TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM 2020

What is the TY 505X Tax Year 505X Individual Taxpayer Form

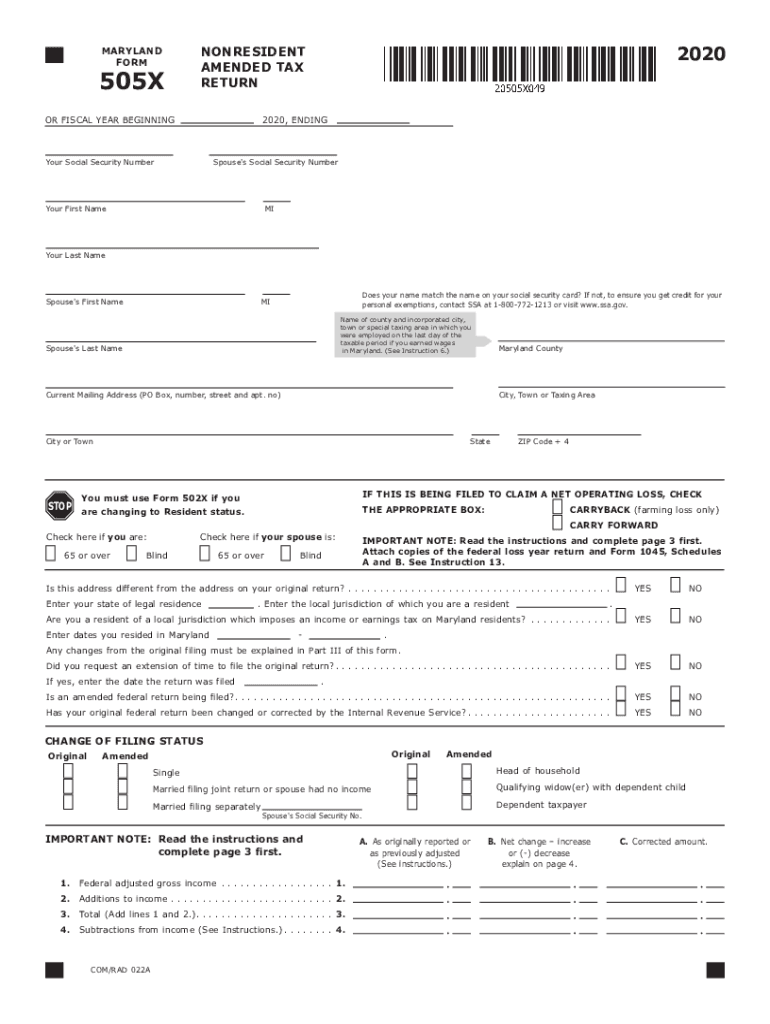

The TY 505X is a tax form used by individuals in Maryland to amend their previously filed tax returns. This form is essential for correcting errors or making changes to a tax return submitted for the tax year specified. It allows taxpayers to adjust their income, deductions, credits, or filing status. Understanding the purpose of this form is crucial for ensuring compliance with state tax laws and for obtaining any potential refunds or adjustments due to changes in tax liability.

How to Use the TY 505X Tax Year 505X Individual Taxpayer Form

Using the TY 505X form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant documents, including the original tax return and any supporting documentation for the changes being made. Next, fill out the form by providing the requested information, including personal details and the specific changes to be made. It is important to clearly explain the reason for the amendment in the designated section. After completing the form, review it for accuracy before submission.

Steps to Complete the TY 505X Tax Year 505X Individual Taxpayer Form

Completing the TY 505X form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the TY 505X form from the Maryland Comptroller's office or their official website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the tax year you are amending and provide details of the original return.

- Clearly state the changes you are making, including any additional income or deductions.

- Sign and date the form to confirm its accuracy.

Legal Use of the TY 505X Tax Year 505X Individual Taxpayer Form

The TY 505X form is legally recognized for amending tax returns in Maryland. To ensure its validity, it must be completed accurately and submitted within the timeframe specified by state tax regulations. The form must also comply with the Maryland tax laws governing amendments, which stipulate the necessary documentation and reasons for changes. Utilizing this form correctly can help avoid penalties and ensure that any adjustments are processed in accordance with the law.

Filing Deadlines / Important Dates

Timely filing of the TY 505X form is crucial for compliance with Maryland tax regulations. Generally, the amended return should be filed within three years from the original due date of the return or within one year from the date of any tax payment made, whichever is later. It is important to keep track of these deadlines to avoid potential penalties or interest charges. Always verify current deadlines as they may change annually.

Who Issues the Form

The TY 505X form is issued by the Comptroller of Maryland. This office is responsible for the administration of state tax laws and provides the necessary forms and guidance for taxpayers. The Comptroller's office also handles the processing of submitted forms and any resulting adjustments to tax liabilities. Taxpayers can contact the office for assistance regarding the completion and submission of the TY 505X form.

Quick guide on how to complete ty 2020 505x tax year 2020 505x individual taxpayer form

Manage TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary files and securely store them online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest way to modify and eSign TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM effortlessly

- Obtain TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to submit your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ty 2020 505x tax year 2020 505x individual taxpayer form

Create this form in 5 minutes!

How to create an eSignature for the ty 2020 505x tax year 2020 505x individual taxpayer form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is form 505 Maryland and why do I need it?

Form 505 Maryland is a specific document required for various legal and administrative purposes in the state of Maryland. It is essential for businesses and individuals needing to comply with state regulations or submit important information. Using airSlate SignNow, you can easily create, send, and eSign form 505 Maryland documents without hassle.

-

How does airSlate SignNow simplify the process of filling out form 505 Maryland?

AirSlate SignNow provides a user-friendly interface that streamlines the process of filling out form 505 Maryland. With features like template saving and easy document sharing, you can quickly prepare the form, ensuring that all necessary fields are completed efficiently. This signNowly reduces errors and saves time.

-

Is there a cost associated with using airSlate SignNow for form 505 Maryland?

Yes, airSlate SignNow offers various pricing plans depending on the features you require. Our plans are designed to be cost-effective for businesses of all sizes looking to manage their document workflows, including form 505 Maryland. You can start with a free trial to experience how efficient our solution is before committing.

-

What features does airSlate SignNow offer for handling form 505 Maryland?

AirSlate SignNow includes a range of features perfect for managing form 505 Maryland, including customizable templates, secure eSignature capabilities, and document tracking. These features ensure that you can handle your documents efficiently while remaining compliant with state laws. Additionally, you can store and retrieve documents effortlessly.

-

Does airSlate SignNow integrate with other platforms for managing form 505 Maryland?

Yes, airSlate SignNow integrates seamlessly with numerous platforms, including CRM systems, cloud storage services, and other business applications. This allows you to manage form 505 Maryland alongside your existing workflows, enhancing productivity and simplifying your document management processes.

-

Can I use airSlate SignNow on mobile devices for form 505 Maryland?

Absolutely! AirSlate SignNow is optimized for mobile use, enabling you to access and eSign form 505 Maryland from anywhere. Whether you are using your smartphone or tablet, our platform ensures a smooth experience, allowing for quick document management on the go.

-

What security measures are in place for signing form 505 Maryland with airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including form 505 Maryland. We implement advanced encryption and authentication protocols to ensure that your data remains confidential and secure throughout the signing process. You can trust that your sensitive information is protected with industry-standard security measures.

Get more for TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM

Find out other TY 505X TAX YEAR 505X INDIVIDUAL TAXPAYER FORM

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking