Schedule a Form 940 Multi State Employer and Credit Reduction Information 2020

Understanding Schedule A Form 940 for Multi-State Employers

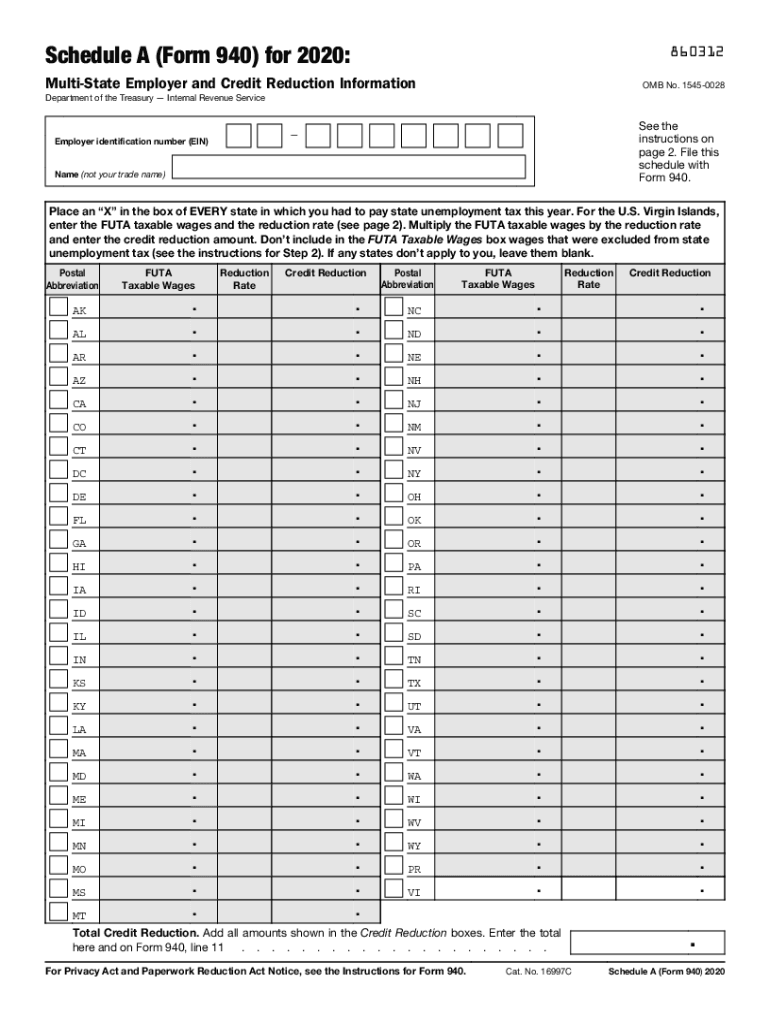

The Schedule A Form 940 is specifically designed for employers who operate in multiple states and need to report their unemployment tax obligations accurately. This form is essential for employers who have employees in more than one state and may be subject to varying state unemployment tax rates. The Schedule A allows these employers to calculate any credit reductions that may apply based on their state’s unemployment insurance program. Understanding this form is crucial for compliance and ensuring that your business meets federal requirements while optimizing tax liabilities.

Steps to Complete Schedule A Form 940

Completing the Schedule A Form 940 involves several key steps to ensure accuracy and compliance. First, gather all necessary information regarding your employees, including their state of employment and wages. Next, determine the state unemployment tax rates applicable to your business. Fill out the form by entering the required data, including the total wages paid to employees in each state and any applicable credits. It is important to review the completed form for accuracy before submission. Finally, ensure that the form is submitted by the IRS deadline to avoid penalties.

Legal Use of Schedule A Form 940

The Schedule A Form 940 is legally binding and must be completed in accordance with IRS regulations. Employers are required to use this form to report unemployment taxes accurately, especially when operating in multiple states. Failure to comply with the legal requirements can result in penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of the information reported on this form, as it impacts both the employer's tax obligations and the benefits available to employees.

Filing Deadlines for Schedule A Form 940

Filing deadlines for the Schedule A Form 940 align with the annual filing requirements for the Form 940 itself. Employers must submit the completed form by January 31 of the year following the tax year being reported. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is crucial for employers to adhere to these deadlines to avoid late fees and ensure compliance with federal tax regulations.

