505X49 011023 a 505X49 011023 a 2022

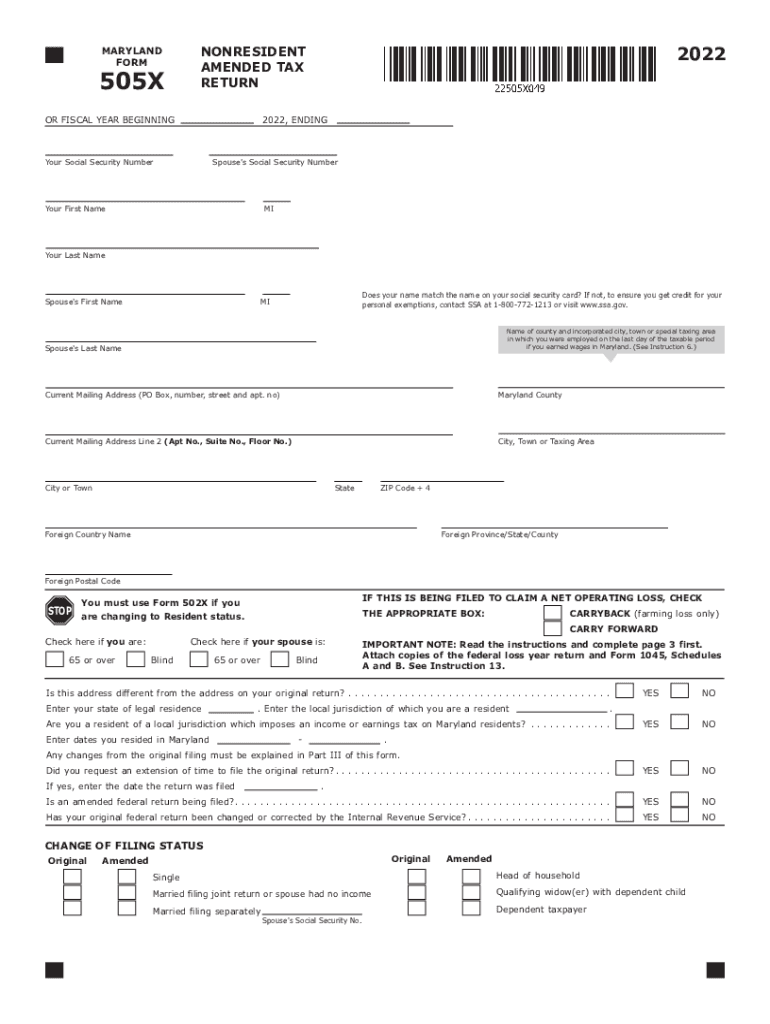

What is the Maryland Form 505?

The Maryland Form 505 is a tax return form specifically designed for non-resident individuals and certain pass-through entities to report income earned in Maryland. This form is essential for those who have income sourced from Maryland but do not reside in the state. It allows taxpayers to calculate their Maryland tax liability accurately based on their income and applicable deductions. Understanding the purpose and requirements of the Maryland Form 505 is crucial for ensuring compliance with state tax laws.

Steps to Complete the Maryland Form 505

Completing the Maryland Form 505 involves several key steps:

- Gather Required Information: Collect all necessary documentation, including W-2s, 1099s, and any other income statements that reflect earnings from Maryland.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income: Accurately report all income earned in Maryland on the appropriate lines of the form.

- Claim Deductions and Credits: Identify any deductions or credits you may qualify for, which can reduce your overall tax liability.

- Calculate Tax Liability: Use the provided tax tables to determine the amount of tax owed based on your reported income.

- Sign and Date the Form: Ensure that you sign and date the form before submission to validate your return.

Filing Deadlines and Important Dates

It is essential to be aware of the filing deadlines associated with the Maryland Form 505 to avoid penalties. Typically, the deadline for filing the Maryland tax return is April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any extensions that may apply, allowing for additional time to file without incurring penalties.

Form Submission Methods

The Maryland Form 505 can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Taxpayers can file electronically using approved e-filing software, ensuring a quicker processing time.

- Mail Submission: Completed forms can be mailed to the Maryland Comptroller's office. It is advisable to use certified mail for tracking purposes.

- In-Person Submission: Taxpayers may also choose to deliver their forms directly to a local Comptroller's office, which can provide immediate confirmation of receipt.

Key Elements of the Maryland Form 505

Understanding the key elements of the Maryland Form 505 is vital for accurate completion. The form includes sections for personal information, income reporting, deductions, and tax calculations. Additionally, there are specific lines designated for non-resident income and credits that may apply to your situation. Familiarizing yourself with these elements will aid in ensuring that all required information is accurately reported.

Legal Use of the Maryland Form 505

The Maryland Form 505 is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The use of electronic signatures through compliant platforms can enhance the security and validity of the submission, aligning with legal standards for e-signatures in the United States.

Quick guide on how to complete 505x49 011023 a 505x49 011023 a

Complete 505X49 011023 A 505X49 011023 A effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing for easy access to the correct forms and secure online storage. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage 505X49 011023 A 505X49 011023 A on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign 505X49 011023 A 505X49 011023 A effortlessly

- Obtain 505X49 011023 A 505X49 011023 A and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools offered by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, frustrating form searches, or errors that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign 505X49 011023 A 505X49 011023 A to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 505x49 011023 a 505x49 011023 a

Create this form in 5 minutes!

How to create an eSignature for the 505x49 011023 a 505x49 011023 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 505 and when should I use it?

The Maryland Form 505 is a tax form used for reporting income and calculating state deductions for pass-through entities. You should consider using the Maryland Form 505 if your business operates as an S-corporation or a partnership in Maryland and needs to file taxes. This form ensures compliance with state tax regulations while helping you maximize deductions.

-

How can airSlate SignNow help me with Maryland Form 505?

With airSlate SignNow, you can easily upload, eSign, and send the Maryland Form 505 directly through our platform. Our user-friendly interface makes it simple to complete the form electronically, reducing the hassle of printing and mailing. Additionally, you can track the signing process to ensure timely submissions.

-

What are the pricing options for using airSlate SignNow for Maryland Form 505?

AirSlate SignNow offers flexible pricing plans tailored to different business needs. You can choose from individual, business, or enterprise plans, each designed to accommodate the volume of documents you handle, including Maryland Form 505. All plans come with a free trial to help you determine which option suits your requirements best.

-

Does airSlate SignNow provide any integrations for Maryland Form 505?

Yes, airSlate SignNow offers various integrations with popular software and applications to streamline your workflow for completing the Maryland Form 505. You can connect with cloud storage services, CRM systems, and other business tools to easily access and manage your documents. These integrations enhance productivity and ensure a seamless eSigning experience.

-

What features does airSlate SignNow offer for managing Maryland Form 505?

AirSlate SignNow provides essential features for managing the Maryland Form 505, including customizable templates, bulk sending options, and advanced security protocols. With real-time notifications and signing reminders, you can ensure that all necessary parties complete the form on time. Additionally, our document management tools help you keep track of all submissions.

-

Are there any benefits to using airSlate SignNow for Maryland Form 505 submissions?

Using airSlate SignNow for Maryland Form 505 submissions saves time and reduces errors associated with manual processes. The platform allows for efficient document handling, which can help streamline your tax reporting. Moreover, electronic signatures are legally binding and provide a record of consent for all parties involved.

-

Is airSlate SignNow compliant with Maryland regulations for Form 505?

Absolutely, airSlate SignNow is compliant with all Maryland regulations when it comes to electronic signatures and document handling, including the Maryland Form 505. Our platform adheres to industry standards to ensure that your documents are legally recognized. You can have peace of mind knowing that your submissions meet all necessary requirements.

Get more for 505X49 011023 A 505X49 011023 A

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return south form

- Letter from tenant to landlord containing request for permission to sublease south carolina form

- Sc landlord 497325680 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent south form

- Letter tenant about 497325682 form

- Sc landlord 497325683 form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497325684 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement south carolina form

Find out other 505X49 011023 A 505X49 011023 A

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile