Instructions for Form 940 Internal Revenue Service IRS Tax Forms 2022

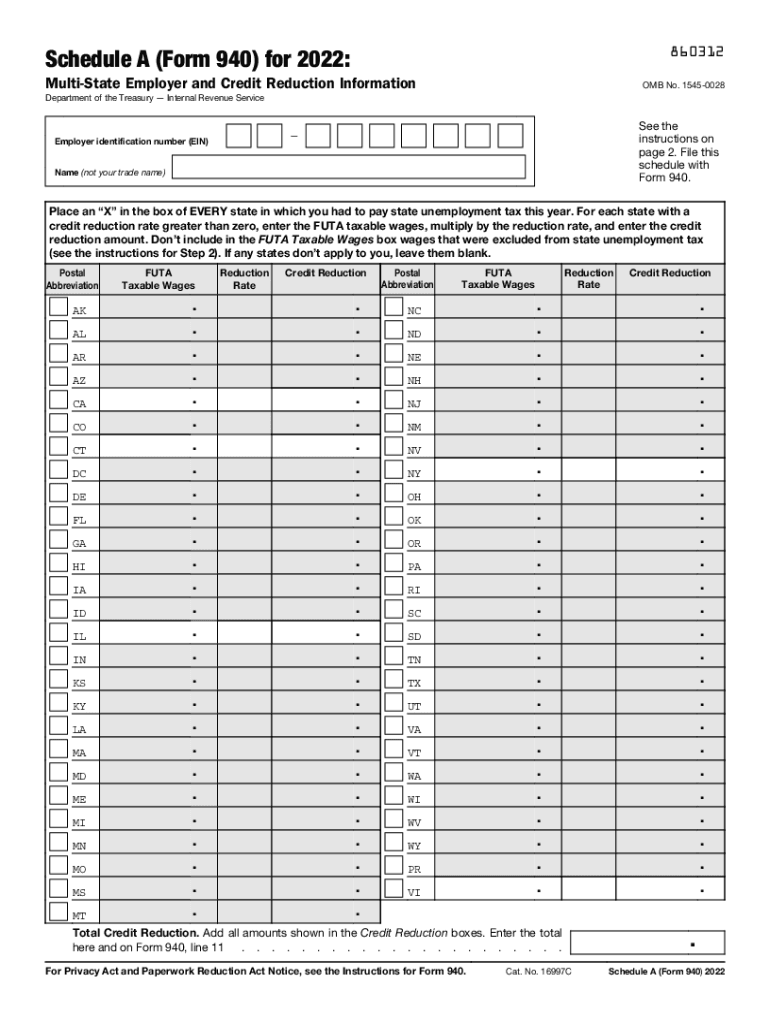

What is the 2016 Schedule 940?

The 2016 Schedule 940 is a form used by employers to report their Federal Unemployment Tax Act (FUTA) tax obligations to the Internal Revenue Service (IRS). This form is essential for businesses that pay wages to employees, as it helps determine the amount of unemployment tax owed. The information provided on Schedule 940 is crucial for ensuring compliance with federal tax regulations related to unemployment insurance.

Steps to complete the 2016 Schedule 940

Completing the 2016 Schedule 940 involves several key steps:

- Gather necessary information, including total wages paid and any state unemployment taxes paid.

- Fill out the form, ensuring all sections are completed accurately, including the calculation of taxable wages and tax due.

- Review the form for any errors or omissions to avoid penalties.

- Submit the completed form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

The deadline for filing the 2016 Schedule 940 is typically January 31 of the following year. However, if you deposited all FUTA tax owed on time, you may have until February 10 to file. It is important to keep track of these deadlines to avoid late fees and penalties.

Required Documents

To complete the 2016 Schedule 940, you will need the following documents:

- Records of employee wages paid during the calendar year.

- Documentation of any state unemployment tax payments made.

- Prior year’s Schedule 940 for reference, if applicable.

Penalties for Non-Compliance

Failure to file the 2016 Schedule 940 on time or inaccuracies in the form can lead to penalties. The IRS may impose fines based on the amount of tax due, and repeated non-compliance can result in more severe consequences. It is crucial to ensure accurate and timely submission to avoid these issues.

Digital vs. Paper Version

Employers have the option to file the 2016 Schedule 940 either digitally or via paper submission. Digital filing can streamline the process and reduce the risk of errors, while paper forms may be preferred by those who are not comfortable with electronic submissions. Regardless of the method chosen, ensuring compliance with IRS guidelines is essential.

Quick guide on how to complete instructions for form 940 2022internal revenue service irs tax forms

Effortlessly prepare Instructions For Form 940 Internal Revenue Service IRS Tax Forms on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Instructions For Form 940 Internal Revenue Service IRS Tax Forms seamlessly on any platform with airSlate SignNow's Android or iOS applications and enhance any documentation process today.

How to modify and eSign Instructions For Form 940 Internal Revenue Service IRS Tax Forms with ease

- Locate Instructions For Form 940 Internal Revenue Service IRS Tax Forms and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using specialized tools provided by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Instructions For Form 940 Internal Revenue Service IRS Tax Forms while ensuring outstanding communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 940 2022internal revenue service irs tax forms

Create this form in 5 minutes!

People also ask

-

What is the 2016 schedule 940 and why is it important?

The 2016 schedule 940 is a tax form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. It's important because it helps businesses comply with federal tax regulations and contribute to unemployment compensation. Filing the 2016 schedule 940 accurately ensures your business remains in good standing with the IRS.

-

How can airSlate SignNow assist with the 2016 schedule 940 filing process?

AirSlate SignNow provides a user-friendly platform that simplifies the eSigning and sharing of documents, including the 2016 schedule 940. With customizable templates and the ability to securely store your forms, SignNow makes it easy to prepare and file your taxes on time.

-

Is there a cost associated with using airSlate SignNow for the 2016 schedule 940?

AirSlate SignNow offers flexible pricing plans that are budget-friendly, making it accessible for businesses of all sizes. The cost depends on the features you choose, but the investment can save you time and reduce the hassle of paper processes when managing documents like the 2016 schedule 940.

-

What features does airSlate SignNow offer for handling documents like the 2016 schedule 940?

AirSlate SignNow includes features such as document templates, customizable workflows, secure eSigning, and real-time notifications. These features enable users to manage the 2016 schedule 940 efficiently, ensuring that all stakeholders can complete and sign the necessary forms without delays.

-

Can I integrate airSlate SignNow with other software tools for my 2016 schedule 940?

Yes, airSlate SignNow integrates seamlessly with a variety of software tools like Google Drive, Dropbox, and various CRM systems, which can streamline your workflow when preparing the 2016 schedule 940. This integration makes it easier to access and share your documents across different platforms.

-

What are the benefits of using airSlate SignNow for my 2016 schedule 940?

Using airSlate SignNow for your 2016 schedule 940 comes with several benefits, such as improved document accuracy, enhanced collaboration, and reduced turnaround time for getting signatures. The ability to sign a document digitally means you can complete your tax filings faster and with greater ease.

-

How does airSlate SignNow ensure the security of my 2016 schedule 940?

AirSlate SignNow employs advanced security measures, including encryption and secure data storage, to protect your sensitive information related to the 2016 schedule 940. Compliance with various regulations ensures that your documents remain confidential and secure during the eSigning process.

Get more for Instructions For Form 940 Internal Revenue Service IRS Tax Forms

- Warranty deed form nm

- Deed personal form

- New mexico quitclaim deed 497320384 form

- Warranty deed for co trustees to husband and wife as tenants in common or as community property new mexico form

- New mexico warranty deed form

- New mexico form 497320387

- Warranty deed from trust to one individual new mexico form

- Petition for admission to practice new mexico form

Find out other Instructions For Form 940 Internal Revenue Service IRS Tax Forms

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT