245 ACTIVITIES REPORT of BUSINESS and GENERAL Nyc Gov 2020

Understanding the New York Hotel Room Occupancy Tax Return

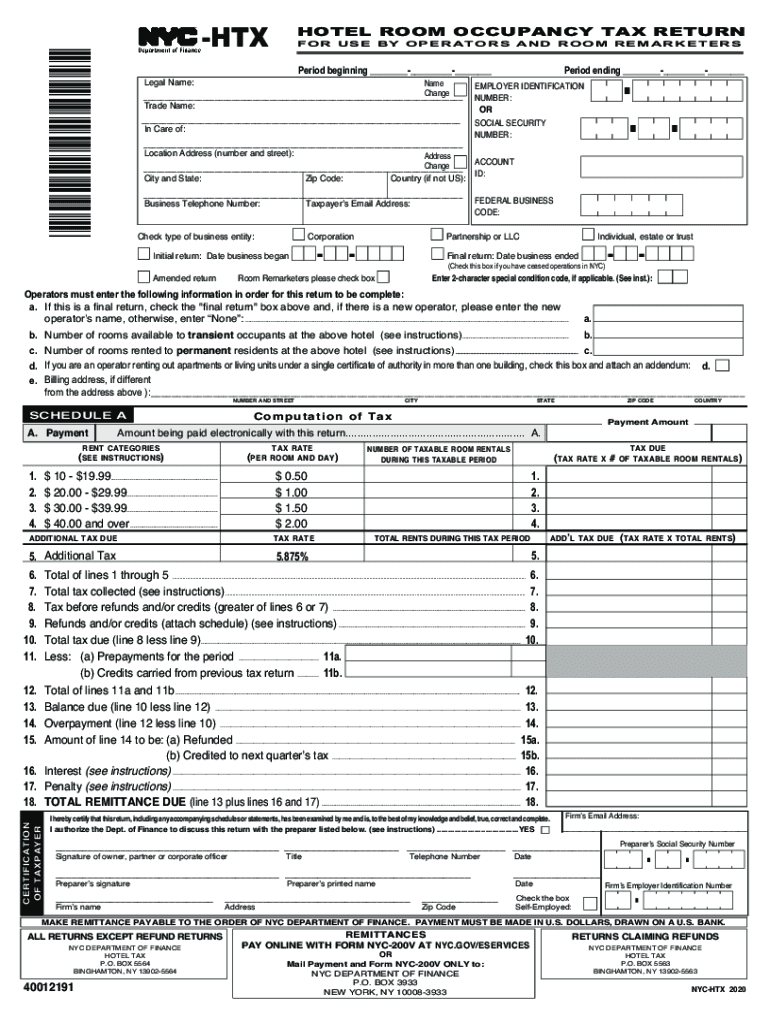

The New York hotel room occupancy tax return is a crucial document for businesses operating in the hospitality sector. This form is designed to report and remit the occupancy tax collected from guests. The tax applies to all hotel rooms rented within New York City, and it is essential for compliance with local tax laws. Understanding the specifics of this return can help ensure that businesses meet their tax obligations accurately and on time.

Key Elements of the New York Hotel Room Occupancy Tax Return

When completing the New York hotel room occupancy tax return, several key elements must be included:

- Business Information: Include the name, address, and contact details of the hotel.

- Tax Period: Specify the period for which the tax is being reported.

- Gross Receipts: Report the total amount of rents collected from guests.

- Tax Calculation: Calculate the occupancy tax based on the applicable rate.

- Payment Information: Provide details on how the tax will be remitted.

Steps to Complete the New York Hotel Room Occupancy Tax Return

Completing the New York hotel room occupancy tax return involves several steps:

- Gather all necessary financial records, including guest receipts and occupancy records.

- Calculate the total gross receipts from room rentals during the tax period.

- Apply the current occupancy tax rate to the gross receipts to determine the total tax owed.

- Fill out the tax return form with the required information and calculations.

- Review the completed form for accuracy before submission.

- Submit the form either online or by mail, along with any payment due.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is essential for compliance. The New York hotel room occupancy tax return typically has specific due dates based on the reporting period. Businesses should mark these dates on their calendars to avoid late fees or penalties. It is advisable to check with the New York City Department of Finance for the most current deadlines, as they may vary from year to year.

Penalties for Non-Compliance

Failure to file the New York hotel room occupancy tax return on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand these consequences and prioritize timely filing to maintain compliance with local tax regulations.

Form Submission Methods

The New York hotel room occupancy tax return can be submitted through various methods. Businesses have the option to file online, which is often the most efficient method, or they can submit a paper form by mail. In-person submissions may also be possible at designated tax offices. Each method has its own guidelines, so it is important to choose the one that best suits the business's needs.

Quick guide on how to complete 245 activities report of business and general nycgov

Complete 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can find the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov with ease

- Find 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from your preferred device. Modify and eSign 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 245 activities report of business and general nycgov

Create this form in 5 minutes!

How to create an eSignature for the 245 activities report of business and general nycgov

How to create an electronic signature for a PDF in the online mode

How to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is the ny hotel room occupancy tax return?

The NY hotel room occupancy tax return is a tax form that hotel operators in New York must file to report the occupancy tax collected from guests. This tax is imposed on the rental of rooms in hotels, motels, and other lodging facilities. Understanding how to correctly fill out this return is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the ny hotel room occupancy tax return?

airSlate SignNow streamlines the process of preparing and submitting your ny hotel room occupancy tax return by allowing you to eSign documents securely. Our platform simplifies document management, making it easier to keep track of your tax returns and ensure compliance with state regulations. Use SignNow’s templates to ensure you never miss a required field.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow provides features like customizable templates, secure eSignature options, and real-time tracking for documents related to your ny hotel room occupancy tax return. You can access your documents from any device, collaborate efficiently with team members, and ensure that all necessary information is captured correctly. This can signNowly speed up the filing process.

-

Are there any integrations available with airSlate SignNow that relate to tax filings?

Yes, airSlate SignNow offers integrations with popular accounting software and tax management tools that can enhance your ability to file the ny hotel room occupancy tax return. These integrations help sync data and streamline workflows, reducing the risk of errors in your submissions. Check our website to explore all available integrations.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business sizes and needs, ensuring you find the right package for managing your ny hotel room occupancy tax return. Our plans are designed to be cost-effective while providing robust features for document management and eSigning. Visit our pricing page for more details on the options available.

-

Is airSlate SignNow easy to use for filing the ny hotel room occupancy tax return?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to file their ny hotel room occupancy tax return without hassle. Our intuitive interface guides users through the eSigning and document management processes, allowing you to handle your tax submission confidently. No prior experience is necessary.

-

How secure is my information when using airSlate SignNow?

Your security is a top priority at airSlate SignNow. We implement stringent security measures, including encryption and secure servers, to protect all information related to your ny hotel room occupancy tax return. You can trust that your sensitive data is safe, ensuring compliance with privacy regulations.

Get more for 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov

- Commercial lease assignment from tenant to new tenant washington form

- Tenant consent to background and reference check washington form

- Washington lease 497429784 form

- Residential rental lease agreement washington form

- Tenant welcome letter washington form

- Warning of default on commercial lease washington form

- Warning of default on residential lease washington form

- Landlord tenant closing statement to reconcile security deposit washington form

Find out other 245 ACTIVITIES REPORT OF BUSINESS AND GENERAL Nyc gov

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter