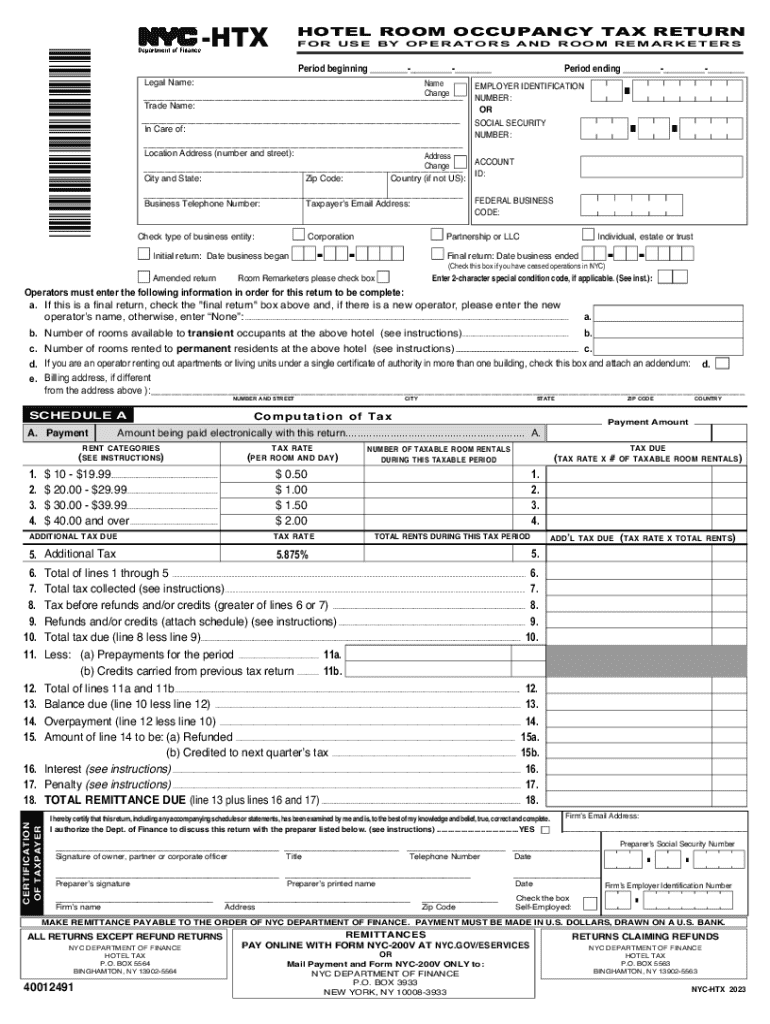

*40012491*HTXHOTEL ROOM OCCUPANCY TAX RETURNFOR US 2023-2026

What is the HTX Hotel Room Occupancy Tax Return?

The HTX Hotel Room Occupancy Tax Return is a specific form used by hotels and similar establishments to report and remit occupancy taxes to the appropriate state or local authorities. This tax is typically levied on guests who stay in hotels, motels, or similar accommodations, and the collected tax is often used to fund local services and tourism initiatives. Understanding this form is essential for compliance with local tax regulations.

Steps to Complete the HTX Hotel Room Occupancy Tax Return

Completing the HTX Hotel Room Occupancy Tax Return involves several key steps:

- Gather necessary information, including total room revenue, number of occupied rooms, and applicable tax rates.

- Fill out the form accurately, ensuring all figures are correct and reflect the reporting period.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the HTX Hotel Room Occupancy Tax Return. Typically, returns are due on a monthly or quarterly basis, depending on local regulations. Missing these deadlines can result in penalties or interest charges. Check with your local tax authority for specific dates relevant to your jurisdiction.

Required Documents

When completing the HTX Hotel Room Occupancy Tax Return, you may need to provide supporting documents. These can include:

- Sales records showing total room revenue.

- Guest occupancy records for the reporting period.

- Any prior tax returns for reference.

Having these documents ready can streamline the filing process and ensure accuracy.

Penalties for Non-Compliance

Failure to file the HTX Hotel Room Occupancy Tax Return on time or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential to understand the consequences of non-compliance to avoid unnecessary financial burdens.

Digital vs. Paper Version

The HTX Hotel Room Occupancy Tax Return can typically be submitted in both digital and paper formats. Digital submissions are often encouraged due to their efficiency and ease of tracking. However, some jurisdictions may still require paper forms. It is important to verify the preferred submission method with local tax authorities.

Create this form in 5 minutes or less

Find and fill out the correct 40012491htxhotel room occupancy tax returnfor us

Create this form in 5 minutes!

How to create an eSignature for the 40012491htxhotel room occupancy tax returnfor us

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an occupancy tax return?

An occupancy tax return is a document that businesses must file to report and remit taxes collected from guests for short-term rentals or hotel stays. Understanding how to accurately complete an occupancy tax return is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with my occupancy tax return?

airSlate SignNow streamlines the process of preparing and submitting your occupancy tax return by allowing you to easily eSign and send documents. Our platform ensures that your forms are completed accurately and submitted on time, reducing the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our cost-effective solution ensures that you can manage your occupancy tax return and other document needs without breaking the bank.

-

Are there any features specifically for managing occupancy tax returns?

Yes, airSlate SignNow includes features that simplify the management of occupancy tax returns, such as customizable templates and automated reminders. These tools help ensure that you never miss a filing deadline.

-

Can I integrate airSlate SignNow with other software for my occupancy tax return?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and property management software, making it easier to manage your occupancy tax return alongside your other financial tasks. This integration helps streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my occupancy tax return?

Using airSlate SignNow for your occupancy tax return offers numerous benefits, including increased accuracy, time savings, and enhanced compliance. Our platform simplifies the eSigning process, allowing you to focus on your business rather than paperwork.

-

Is airSlate SignNow secure for handling my occupancy tax return?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your occupancy tax return and sensitive information are protected. We utilize advanced encryption and security protocols to safeguard your data throughout the signing process.

Get more for *40012491*HTXHOTEL ROOM OCCUPANCY TAX RETURNFOR US

- Law enforcement officer form

- Statement of emergency detention by treatment director wisconsin form

- Petition for examination wisconsin form

- Order of dismissal compliance with settlement agreement wisconsin form

- Order for involuntary medication and treatment wisconsin form

- Wi district attorney form

- Settlement court approval form

- Wisconsin settlement agreement form

Find out other *40012491*HTXHOTEL ROOM OCCUPANCY TAX RETURNFOR US

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed