Form NY NYC HTX Fill Online, Printable, Fillable 2021

What is the Form NY NYC HTX?

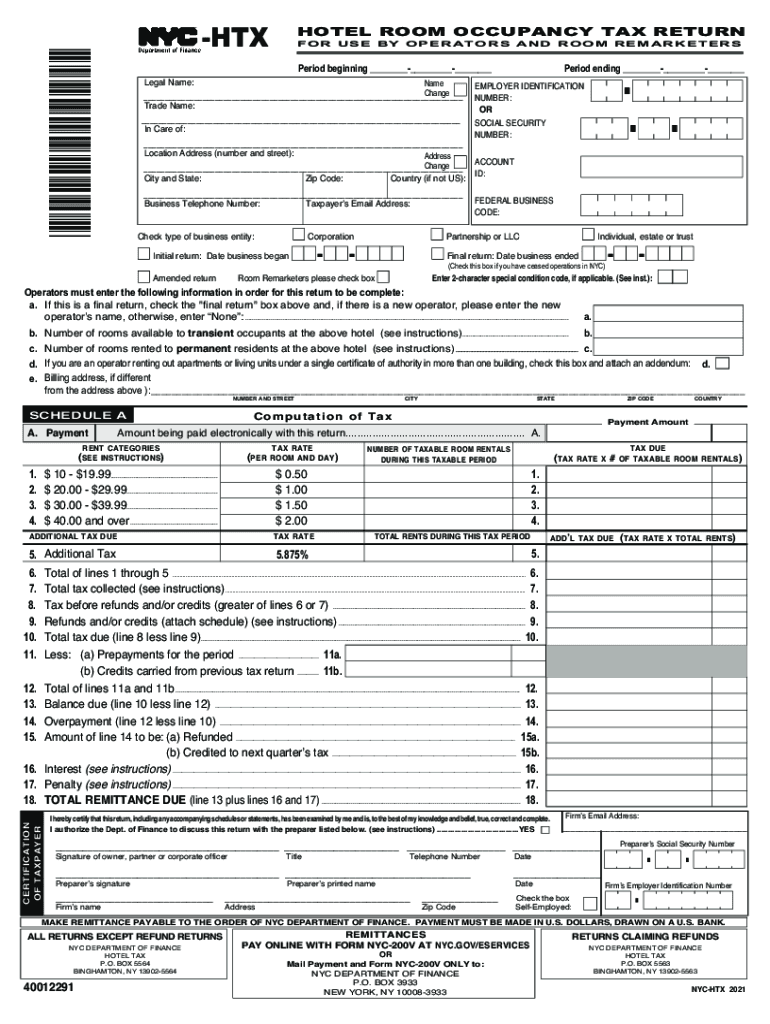

The Form NY NYC HTX, also known as the New York hotel occupancy tax return form, is a crucial document for businesses operating within New York City that rent out rooms. This form is used to report the occupancy tax collected from guests and remit it to the city. The tax applies to all short-term rentals, including hotels, motels, and other lodging facilities. Understanding this form is essential for compliance with local tax regulations.

Steps to Complete the Form NY NYC HTX

Filling out the Form NY NYC HTX involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and the total occupancy tax collected during the reporting period. Next, accurately fill in the form by providing the required data, such as the number of rooms rented and the applicable tax rate. After completing the form, review it for any errors before submission. Finally, submit the form either online or via mail, depending on your preference.

Filing Deadlines / Important Dates

Timely filing of the Form NY NYC HTX is crucial to avoid penalties. The filing deadlines typically align with the end of each quarter, meaning that forms are due on the last day of January, April, July, and October. It is important to mark these dates on your calendar to ensure compliance and avoid late fees.

Penalties for Non-Compliance

Failure to file the Form NY NYC HTX on time can result in significant penalties. The city may impose fines based on the amount of tax owed, and repeated non-compliance can lead to increased scrutiny from tax authorities. It is advisable to stay informed about your filing obligations to avoid these penalties and maintain good standing with the city.

Required Documents

To successfully complete the Form NY NYC HTX, certain documents are necessary. These include records of all room rentals, receipts showing the occupancy tax collected, and any previous tax returns filed. Keeping organized records will streamline the process and ensure that all required information is readily available when filling out the form.

Form Submission Methods

The Form NY NYC HTX can be submitted through various methods to accommodate different preferences. Businesses can choose to file the form online through the city's tax portal, which offers a convenient and efficient way to submit. Alternatively, the form can be mailed directly to the appropriate tax authority or submitted in person at designated locations. Each method has its advantages, so selecting the one that best suits your needs is important.

State-Specific Rules for the Form NY NYC HTX

New York City has specific regulations governing the hotel occupancy tax, which must be adhered to when completing the Form NY NYC HTX. These rules include the tax rate applicable to different types of accommodations and guidelines on exemptions. Familiarizing yourself with these state-specific rules is essential for accurate reporting and compliance with local laws.

Quick guide on how to complete 2020 form ny nyc htx fill online printable fillable

Prepare Form NY NYC HTX Fill Online, Printable, Fillable effortlessly on any device

Online document management has become widely embraced by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage Form NY NYC HTX Fill Online, Printable, Fillable on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to adjust and eSign Form NY NYC HTX Fill Online, Printable, Fillable effortlessly

- Locate Form NY NYC HTX Fill Online, Printable, Fillable and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Select your preferred method for sending your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration requirements in just a few clicks from any device of your choosing. Modify and eSign Form NY NYC HTX Fill Online, Printable, Fillable and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form ny nyc htx fill online printable fillable

Create this form in 5 minutes!

How to create an eSignature for the 2020 form ny nyc htx fill online printable fillable

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an e-signature from your smartphone

The best way to create an e-signature for a PDF file on iOS devices

The best way to make an e-signature for a PDF file on Android

People also ask

-

What is the New York hotel occupancy tax?

The New York hotel occupancy tax is a tax imposed on guests staying in hotels, motels, and similar accommodations in New York City. This tax is typically calculated as a percentage of the room rate and is payable along with the cost of lodging. Understanding this tax is crucial for both hotel owners and guests to ensure compliance and accurate billing.

-

How does the New York hotel occupancy tax affect hotel pricing?

Hotels in New York add the occupancy tax to their rates, which can increase the total cost of stays. As a prospective guest, it's important to consider this tax when budgeting for your hotel stay. For hotel owners, accurately incorporating the New York hotel occupancy tax into pricing strategies is essential for transparency and customer satisfaction.

-

Are there any exemptions to the New York hotel occupancy tax?

Certain exemptions apply to the New York hotel occupancy tax, including stays by government employees or those staying for extended periods. It's advisable to check the specific guidelines provided by the New York City Department of Finance for eligibility. Knowing these exemptions can benefit both guests and hotel operators in terms of compliance and potential savings.

-

How can hotels manage the New York hotel occupancy tax effectively?

Hotels can manage the New York hotel occupancy tax by implementing reliable billing systems and training staff on tax regulations. Utilizing tools like airSlate SignNow can streamline document management related to tax compliance, ensuring that all information is accurate and up-to-date. A proactive approach helps avoid penalties and ensures seamless guest experiences.

-

Is the New York hotel occupancy tax included in the online reservation total?

In many cases, the New York hotel occupancy tax is not included in the quoted price during online reservations and is added at checkout. Therefore, guests should check the final total carefully before confirming their booking. Hotel operators should clearly indicate this tax during the booking process to prevent any misunderstandings.

-

What are the consequences of not complying with the New York hotel occupancy tax?

Not complying with the New York hotel occupancy tax can lead to signNow penalties, including fines and back taxes owed to the city. This not only affects a hotel’s financial standing but can also damage its reputation. Hotel owners must stay informed and compliant to avoid such adverse outcomes.

-

Can I find resources to learn more about the New York hotel occupancy tax?

Yes, the New York City Department of Finance provides comprehensive resources regarding the New York hotel occupancy tax. These resources include guidelines, FAQs, and contact information for assistance. Utilizing these resources helps ensure that both guests and hotel owners are well-informed and compliant.

Get more for Form NY NYC HTX Fill Online, Printable, Fillable

- Community service la form

- Bill particulars sample form

- Louisiana partition form

- Louisiana partition 497308976 form

- Affidavit paternity form

- La revised statutes form

- Petition to be relieved of registering pursuant to la rs 15540 et seq sex offender with order to show cause louisiana form

- Louisiana petition divorce form

Find out other Form NY NYC HTX Fill Online, Printable, Fillable

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word