Request for Ruling Hotel Room Occupancy Tax FLR#024791 2022

Understanding the New York Hotel Occupancy Tax

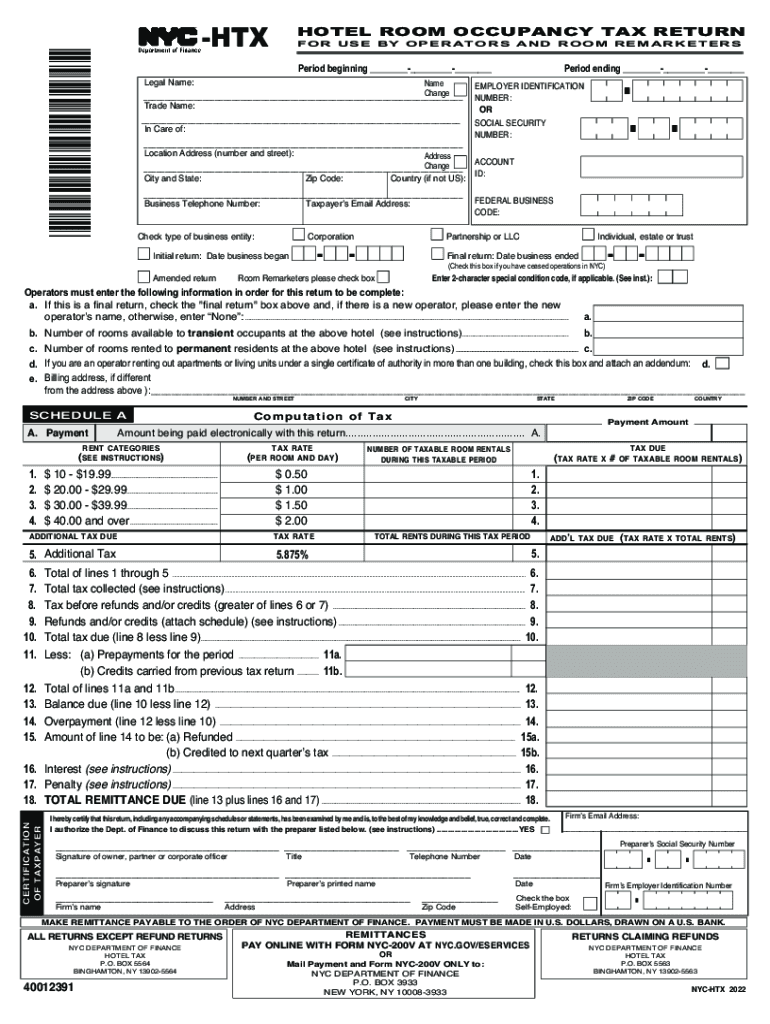

The New York hotel occupancy tax is a tax imposed on the rental of hotel rooms within the state. This tax is applicable to all hotels, motels, and other lodging facilities that provide accommodations to guests. The rate of the occupancy tax can vary based on the location and type of accommodation. It is essential for hotel operators and guests to understand this tax as it directly impacts the overall cost of lodging in New York.

Steps to Complete the Occupancy Tax Return

Filing the occupancy tax return involves several steps to ensure compliance with state regulations. First, gather all necessary financial records related to room rentals, including invoices and receipts. Next, calculate the total amount of taxable room rentals and apply the appropriate tax rate. Once the calculations are complete, fill out the New York occupancy tax return form accurately, ensuring all required information is included. Finally, submit the form by the designated deadline, either online or via mail, to avoid penalties.

Required Documents for Filing

To file the New York hotel occupancy tax return, certain documents are necessary. These typically include:

- Invoices for all room rentals.

- Records of any exemptions or deductions claimed.

- Previous occupancy tax returns, if applicable.

- Proof of payment for the current tax period.

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Filing Deadlines for the Occupancy Tax Return

It is crucial to be aware of the filing deadlines for the New York hotel occupancy tax return. Generally, the tax return must be submitted quarterly, with specific due dates depending on the end of each quarter. Late submissions can result in penalties and interest charges, so staying informed about these dates is essential for compliance.

Penalties for Non-Compliance

Failing to comply with the New York hotel occupancy tax regulations can lead to significant penalties. These may include fines based on the amount of tax owed, interest on late payments, and potential legal action. It is important for hotel operators to understand these consequences and take proactive measures to ensure timely and accurate filings.

Digital vs. Paper Version of the Occupancy Tax Return

Filing the New York hotel occupancy tax return can be done either digitally or via paper forms. The digital version offers advantages such as easier calculations, automatic error checking, and faster submission times. Conversely, some may prefer the paper version for its tangible nature. Regardless of the method chosen, ensuring that all information is accurately reported is critical for compliance.

Quick guide on how to complete request for ruling hotel room occupancy tax flr024791

Complete Request For Ruling Hotel Room Occupancy Tax FLR#024791 effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you need to generate, modify, and eSign your documents promptly without any holdups. Manage Request For Ruling Hotel Room Occupancy Tax FLR#024791 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to adjust and eSign Request For Ruling Hotel Room Occupancy Tax FLR#024791 with ease

- Obtain Request For Ruling Hotel Room Occupancy Tax FLR#024791 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Decide how you want to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your needs in document management with just a few clicks from any device of your preference. Modify and eSign Request For Ruling Hotel Room Occupancy Tax FLR#024791 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct request for ruling hotel room occupancy tax flr024791

Create this form in 5 minutes!

How to create an eSignature for the request for ruling hotel room occupancy tax flr024791

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York hotel occupancy tax?

The New York hotel occupancy tax is a tax applied to the rental of hotel rooms within New York State. This tax is usually a percentage of the room rate and is collected by hotel operators on behalf of the state. Understanding this tax is crucial for businesses managing travel accommodations.

-

How does the New York hotel occupancy tax affect my hotel pricing?

The New York hotel occupancy tax can signNowly impact your hotel's pricing strategy. When determining room rates, it's essential to account for this tax, as it affects the total cost to guests. By factoring in the New York hotel occupancy tax, you can maintain competitive pricing while ensuring compliance.

-

Who is responsible for collecting the New York hotel occupancy tax?

Hotel operators are responsible for collecting the New York hotel occupancy tax from guests at the time of booking. This collected tax is then remitted to the state on a regular basis. Ensuring accurate collection is vital to avoid penalties and maintain operational integrity.

-

What features does airSlate SignNow offer to help with hotel occupancy tax documentation?

airSlate SignNow provides tools for hotels to create, send, and eSign documents related to the New York hotel occupancy tax easily. Our platform streamlines the process of drafting tax compliance documents, ensuring secure and efficient handling of sensitive information. With these features, hotels can focus on their core business while staying tax compliant.

-

Is airSlate SignNow suitable for small hotels managing the New York hotel occupancy tax?

Yes, airSlate SignNow is designed to be user-friendly and cost-effective, making it a perfect choice for small hotels managing the New York hotel occupancy tax. Our solution offers affordable plans that enable small hotel operators to manage their documents without needing extensive technical expertise. By using our platform, they can ensure compliance efficiently and affordably.

-

Can I integrate airSlate SignNow with my existing hotel management software for the New York hotel occupancy tax?

Absolutely! airSlate SignNow offers seamless integrations with various hotel management software, enhancing your ability to manage the New York hotel occupancy tax efficiently. This integration allows for automatic data updates and document workflows, helping you maintain compliance with less effort.

-

What are the benefits of using airSlate SignNow for handling the New York hotel occupancy tax?

Using airSlate SignNow to handle the New York hotel occupancy tax streamlines document management and tax compliance tasks. It reduces manual errors and saves time by automating the process of document signing and data capture. With our platform, hotels can enhance their efficiency while ensuring they're meeting tax obligations.

Get more for Request For Ruling Hotel Room Occupancy Tax FLR#024791

Find out other Request For Ruling Hotel Room Occupancy Tax FLR#024791

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile