Tax Brief Form 990, Schedule I Grants and Other Assistance 2023

Understanding the Tax Brief Form 990, Schedule I Grants and Other Assistance

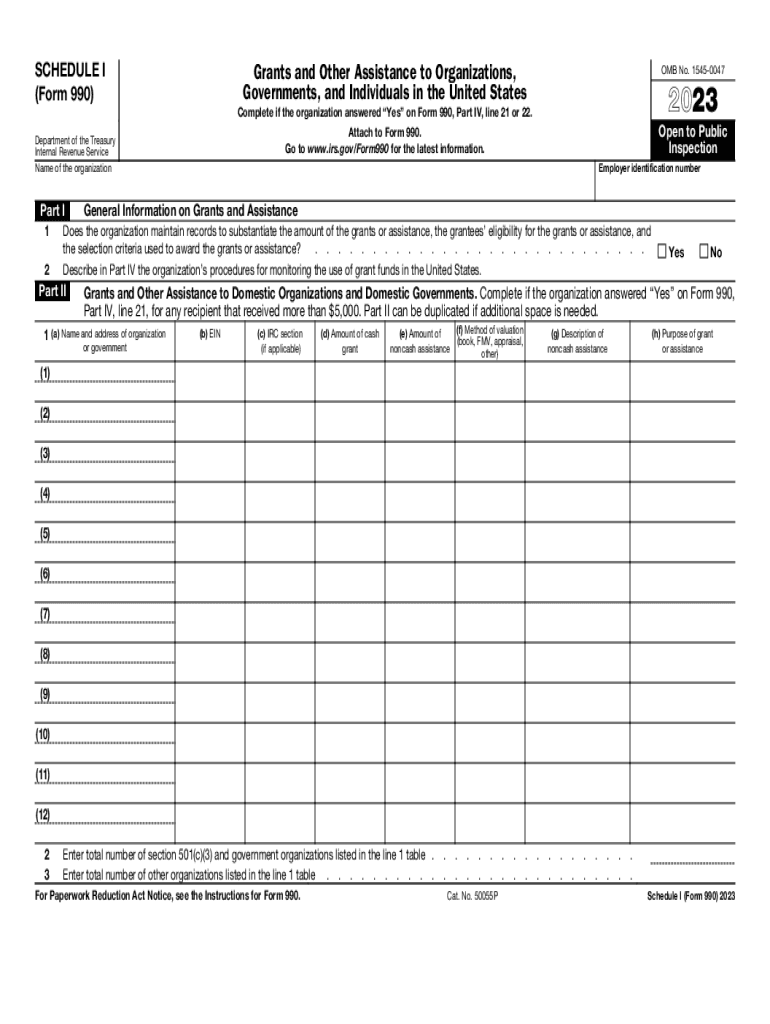

The Tax Brief Form 990, Schedule I is essential for organizations that provide grants and other forms of assistance. This form helps to report the financial activities of tax-exempt organizations, detailing the grants made to individuals and other entities. It is crucial for transparency and compliance with IRS regulations, ensuring that the public can see how funds are distributed and utilized. Understanding this form is vital for both the organizations that file it and the individuals who receive assistance.

Steps to Complete the Tax Brief Form 990, Schedule I Grants and Other Assistance

Completing the Tax Brief Form 990, Schedule I requires careful attention to detail. Here are the steps involved:

- Gather necessary financial records, including previous tax filings and documentation of grants.

- Identify the types of assistance provided, categorizing them appropriately.

- Fill out the form accurately, ensuring all information is current and complete.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Submit the form by the designated deadline to avoid penalties.

Legal Use of the Tax Brief Form 990, Schedule I Grants and Other Assistance

The legal use of the Tax Brief Form 990, Schedule I is governed by IRS regulations. Organizations must use this form to report their financial activities related to grants and assistance. Failure to comply with these regulations can result in penalties, including fines and loss of tax-exempt status. It is important for organizations to understand their legal obligations and ensure that they are using the form correctly to maintain compliance.

Filing Deadlines and Important Dates

Filing deadlines for the Tax Brief Form 990, Schedule I vary depending on the organization’s fiscal year. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this typically means a May fifteenth deadline. It is crucial to be aware of these dates to avoid late fees and ensure timely reporting to the IRS.

Required Documents for Filing the Tax Brief Form 990, Schedule I

When preparing to file the Tax Brief Form 990, Schedule I, organizations must gather several key documents:

- Previous years' Form 990 filings for reference.

- Documentation of all grants and assistance provided during the reporting period.

- Financial statements, including balance sheets and income statements.

- Any correspondence with the IRS related to previous filings.

Examples of Using the Tax Brief Form 990, Schedule I Grants and Other Assistance

Organizations often use the Tax Brief Form 990, Schedule I to report various types of assistance. For example, a nonprofit providing educational grants to students would detail the amounts awarded, the recipients, and the purpose of each grant. Similarly, a health organization might report funding provided to individuals for medical expenses. These examples illustrate the form's role in promoting transparency and accountability in the distribution of assistance.

Quick guide on how to complete tax brief form 990 schedule i grants and other assistance

Complete Tax Brief Form 990, Schedule I Grants And Other Assistance effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it in the cloud. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Brief Form 990, Schedule I Grants And Other Assistance on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Tax Brief Form 990, Schedule I Grants And Other Assistance with ease

- Locate Tax Brief Form 990, Schedule I Grants And Other Assistance and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Tax Brief Form 990, Schedule I Grants And Other Assistance and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax brief form 990 schedule i grants and other assistance

Create this form in 5 minutes!

How to create an eSignature for the tax brief form 990 schedule i grants and other assistance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it help 2017 assistance individuals?

airSlate SignNow is a digital document management solution that enables 2017 assistance individuals to send and eSign documents easily. This user-friendly platform streamlines the signing process, making it efficient for those providing or receiving assistance in various contexts.

-

Is airSlate SignNow cost-effective for 2017 assistance individuals?

Yes, airSlate SignNow offers affordable pricing plans specifically designed for 2017 assistance individuals. This ensures that anyone in need can access essential document signing functionalities without breaking the bank.

-

What features are available for 2017 assistance individuals using airSlate SignNow?

airSlate SignNow includes features such as customizable templates, real-time collaboration, and secure document storage. These features are particularly beneficial for 2017 assistance individuals who need to manage and sign documents securely and efficiently.

-

Can 2017 assistance individuals integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow can be easily integrated with a variety of tools and applications. This flexibility allows 2017 assistance individuals to streamline their workflows by connecting their favorite applications with airSlate SignNow.

-

What benefits does airSlate SignNow offer to 2017 assistance individuals?

For 2017 assistance individuals, airSlate SignNow enhances productivity by reducing the time spent on document management. It promotes quicker decision-making and easy tracking of signed documents, which is essential for individuals handling urgent assistance needs.

-

How secure is airSlate SignNow for 2017 assistance individuals?

Security is a top priority for airSlate SignNow, making it a perfect choice for 2017 assistance individuals. The platform implements advanced encryption and compliance measures to safeguard sensitive documents and personal information.

-

Can 2017 assistance individuals access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing 2017 assistance individuals to send and sign documents on the go. This mobile accessibility ensures that assistance can be provided promptly, regardless of location.

Get more for Tax Brief Form 990, Schedule I Grants And Other Assistance

- The sad rainbow form

- Csd mvlampp state id application form indd

- Massachusetts nurse aide testing and registration application form redcross

- Smith transport inc smithtransport form

- Peta check in form word revision final 12 22

- Outhwest licking community water amp sew ohio auditor of state form

- Navpers 1650 100095388 form

- Farm contract template form

Find out other Tax Brief Form 990, Schedule I Grants And Other Assistance

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure