990 Schedule Form 2016

What is the 990 Schedule Form

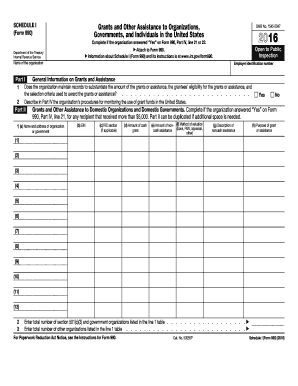

The 990 Schedule Form is a crucial document used by tax-exempt organizations in the United States to report financial information to the Internal Revenue Service (IRS). This form provides transparency regarding an organization’s activities, governance, and financial health. It is part of the larger Form 990, which is required for most tax-exempt entities. The 990 Schedule Form helps the IRS ensure compliance with tax regulations and allows the public to access information about nonprofit organizations.

How to use the 990 Schedule Form

Using the 990 Schedule Form involves several steps to ensure accurate reporting. First, organizations must gather financial data, including revenue, expenses, and assets. Next, they should review the specific requirements of the form, as different organizations may have varying reporting needs based on their tax status. Once the necessary information is compiled, organizations can fill out the form, ensuring all sections are completed accurately. Finally, the completed form must be submitted to the IRS by the designated deadline.

Steps to complete the 990 Schedule Form

Completing the 990 Schedule Form requires attention to detail and adherence to IRS guidelines. Here are the essential steps:

- Gather financial records, including income statements and balance sheets.

- Review the specific sections of the form that apply to your organization.

- Fill out each section, providing accurate and complete information.

- Double-check for any errors or omissions before finalizing the form.

- Submit the form electronically or by mail, ensuring it reaches the IRS by the deadline.

Legal use of the 990 Schedule Form

The legal use of the 990 Schedule Form is governed by IRS regulations. Organizations must ensure that the information provided is truthful and complete, as inaccuracies can lead to penalties or loss of tax-exempt status. The form serves as a public document, meaning it can be accessed by anyone interested in the organization’s financial practices. Therefore, it is essential for organizations to maintain compliance with all relevant laws and regulations when completing and submitting this form.

Filing Deadlines / Important Dates

Filing deadlines for the 990 Schedule Form vary depending on the organization’s fiscal year. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December 31, the form would be due by May 15 of the following year. Organizations can apply for an extension, but it is crucial to submit the extension request before the original deadline to avoid penalties.

Required Documents

To complete the 990 Schedule Form, organizations need to prepare several documents, including:

- Financial statements, such as income statements and balance sheets.

- Records of contributions and grants received.

- Details of any compensation paid to officers, directors, and key employees.

- Documentation of program service accomplishments and activities.

Having these documents ready will facilitate a smoother completion process and ensure compliance with IRS requirements.

Quick guide on how to complete 2016 990 schedule form

Effortlessly Prepare 990 Schedule Form on Any Device

Managing documents online has surged in popularity among businesses and individuals alike. It presents an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Handle 990 Schedule Form on any device using the airSlate SignNow apps for Android or iOS and enhance your document-driven processes today.

The easiest method to adjust and eSign 990 Schedule Form without hassle

- Find 990 Schedule Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specially provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes just seconds and holds the same legal significance as a traditional signature made with ink.

- Verify the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device. Adjust and eSign 990 Schedule Form while ensuring seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 990 schedule form

Create this form in 5 minutes!

How to create an eSignature for the 2016 990 schedule form

How to create an eSignature for your 2016 990 Schedule Form online

How to generate an electronic signature for the 2016 990 Schedule Form in Chrome

How to make an eSignature for putting it on the 2016 990 Schedule Form in Gmail

How to create an electronic signature for the 2016 990 Schedule Form right from your smart phone

How to generate an electronic signature for the 2016 990 Schedule Form on iOS

How to create an electronic signature for the 2016 990 Schedule Form on Android devices

People also ask

-

What is the 990 Schedule Form and why is it important?

The 990 Schedule Form is a crucial document for tax-exempt organizations, providing detailed information about their financial activities. It helps organizations maintain transparency and compliance with IRS regulations, which is essential for maintaining their tax-exempt status. Utilizing airSlate SignNow can streamline the eSigning process for this form, making it easier for organizations to manage their documentation.

-

How does airSlate SignNow simplify the 990 Schedule Form process?

airSlate SignNow streamlines the 990 Schedule Form process by allowing users to create, send, and eSign documents electronically. This eliminates the need for paper documents and reduces the time spent on administrative tasks. With features like templates and automated workflows, airSlate SignNow enhances efficiency, ensuring your 990 Schedule Form is completed accurately and promptly.

-

Is airSlate SignNow cost-effective for filing the 990 Schedule Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 990 Schedule Form and other document processes. Our pricing plans are designed to cater to various business needs, ensuring that even small organizations can access professional eSigning solutions. This affordability helps organizations save both time and money while maintaining compliance.

-

Can I integrate airSlate SignNow with other software for the 990 Schedule Form?

Absolutely! airSlate SignNow offers seamless integrations with various software platforms, including accounting and tax software. This allows you to manage your 990 Schedule Form alongside other essential business documents, enhancing workflow and ensuring that all necessary information is readily available.

-

What features does airSlate SignNow offer for managing the 990 Schedule Form?

airSlate SignNow includes a variety of features specifically designed to facilitate the management of the 990 Schedule Form. These features include customizable templates, real-time tracking of document status, and secure storage options. Each of these tools is designed to enhance your efficiency and organization when handling important tax documents.

-

How secure is the electronic signing of the 990 Schedule Form with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption methods and complies with industry standards to ensure that your 990 Schedule Form and other sensitive documents are protected. You can trust us to keep your information safe while you eSign and manage your documents online.

-

Can I access my signed 990 Schedule Form from any device?

Yes, airSlate SignNow is a cloud-based solution, allowing you to access your signed 990 Schedule Form from any device with internet connectivity. Whether you’re in the office or on the go, you can easily manage your documents and ensure that everything is up to date and accessible.

Get more for 990 Schedule Form

Find out other 990 Schedule Form

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free