Schedule a Form 940 for 2018

What is the Schedule A Form 940 For

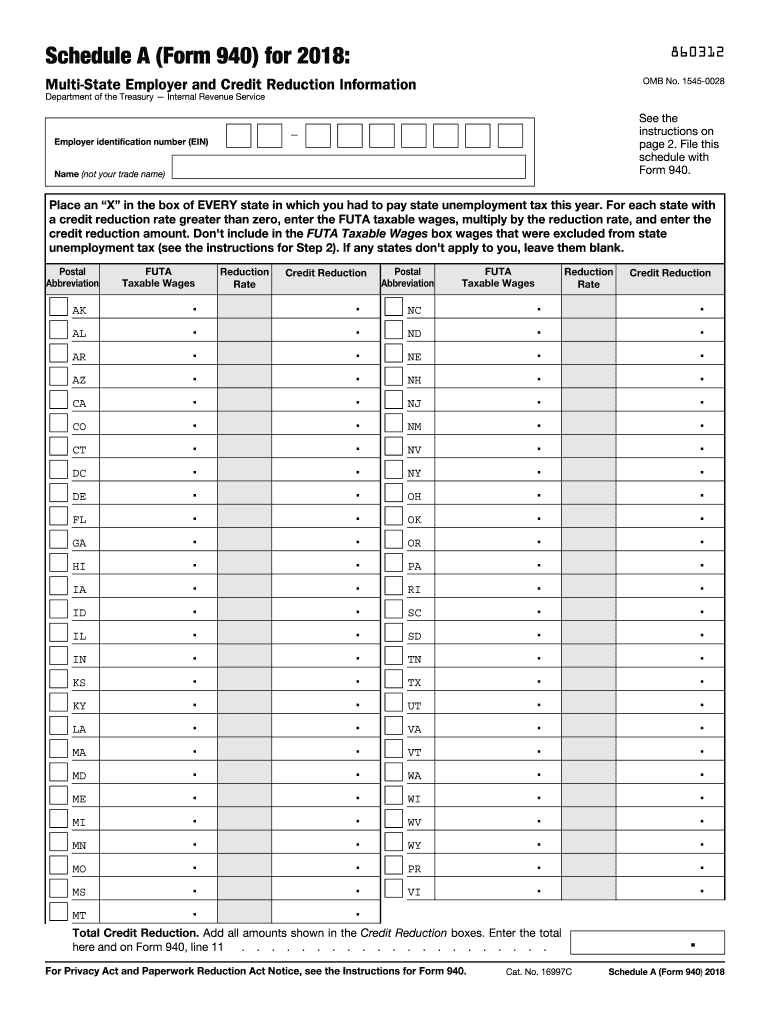

The Schedule A Form 940 is a supplementary document used by employers to report their federal unemployment tax obligations. This form is specifically designed to calculate any adjustments related to state unemployment taxes. Employers may use this form to claim credits for state unemployment taxes paid, which can reduce their overall federal tax liability. It is essential for employers to understand the purpose of this form to ensure compliance with federal tax regulations.

Steps to Complete the Schedule A Form 940 For

Completing the Schedule A Form 940 involves several key steps:

- Gather necessary information, including total wages paid and state unemployment taxes.

- Fill in the employer identification number (EIN) and other identifying information at the top of the form.

- Calculate the total state unemployment taxes paid during the tax year.

- Determine any credits for state taxes that can be applied against the federal unemployment tax.

- Review the completed form for accuracy and ensure all required fields are filled.

Once completed, the form must be submitted along with the annual Form 940.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule A Form 940. Employers should refer to the IRS instructions for Form 940, which detail the requirements for reporting state unemployment taxes and claiming credits. Key points include:

- Ensure all calculations are accurate to avoid penalties.

- Submit the form by the due date to maintain compliance.

- Keep copies of all submitted forms and supporting documentation for record-keeping purposes.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines for the Schedule A Form 940. Generally, the deadline for submitting Form 940, including any attached Schedule A forms, is January 31 of the following year. If the employer has made timely payments of the taxes owed, they may have until February 10 to file. It is crucial to mark these dates on the calendar to avoid late fees and penalties.

Required Documents

To complete the Schedule A Form 940 accurately, employers should have the following documents ready:

- Records of total wages paid to employees during the tax year.

- Documentation of state unemployment taxes paid.

- Previous year’s Form 940, if applicable, for reference.

Having these documents on hand will streamline the process and help ensure accuracy in reporting.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Schedule A Form 940. They can file electronically through the IRS e-file system, which is often faster and more secure. Alternatively, the form can be mailed to the appropriate IRS address based on the employer's location. In-person submissions are generally not available for this form. Employers should choose the method that best suits their needs while ensuring compliance with submission deadlines.