IRS Guidelines for Schedule A Form 940

The IRS provides specific guidelines for completing and submitting the Schedule A Form 940. These guidelines outline the necessary information required, the calculation of unemployment tax credits, and the reporting of wages across different states. Employers should review these guidelines carefully to ensure that they meet all requirements and avoid common pitfalls. Adhering to IRS guidelines helps maintain compliance and supports accurate tax reporting.

Examples of Using Schedule A Form 940

Utilizing the Schedule A Form 940 can vary based on the specific circumstances of an employer. For instance, a business with employees in multiple states may use this form to report wages and calculate unemployment tax credits for each state. An example could involve a company with employees in California and Texas, where the employer must report the total wages paid in each state and apply the appropriate state tax rates. These examples illustrate the form's practical application in managing multi-state employment and tax obligations.

Quick guide on how to complete 2020 schedule a form 940 multi state employer and credit reduction information

Complete Schedule A Form 940 Multi State Employer And Credit Reduction Information easily on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruptions. Manage Schedule A Form 940 Multi State Employer And Credit Reduction Information on any device using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to modify and electronically sign Schedule A Form 940 Multi State Employer And Credit Reduction Information effortlessly

- Locate Schedule A Form 940 Multi State Employer And Credit Reduction Information and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Schedule A Form 940 Multi State Employer And Credit Reduction Information to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule a form 940 multi state employer and credit reduction information

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule a form 940 multi state employer and credit reduction information

How to make an electronic signature for your PDF document online

How to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

The best way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the 2020 940 form and why is it important?

The 2020 940 form is used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax. It is crucial for businesses to accurately file this form to ensure compliance with federal regulations and avoid penalties. Understanding the ins and outs of the 2020 940 is essential for proper tax planning and financial management.

-

How does airSlate SignNow simplify the process of signing the 2020 940?

airSlate SignNow offers a straightforward way to eSign documents, including the 2020 940 form. Our platform allows you to upload your tax forms, fill them out, and securely send them for signatures all in one place. This streamlines the process, reducing paper waste and ensuring you meet filing deadlines.

-

What features does airSlate SignNow offer for managing the 2020 940?

airSlate SignNow includes robust features such as templates, customizable workflows, and team collaboration tools to manage the 2020 940 form effectively. These features help you ensure that all necessary fields are completed correctly, reducing the likelihood of errors. Additionally, you can track document status in real-time.

-

Is there a cost associated with using airSlate SignNow for the 2020 940?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers to fit different business needs. For those dealing with the 2020 940 form regularly, investing in our solution can save time and reduce the costs associated with printing and mailing. Visit our pricing page for detailed information about our plans.

-

Can airSlate SignNow integrate with other accounting software for filing the 2020 940?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to connect your workflows for filing the 2020 940 form. This integration simplifies the transfer of data and ensures accuracy across your financial reporting and tax submissions. Check our integrations section for a complete list of compatible tools.

-

How secure is airSlate SignNow when handling documents like the 2020 940?

airSlate SignNow prioritizes security with top-notch encryption and compliance with industry standards. Your sensitive documents, such as the 2020 940, are protected throughout the signing process to prevent unauthorized access. We also provide audit trails for all transactions to ensure transparency.

-

What are the benefits of using airSlate SignNow for the 2020 940 form?

Using airSlate SignNow for the 2020 940 form provides numerous benefits, including improved efficiency, paperless processes, and enhanced collaboration among team members. The ease of use reduces the time spent on administrative tasks, allowing you to focus more on your core business functions. Plus, our user-friendly interface makes it accessible for everyone.

Get more for Schedule A Form 940 Multi State Employer And Credit Reduction Information

- National council for tibb form

- Swamy handbook 2022 pdf download form

- Retrenchment letter template south africa form

- Directorate general pakistan post office islamabad office of the form

- Work order format for labour contractor

- Brigada eskwela monitoring and evaluation tool 2021 form

- Sw comprehensive warrantdoc le alcoda form

- Camp petosega form

Find out other Schedule A Form 940 Multi State Employer And Credit Reduction Information

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF