Www Irs Govforms Pubsabout Schedule I Form 990About Schedule I Form 990, Grants and Other Assistance to 2021

Understanding Schedule I Form 990

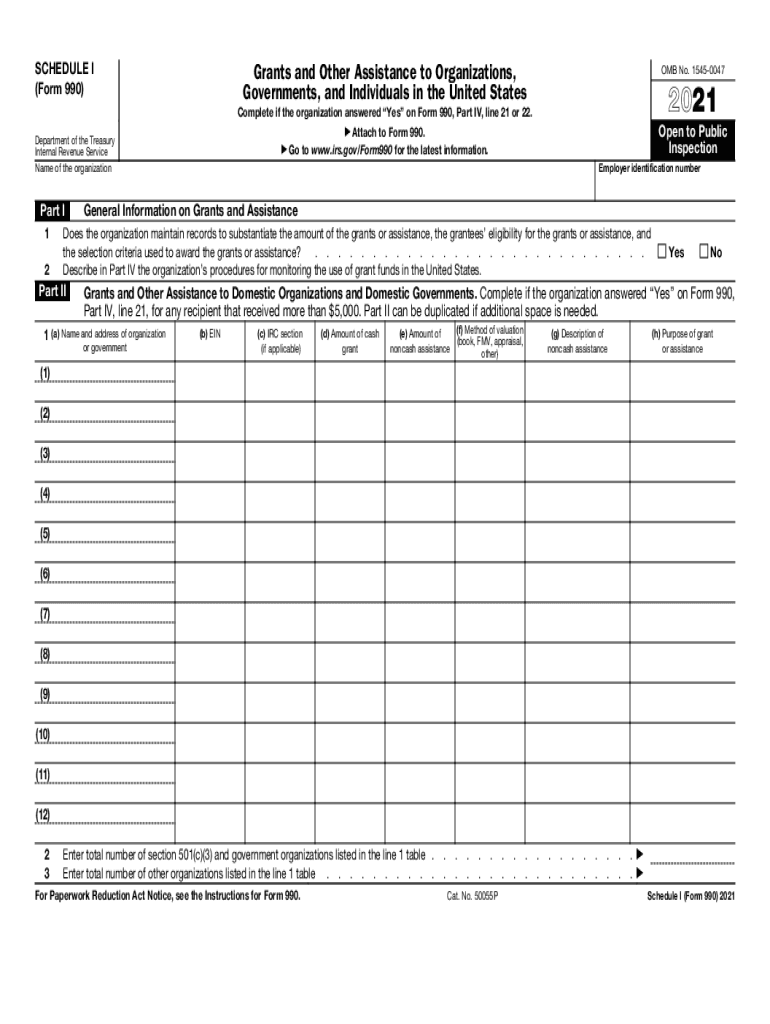

Schedule I of Form 990 is designed for organizations to report on grants and other assistance they provide. This form is essential for non-profit organizations to disclose how they allocate funds and support their activities. Understanding the details of this form can help ensure compliance with IRS regulations and provide transparency to stakeholders.

Organizations must provide specific information about the types of grants and assistance they offer, including the recipients and the amounts distributed. This transparency is crucial for maintaining public trust and fulfilling legal obligations.

Steps to Complete Schedule I Form 990

Completing Schedule I Form 990 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial records related to grants and assistance provided during the tax year. This includes documentation of amounts, recipients, and the purpose of each grant.

Next, fill out the form by entering the required information in the appropriate sections. Pay close attention to the instructions provided by the IRS to avoid errors. Once completed, review the form carefully to ensure all information is accurate before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for Schedule I Form 990 to avoid penalties. Typically, the form must be filed on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due by May 15 of the following year.

Extensions may be available, but it is important to file the necessary paperwork to request an extension before the original deadline. Keeping track of these dates helps ensure compliance and avoids potential fines.

IRS Guidelines for Schedule I Form 990

The IRS provides specific guidelines for completing Schedule I Form 990. These guidelines outline the necessary information required, the format in which it should be presented, and any additional documentation that may need to accompany the form.

Organizations should familiarize themselves with these guidelines to ensure they meet all requirements and provide accurate information. Regularly reviewing IRS updates can also help organizations stay informed about any changes to the filing process or requirements.

Required Documents for Schedule I Form 990

When preparing to file Schedule I Form 990, organizations must gather several key documents. This includes financial statements, records of grants and assistance provided, and any correspondence related to funding sources.

Having these documents readily available will facilitate the completion of the form and ensure that all necessary information is accurately reported. It is advisable to maintain organized records throughout the year to simplify the filing process.

Penalties for Non-Compliance with Schedule I Form 990

Failure to file Schedule I Form 990 accurately and on time can result in significant penalties for organizations. The IRS may impose fines for late filings, incomplete forms, or failure to provide required information. These penalties can accumulate quickly, impacting the organization’s financial health.

To avoid these consequences, organizations should prioritize timely and accurate submissions of their forms, ensuring that they adhere to all IRS regulations and guidelines.

Quick guide on how to complete wwwirsgovforms pubsabout schedule i form 990about schedule i form 990 grants and other assistance to

Complete Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To with ease

- Locate Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive content with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovforms pubsabout schedule i form 990about schedule i form 990 grants and other assistance to

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovforms pubsabout schedule i form 990about schedule i form 990 grants and other assistance to

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is schedule 1 2021 and how does it relate to airSlate SignNow?

Schedule 1 2021 is a crucial form for reporting certain types of income on your tax return. Using airSlate SignNow, you can easily manage, send, and eSign this document securely and efficiently, ensuring that all your necessary paperwork is completed on time.

-

What features does airSlate SignNow offer for handling schedule 1 2021 documents?

airSlate SignNow provides robust features like customizable templates, secure eSigning, and document tracking for schedule 1 2021. These features streamline your document management process, allowing you to focus on your business while ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for managing schedule 1 2021 documents?

Pricing for airSlate SignNow is competitive and designed to fit various budgets, starting from a basic plan to advanced options. You can manage multiple schedule 1 2021 documents at an affordable price, making it a cost-effective choice for businesses of all sizes.

-

Can I integrate airSlate SignNow with other applications for working with schedule 1 2021?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRMs and accounting software, which can be beneficial for managing tasks related to schedule 1 2021. This integration helps ensure that all your systems work together smoothly, enhancing your workflow.

-

What are the benefits of using airSlate SignNow for schedule 1 2021 over traditional methods?

Using airSlate SignNow for schedule 1 2021 provides several benefits over traditional methods, such as faster processing times and reduced paper waste. Additionally, you gain the ability to track document statuses and ensure security and compliance with digital signatures.

-

Is airSlate SignNow user-friendly for completing schedule 1 2021 forms?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete and eSign schedule 1 2021 forms. Its intuitive interface helps you navigate every step without needing extensive training or technical expertise.

-

What support does airSlate SignNow offer for issues related to schedule 1 2021?

airSlate SignNow provides excellent customer support to assist users with any inquiries related to schedule 1 2021. Whether you have questions about the signing process or need technical assistance, their support team is readily available to help you.

Get more for Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To

- Ga defendant form

- Georgia plaintiff form

- Legal last will and testament form for single person with no children georgia

- Legal last will and testament form for a single person with minor children georgia

- Legal last will and testament form for single person with adult and minor children georgia

- Legal last will and testament form for single person with adult children georgia

- Legal last will and testament for married person with minor children from prior marriage georgia form

- Legal last will and testament form for married person with adult children from prior marriage georgia

Find out other Www irs govforms pubsabout schedule i form 990About Schedule I Form 990, Grants And Other Assistance To

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online