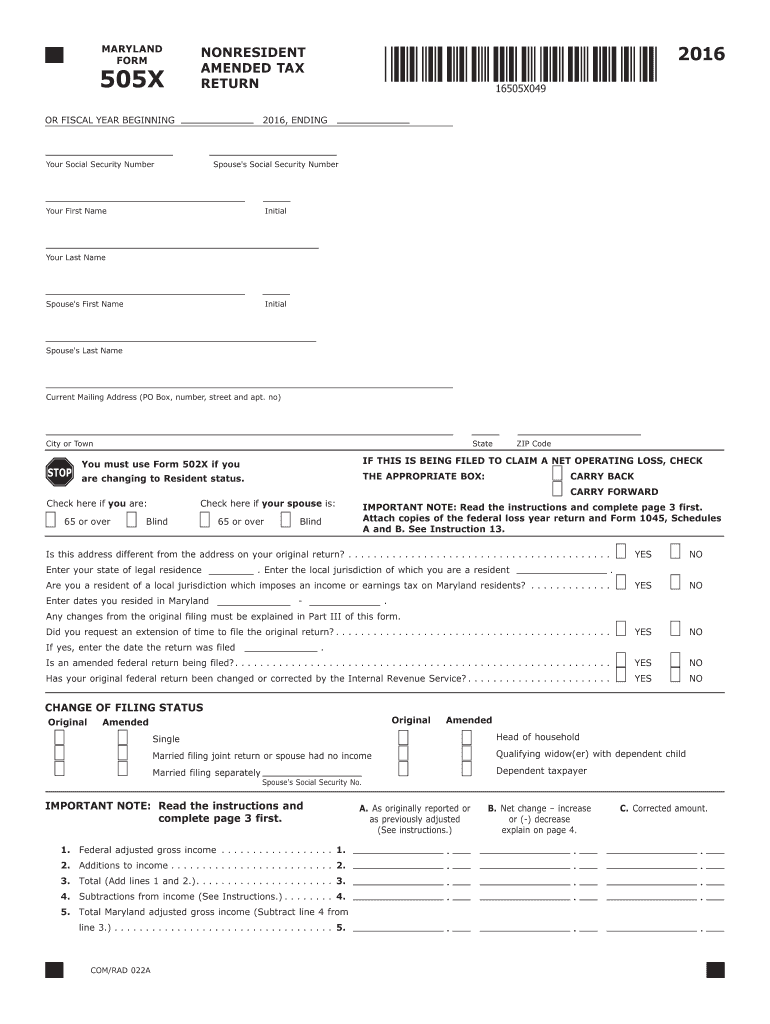

Form 505x 2016

What is the Form 505x

The Form 505x is a tax-related document used primarily for amending previous tax returns. It allows taxpayers to correct errors or make changes to their filed returns, ensuring that their tax information is accurate and up to date. This form is particularly relevant for individuals who have discovered discrepancies in their income, deductions, or credits after submitting their original tax returns. By filing the Form 505x, taxpayers can rectify these issues and avoid potential penalties associated with incorrect filings.

How to use the Form 505x

Using the Form 505x involves several straightforward steps. First, ensure you have the correct version of the form, which can be obtained from the IRS website or through authorized tax software. Next, gather all necessary documentation related to the original return you wish to amend. This includes W-2s, 1099s, and any other relevant tax documents. Fill out the form carefully, providing accurate information about the changes you are making. Finally, submit the completed form to the appropriate IRS address, depending on your state of residence.

Steps to complete the Form 505x

Completing the Form 505x requires careful attention to detail. Follow these steps:

- Obtain the latest version of the Form 505x from the IRS.

- Review your original tax return and identify the specific areas that need correction.

- Fill out the Form 505x, clearly indicating the changes and providing any necessary explanations.

- Attach any supporting documents that substantiate your amendments.

- Double-check your entries for accuracy before submitting.

- Mail the completed form to the designated IRS address based on your state.

Legal use of the Form 505x

The legal use of the Form 505x is governed by IRS regulations. When properly completed and submitted, the form serves as a legally binding document that amends your tax return. It is essential to comply with all IRS guidelines to ensure that your amendments are recognized. Filing the Form 505x helps maintain compliance with tax laws and can protect you from penalties associated with incorrect filings. Always keep copies of submitted forms and any correspondence with the IRS for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Form 505x are crucial for ensuring that your amendments are accepted without penalty. Generally, you must file the form within three years from the original return's due date or within two years from the date you paid the tax, whichever is later. It is important to stay informed about specific deadlines, especially if you are amending returns for multiple tax years. Mark these dates on your calendar to avoid missing the opportunity to correct your tax filings.

Examples of using the Form 505x

There are several scenarios in which the Form 505x can be utilized effectively. For instance, if a taxpayer discovers that they omitted income from their original return, they can file the Form 505x to report the additional income and adjust their tax liability accordingly. Another example includes correcting deductions that were mistakenly left out, such as business expenses for self-employed individuals. By using the Form 505x in these situations, taxpayers can ensure their tax records are accurate and compliant with IRS regulations.

Quick guide on how to complete form 505x 2016

Prepare Form 505x effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to generate, alter, and eSign your documents swiftly without difficulties. Manage Form 505x on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Form 505x with ease

- Obtain Form 505x and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, via email, SMS, or invitation link, or download it onto your PC.

Eliminate concerns about lost or mislaid files, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 505x and guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 505x 2016

Create this form in 5 minutes!

How to create an eSignature for the form 505x 2016

How to create an eSignature for the Form 505x 2016 in the online mode

How to generate an eSignature for your Form 505x 2016 in Google Chrome

How to create an eSignature for signing the Form 505x 2016 in Gmail

How to generate an eSignature for the Form 505x 2016 straight from your smart phone

How to generate an electronic signature for the Form 505x 2016 on iOS

How to create an eSignature for the Form 505x 2016 on Android

People also ask

-

What is Form 505x and how does it work with airSlate SignNow?

Form 505x is a specialized document that allows businesses to submit specific information electronically. With airSlate SignNow, you can easily create, send, and eSign your Form 505x, streamlining the submission process and ensuring compliance with regulations. Our platform's user-friendly interface simplifies the entire workflow, making it accessible for all users.

-

How can I integrate Form 505x into my existing workflow using airSlate SignNow?

Integrating Form 505x into your workflow with airSlate SignNow is seamless. Our platform offers various integration options with popular applications, allowing you to automate the process of sending and signing documents. You can easily configure the integration to ensure that your Form 505x fits into your existing systems without disruption.

-

What features does airSlate SignNow offer for managing Form 505x documents?

airSlate SignNow provides robust features for managing Form 505x documents, including customizable templates, real-time tracking, and audit trails. These features help you monitor the status of your documents and ensure that all necessary signatures are collected promptly. Additionally, our secure cloud storage ensures your Form 505x documents are safe and accessible whenever you need them.

-

Is there a free trial available for using Form 505x with airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the functionalities of sending and eSigning Form 505x documents. This trial period gives you the opportunity to experience our platform's features fully and determine how it can benefit your business. Sign up today and start managing your Form 505x with ease.

-

What are the pricing options for using airSlate SignNow with Form 505x?

airSlate SignNow offers various pricing plans designed to accommodate different business needs using Form 505x. Our plans are flexible and provide options for individuals, small teams, and larger enterprises. You can choose the plan that best fits your requirements and budget, ensuring that you get the most value from our eSigning solution.

-

Can airSlate SignNow help me ensure compliance when submitting Form 505x?

Absolutely! airSlate SignNow is designed to help businesses maintain compliance when submitting Form 505x. Our platform includes features like secure eSigning that meets industry standards, alongside audit trails that provide documentation of the signing process, ensuring that your submissions adhere to necessary regulations.

-

What benefits can I expect from using airSlate SignNow for Form 505x?

Using airSlate SignNow for Form 505x provides numerous benefits, such as increased efficiency, reduced processing time, and improved accuracy. By digitizing your signing process, you can eliminate paperwork and streamline workflows, allowing your business to focus on what matters most. Additionally, the ease of use and cost-effectiveness of our solution makes it a smart choice for any organization.

Get more for Form 505x

- Illinois statutory power of attorney for mental health care form

- Quick claim deed form

- Automobile form

- Intent to lien form

- North carolina final notice of forfeiture and request to vacate property under contract for deed form

- Promissory note form

- Maryland general power of attorney for care and custody of child or children form

- New mexico fiduciary deed form

Find out other Form 505x

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form