill In Fiduciarys Irs on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Fill In Fiduciarys Irs effortlessly

- Obtain Fill In Fiduciarys Irs and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or hide sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all information and click on the Done button to save your adjustments.

- Choose how you'd like to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Fill In Fiduciarys Irs and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fill in fiduciarys irs

Create this form in 5 minutes!

How to create an eSignature for the fill in fiduciarys irs

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the process to Fill In Fiduciarys Irs using airSlate SignNow?

To Fill In Fiduciarys Irs with airSlate SignNow, simply upload your IRS form, use our intuitive interface to fill in the required fields, and then send it for electronic signatures. Our platform is designed to streamline document management, making it easy to complete IRS-related tasks quickly.

-

Are there any costs associated with using airSlate SignNow to Fill In Fiduciarys Irs?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including a free trial to test our services. Costs may depend on the number of users and features chosen, but using our platform to Fill In Fiduciarys Irs remains a cost-effective solution for managing your documentation.

-

What features does airSlate SignNow offer to assist in Filling In Fiduciarys Irs?

Our platform includes a range of features such as customizable templates, automated workflows, and integration with popular business apps. These features help simplify the process when you need to Fill In Fiduciarys Irs, ensuring efficiency and accuracy in document handling.

-

Can I integrate other applications with airSlate SignNow to Fill In Fiduciarys Irs more efficiently?

Yes, airSlate SignNow offers seamless integrations with various applications like Google Drive, Dropbox, and CRM systems. This allows you to access and manage your documents easily in one place, making it simpler to Fill In Fiduciarys Irs without switching between platforms.

-

What are the security measures in place when using airSlate SignNow to Fill In Fiduciarys Irs?

airSlate SignNow prioritizes your data's security, employing encryption, secure servers, and compliance with industry standards. When you Fill In Fiduciarys Irs, you can rest assured that your sensitive information is protected throughout the entire process.

-

Is airSlate SignNow suitable for all business sizes when Filling In Fiduciarys Irs?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, from startups to large enterprises. Our solution for Filling In Fiduciarys Irs adapts to your business's specific needs, ensuring everyone can efficiently manage their documents.

-

How does electronic signature simplify the process of Filling In Fiduciarys Irs?

Using electronic signatures with airSlate SignNow signNowly reduces the time and effort needed to finalize documents. You can quickly Fill In Fiduciarys Irs, send it for signature, and receive it back in seconds instead of waiting for physical documents to be mailed.

Get more for Fill In Fiduciarys Irs

Find out other Fill In Fiduciarys Irs

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free