Quick guide on how to complete irs form 940 schedule a 2018

Discover the most efficient method to complete and endorse your Schedule A Form 940 For

Are you still spending time preparing your official documents on paper instead of handling them online? airSlate SignNow provides a superior approach to complete and endorse your Schedule A Form 940 For and related forms for public services. Our advanced electronic signature solution equips you with all the tools needed to manage paperwork swiftly and in compliance with legal standards - comprehensive PDF editing, handling, safeguarding, signing, and sharing features all available within an intuitive interface.

Only a few steps are necessary to finish filling out and signing your Schedule A Form 940 For:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to include in your Schedule A Form 940 For.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Conceal fields that are no longer relevant.

- Click on Sign to create a legally recognized electronic signature using your preferred method.

- Add the Date beside your signature and finalize your work with the Done button.

Store your finalized Schedule A Form 940 For in the Documents folder of your profile, download it, or send it to your chosen cloud storage. Our solution also allows versatile form sharing. There’s no need to print your forms when you can submit them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 940 schedule a 2018

FAQs

-

The IRS sent me a form 1065, but I am a sole proprietor. Do I ignore this form and fill out a schedule C?

I would assume that you applied for an employer identification number and checked the partnership box by mistake instead of sole proprietor. If this is the case, this requires you to obtain a new EIN.If you properly filled out the application for an EIN, you can ignore the 1065 notice.Your EIN acknowledgement letter from the IRS will state what type of return they expect you to file under the EIN.

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

How do I schedule a US visa interview of two people together after filling out a DS160 form?

Here is a link that might help answer your question >> DS-160: Frequently Asked QuestionsFor more information on this and similar matters, please call me direct: 650.424.1902Email: heller@hellerimmigration.comHeller Immigration Law Group | Silicon Valley Immigration Attorneys

Create this form in 5 minutes!

How to create an eSignature for the irs form 940 schedule a 2018

How to create an eSignature for the Irs Form 940 Schedule A 2018 in the online mode

How to create an electronic signature for your Irs Form 940 Schedule A 2018 in Chrome

How to generate an electronic signature for putting it on the Irs Form 940 Schedule A 2018 in Gmail

How to make an eSignature for the Irs Form 940 Schedule A 2018 from your smartphone

How to make an eSignature for the Irs Form 940 Schedule A 2018 on iOS

How to generate an electronic signature for the Irs Form 940 Schedule A 2018 on Android

People also ask

-

What is the 940 Schedule A for 2017?

The 940 Schedule A for 2017 is a form used by employers to report their annual Federal Unemployment Tax Act (FUTA) liability. This schedule helps businesses determine their eligibility for certain tax credits, which can signNowly reduce their tax burden. Understanding this form is critical for compliance with federal tax regulations.

-

How can airSlate SignNow assist with the 940 Schedule A for 2017?

AirSlate SignNow simplifies the process of signing and sending documents related to the 940 Schedule A for 2017. With our easy-to-use platform, businesses can quickly eSign important tax forms and ensure timely submission. Our solution helps increase efficiency and reduce paperwork, making tax season less stressful.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you need basic eSignature capabilities or advanced features for handling forms like the 940 Schedule A for 2017, we have cost-effective solutions to fit your budget. You can choose from monthly or annual subscriptions.

-

What features of airSlate SignNow benefit users dealing with the 940 Schedule A for 2017?

AirSlate SignNow includes features like customizable templates, bulk sending, and advanced security options, all of which are beneficial for managing the 940 Schedule A for 2017. These tools streamline the document process and enhance the user experience by saving time and ensuring compliance with all necessary regulations.

-

Are there integrations available with other software for the 940 Schedule A for 2017?

Yes, airSlate SignNow integrates seamlessly with various popular software applications, making it easy to manage documents related to the 940 Schedule A for 2017. Whether you use accounting software, CRM systems, or other tools, our platform enhances your workflow and ensures that you can eSign documents without hassle.

-

What are the benefits of using airSlate SignNow for tax forms like the 940 Schedule A for 2017?

Using airSlate SignNow for tax forms such as the 940 Schedule A for 2017 offers numerous benefits. Not only does it accelerate the eSigning process, but it also enhances security and compliance. Furthermore, our platform allows easier tracking and management of tax documents, giving businesses peace of mind.

-

Is airSlate SignNow user-friendly for non-technical users regarding the 940 Schedule A for 2017?

Absolutely! airSlate SignNow is designed with user-friendliness in mind. Even non-technical users can easily navigate the platform to complete and eSign documents like the 940 Schedule A for 2017. Our intuitive interface facilitates a smooth user experience for everyone.

Get more for Schedule A Form 940 For

Find out other Schedule A Form 940 For

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now