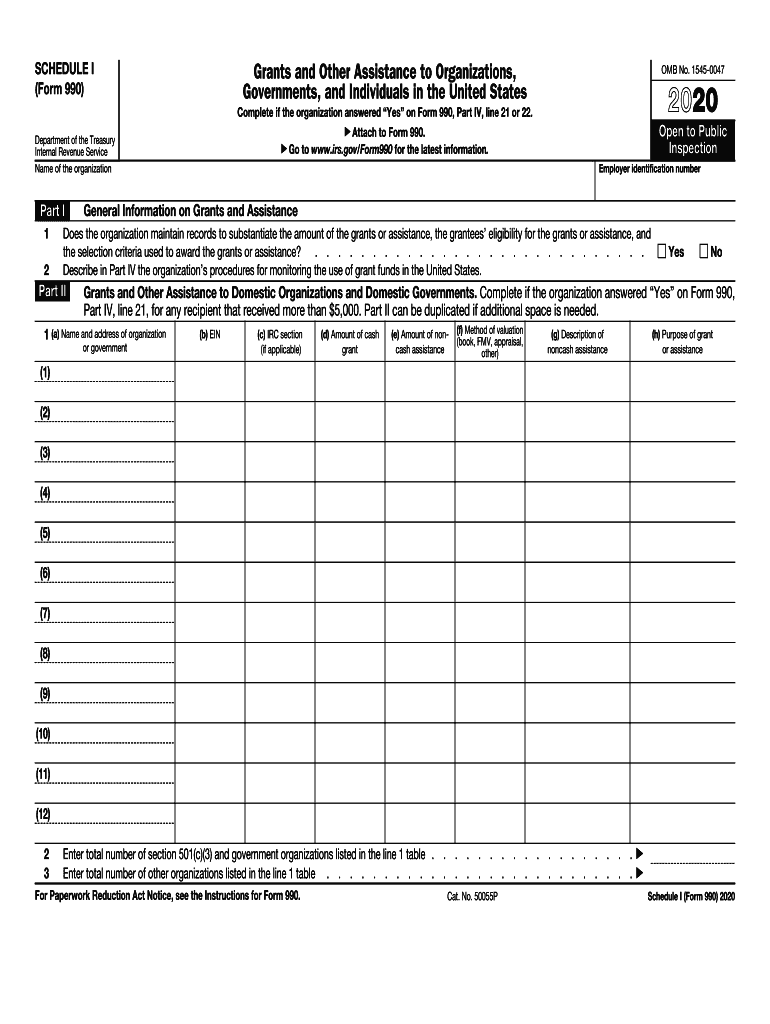

Schedule I Form 990 Internal Revenue Service 2020

What is the Schedule I Form 990?

The Schedule I Form 990 is a supplementary document required by the Internal Revenue Service (IRS) for certain tax-exempt organizations. It provides additional information about the organization’s activities, including details on revenue, expenses, and other financial data. This form is essential for ensuring transparency and compliance with federal tax regulations. Organizations must complete this form accurately to maintain their tax-exempt status and to inform stakeholders about their financial health.

How to use the Schedule I Form 990

Using the Schedule I Form 990 involves several steps. First, organizations must gather all necessary financial information, including revenue sources and expenditures. Next, they should carefully fill out the form, ensuring that all sections are completed accurately. It is crucial to follow IRS instructions closely to avoid errors that could lead to penalties or complications. Once completed, the form should be submitted along with the main Form 990 to the IRS by the designated deadline.

Steps to complete the Schedule I Form 990

Completing the Schedule I Form 990 involves the following steps:

- Gather financial records, including income statements and balance sheets.

- Review the IRS instructions for the Schedule I Form 990 to understand the requirements.

- Fill out the form, providing detailed information about revenue and expenses.

- Double-check all entries for accuracy and completeness.

- Submit the Schedule I along with the main Form 990 by the filing deadline.

Key elements of the Schedule I Form 990

The Schedule I Form 990 includes several key elements that organizations must address. These elements typically cover:

- Revenue sources, including contributions, grants, and program service revenue.

- Expenses related to program services, management, and fundraising activities.

- Details about any changes in the organization’s structure or activities during the year.

- Information on any transactions with related parties or significant donors.

Filing Deadlines / Important Dates

Organizations must be aware of specific filing deadlines for the Schedule I Form 990. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For example, if the fiscal year ends on December thirty-first, the form would be due on May fifteenth of the following year. It is important to file on time to avoid penalties and maintain compliance with IRS regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule I Form 990 can result in significant penalties. Organizations may face fines for late submissions, inaccuracies, or failure to file altogether. Additionally, non-compliance can jeopardize tax-exempt status, leading to further financial repercussions. It is essential for organizations to prioritize accurate and timely filing to avoid these consequences.

Quick guide on how to complete 2020 schedule i form 990 internal revenue service

Complete Schedule I Form 990 Internal Revenue Service effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers a perfect environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without unnecessary delays. Handle Schedule I Form 990 Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Schedule I Form 990 Internal Revenue Service with ease

- Find Schedule I Form 990 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your document, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages your document-related needs in just a few clicks from any device of your preference. Modify and electronically sign Schedule I Form 990 Internal Revenue Service and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule i form 990 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule i form 990 internal revenue service

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the 2020 Schedule 1 and why do I need it?

The 2020 Schedule 1 is a tax form used to report additional income and adjustments to income. You need it to accurately complete your tax return, as it helps in determining your overall tax liability or refund. Using airSlate SignNow can simplify the eSigning process of your 2020 Schedule 1, making it quick and efficient.

-

How can airSlate SignNow help with the 2020 Schedule 1?

airSlate SignNow offers a user-friendly interface that allows you to easily upload, fill out, and eSign your 2020 Schedule 1 documents. This helps streamline your workflow, reduces paper usage, and speeds up the submission process, ensuring everything is completed in one convenient platform.

-

Is there a cost associated with using airSlate SignNow for the 2020 Schedule 1?

Yes, airSlate SignNow provides various pricing plans to suit different business needs. The pricing is competitive, and it is important to assess the features included in each plan to determine the best fit for your requirements related to the 2020 Schedule 1 and other document management tasks.

-

Can I integrate airSlate SignNow with other software for handling the 2020 Schedule 1?

Absolutely! airSlate SignNow offers integrations with numerous software platforms, including CRM systems and cloud storage solutions. This allows you to manage your 2020 Schedule 1 alongside other financial documents seamlessly, enhancing your productivity.

-

What are the benefits of using airSlate SignNow for the 2020 Schedule 1?

Using airSlate SignNow for your 2020 Schedule 1 provides benefits like increased efficiency, reduced turnaround times, and enhanced security for your sensitive tax documents. Additionally, the platform’s easy-to-use features simplify the signing process, making it accessible for all users.

-

Is it safe to eSign my 2020 Schedule 1 with airSlate SignNow?

Yes, airSlate SignNow employs advanced security measures, including encryption and authentication protocols, to ensure the safety and confidentiality of your 2020 Schedule 1 and all other documents. You can eSign with confidence, knowing that your data is protected.

-

What features does airSlate SignNow offer that can benefit the completion of a 2020 Schedule 1?

airSlate SignNow provides several features such as templates, real-time tracking, and audit trails that are particularly beneficial for completing your 2020 Schedule 1. These tools ensure that you can efficiently manage your documents while maintaining compliance and accuracy throughout the signing process.

Get more for Schedule I Form 990 Internal Revenue Service

Find out other Schedule I Form 990 Internal Revenue Service

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure