Schedule I 990 Form Templates 2024-2026

What is the Schedule I 990 Form?

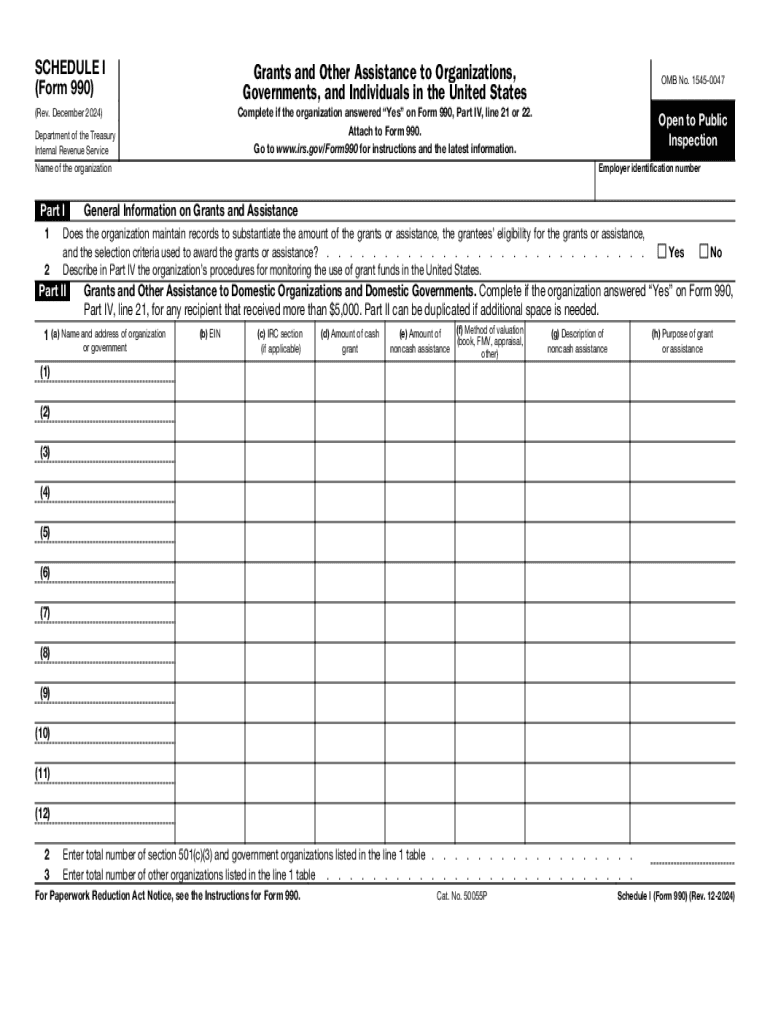

The Schedule I 990 form is a supplementary document used by tax-exempt organizations to report specific financial information to the Internal Revenue Service (IRS). This form is part of the larger Form 990, which is the annual information return that tax-exempt organizations must file. The Schedule I provides detailed insights into the organization’s revenue sources, expenses, and activities. It is crucial for maintaining transparency and compliance with federal regulations.

How to Obtain the Schedule I 990 Form

To obtain the Schedule I 990 form, organizations can visit the IRS website, where the form is available for download in PDF format. Additionally, organizations may request a physical copy by contacting the IRS directly. It is important to ensure that the correct version of the form is obtained, as there may be updates or changes from year to year.

Steps to Complete the Schedule I 990 Form

Completing the Schedule I 990 form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports.

- Fill out the form accurately, ensuring all sections are completed based on the organization’s financial activities.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with Form 990 by the designated filing deadline.

Key Elements of the Schedule I 990 Form

The Schedule I 990 form includes several critical sections that organizations must complete:

- Revenue Sources: Detailed reporting of various income streams.

- Expenses: Breakdown of operational costs and expenditures.

- Program Services: Description of the organization's main activities and their impact.

- Governance: Information about the organization’s leadership and governance structure.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Schedule I 990 form. Typically, the deadline for filing Form 990, along with the Schedule I, is the fifteenth day of the fifth month after the end of the organization’s fiscal year. Extensions may be available, but it is essential to file on time to avoid penalties.

Penalties for Non-Compliance

Failure to file the Schedule I 990 form on time or submitting inaccurate information can lead to significant penalties. The IRS may impose fines, and repeated non-compliance can result in the loss of tax-exempt status. Organizations should prioritize accurate and timely filing to maintain compliance with IRS regulations.

Create this form in 5 minutes or less

Find and fill out the correct schedule i 990 form templates

Create this form in 5 minutes!

How to create an eSignature for the schedule i 990 form templates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2017 schedule i form and why is it important?

The 2017 schedule i form is a crucial document for taxpayers who need to report income from certain sources. It helps ensure compliance with tax regulations and can affect your overall tax liability. Understanding how to properly fill out the 2017 schedule i form can save you time and money during tax season.

-

How can airSlate SignNow assist with the 2017 schedule i form?

airSlate SignNow provides an efficient platform for electronically signing and sending the 2017 schedule i form. With our user-friendly interface, you can easily manage your documents and ensure they are securely signed and submitted. This streamlines the process, making tax filing less stressful.

-

What are the pricing options for using airSlate SignNow for the 2017 schedule i form?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you have access to features that simplify the 2017 schedule i form process. Check our website for detailed pricing information.

-

Are there any integrations available for the 2017 schedule i form with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to easily manage your documents, including the 2017 schedule i form. This integration helps streamline your document management process.

-

What features does airSlate SignNow offer for managing the 2017 schedule i form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the 2017 schedule i form. These tools help you create, send, and manage your forms efficiently, ensuring that you stay organized and compliant with tax regulations.

-

Can I use airSlate SignNow on mobile devices for the 2017 schedule i form?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage the 2017 schedule i form on the go. Whether you are using a smartphone or tablet, you can easily access your documents, send them for eSignature, and track their status from anywhere.

-

What are the benefits of using airSlate SignNow for the 2017 schedule i form?

Using airSlate SignNow for the 2017 schedule i form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and stored securely, minimizing the risk of errors and delays during tax filing. This allows you to focus on your business rather than paperwork.

Get more for Schedule I 990 Form Templates

- Vat103 form

- Bcn qualification form

- Personal information release consent form

- How to write an internship report with examplesindeed com form

- Indiana appointment of a health care representative form

- Body fat percentage chart form

- Sexual harassment training acknowledgement form

- Print all responses clearly form

Find out other Schedule I 990 Form Templates

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed