PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline 2021

Understanding the Maryland Form 505

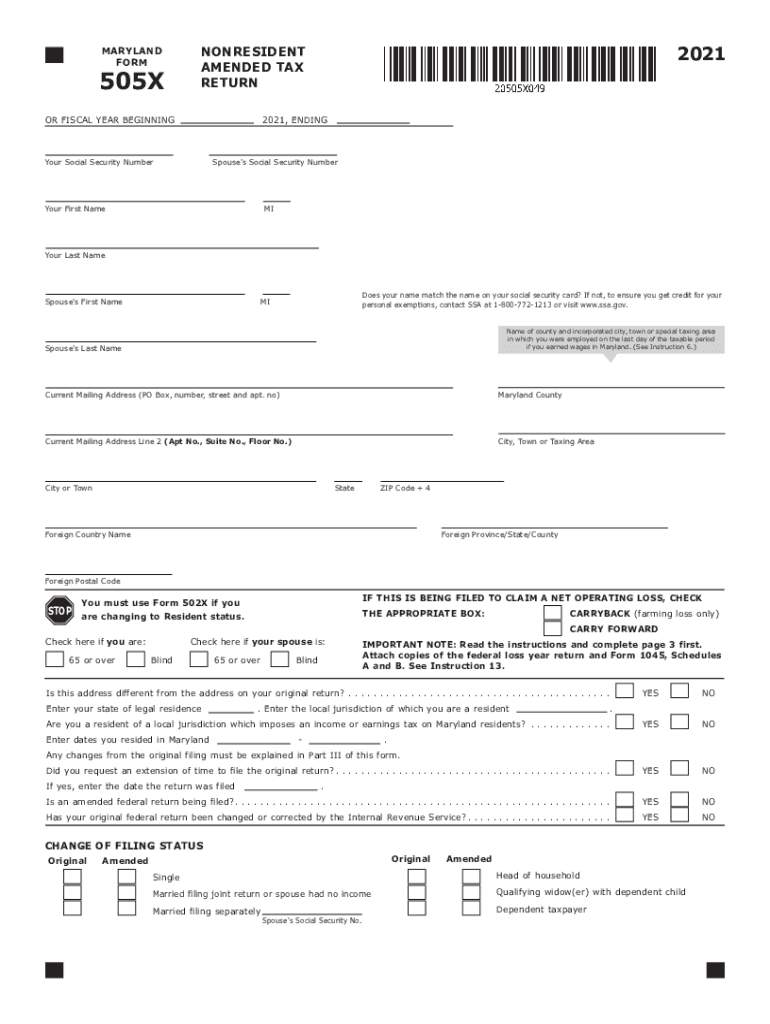

The Maryland Form 505 is a crucial tax document used for filing an amended return for individuals. This form allows taxpayers to correct errors or make changes to their original tax filings. It is essential to understand the specific circumstances under which this form should be used, as well as the implications of filing an amended return. The 505 MD form is particularly relevant for those who have experienced changes in income, deductions, or credits after their initial submission.

Steps to Complete the Maryland Form 505

Filling out the Maryland Form 505 involves several key steps to ensure accuracy and compliance with tax regulations. Start by gathering all relevant financial documents, including your original tax return and any supporting documentation for the changes being made. Next, carefully follow the instructions provided with the form, ensuring that all sections are completed accurately. Pay special attention to the areas where you need to indicate the changes made compared to your original return. Finally, review the completed form for any errors before submission.

Filing Deadlines for the Maryland Form 505

It is important to be aware of the filing deadlines associated with the Maryland Form 505. Generally, amended returns must be filed within three years from the date the original return was filed or within two years from the date the tax was paid, whichever is later. Missing these deadlines can result in penalties or the inability to claim refunds. Always check the Maryland Comptroller's website for any updates or specific dates related to your filing year.

Required Documents for Filing the Maryland Form 505

When preparing to file the Maryland Form 505, certain documents are necessary to support your amended return. These typically include a copy of your original tax return, any W-2s or 1099s that reflect your income, and documentation for any deductions or credits you are claiming. If applicable, include any correspondence from the Maryland Comptroller regarding your original return. Having these documents on hand will facilitate a smoother filing process.

Eligibility Criteria for Using the Maryland Form 505

To use the Maryland Form 505, you must meet specific eligibility criteria. Primarily, this form is intended for individuals who have previously filed a Maryland tax return and need to amend it. Additionally, the changes you are making must be significant enough to warrant an amendment, such as correcting income figures or claiming additional deductions. Ensure that your situation aligns with these criteria before proceeding with the filing.

Legal Use of the Maryland Form 505

The Maryland Form 505 holds legal significance as it serves to rectify previously submitted tax information. Filing this form correctly ensures compliance with state tax laws and can help avoid potential legal issues related to incorrect filings. It is essential to understand that any changes made through this form may also impact your overall tax liability or refund status, making accuracy paramount in its completion.

Quick guide on how to complete pdf 2021 renters tax credit application rtc 1 form filing deadline

Complete PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline effortlessly on any device

Digital document management has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed materials since you can obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline on any device with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

The easiest way to modify and eSign PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline effortlessly

- Locate PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline and click on Get Form to begin.

- Utilize the tools we supply to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf 2021 renters tax credit application rtc 1 form filing deadline

Create this form in 5 minutes!

How to create an eSignature for the pdf 2021 renters tax credit application rtc 1 form filing deadline

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an e-signature for putting it on PDFs in Gmail

The best way to make an e-signature straight from your smart phone

The way to make an e-signature for a PDF on iOS devices

The best way to make an e-signature for a PDF document on Android OS

People also ask

-

What is the Maryland Form 505?

The Maryland Form 505 is a tax form used by residents to report income and determine the amount of state tax owed. This form is specifically designed for individuals filing as part-year residents or those who qualify for specific deductions. Understanding how to accurately complete the Maryland Form 505 is essential for compliance with state tax regulations.

-

How can airSlate SignNow assist with the Maryland Form 505?

airSlate SignNow provides a streamlined platform for electronically signing and sending documents, including the Maryland Form 505. This ensures a smooth and professional filing process, allowing users to complete their tax documents quickly and securely. By using airSlate SignNow, you can enhance efficiency and reduce turnaround times for your Maryland Form 505 submissions.

-

Is there a fee to use airSlate SignNow for the Maryland Form 505?

Yes, airSlate SignNow operates on a subscription model offering various pricing plans that cater to different needs. The cost is competitive and includes various features such as unlimited document signing, secure storage, and integrations. Investing in airSlate SignNow for handling the Maryland Form 505 can save you time and ensure accuracy in your filings.

-

What features does airSlate SignNow offer for e-signing the Maryland Form 505?

airSlate SignNow offers features such as customizable signing fields, in-person signing options, and document templates. These capabilities simplify the process of filling out the Maryland Form 505, making it easier for users to comply with timing and regulations. Additionally, all interactions are securely encrypted for maximum data protection.

-

Can I integrate airSlate SignNow with other software for managing the Maryland Form 505?

Absolutely, airSlate SignNow offers seamless integrations with popular accounting and document management software. This allows users to efficiently manage their Maryland Form 505 alongside their other financial documents and records. By utilizing these integrations, you can maintain a cohesive workflow and enhance your overall productivity.

-

What are the benefits of using airSlate SignNow for the Maryland Form 505?

Using airSlate SignNow for the Maryland Form 505 offers numerous benefits, such as faster processing times and improved document security. Users can quickly gather signatures, store files securely, and track document status in one centralized platform. These advantages lead to greater efficiency and peace of mind when managing important tax filings.

-

How does airSlate SignNow ensure the security of the Maryland Form 505?

airSlate SignNow employs industry-leading security measures to protect your documents, including the Maryland Form 505. With secure encryption protocols, two-factor authentication, and regular security audits, you can trust that your sensitive information remains safe. This commitment to security helps you confidently handle tax documents online.

Get more for PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline

- Md lease form

- Salary verification form for potential lease maryland

- Maryland landlord tenant 497310349 form

- Notice of default on residential lease maryland form

- Landlord tenant lease co signer agreement maryland form

- Application for sublease maryland form

- Maryland post 497310353 form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out maryland form

Find out other PDF Renters' Tax Credit Application RTC 1 Form Filing Deadline

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later