505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return 2023

What is the 505X Non-Resident Amended Tax Return?

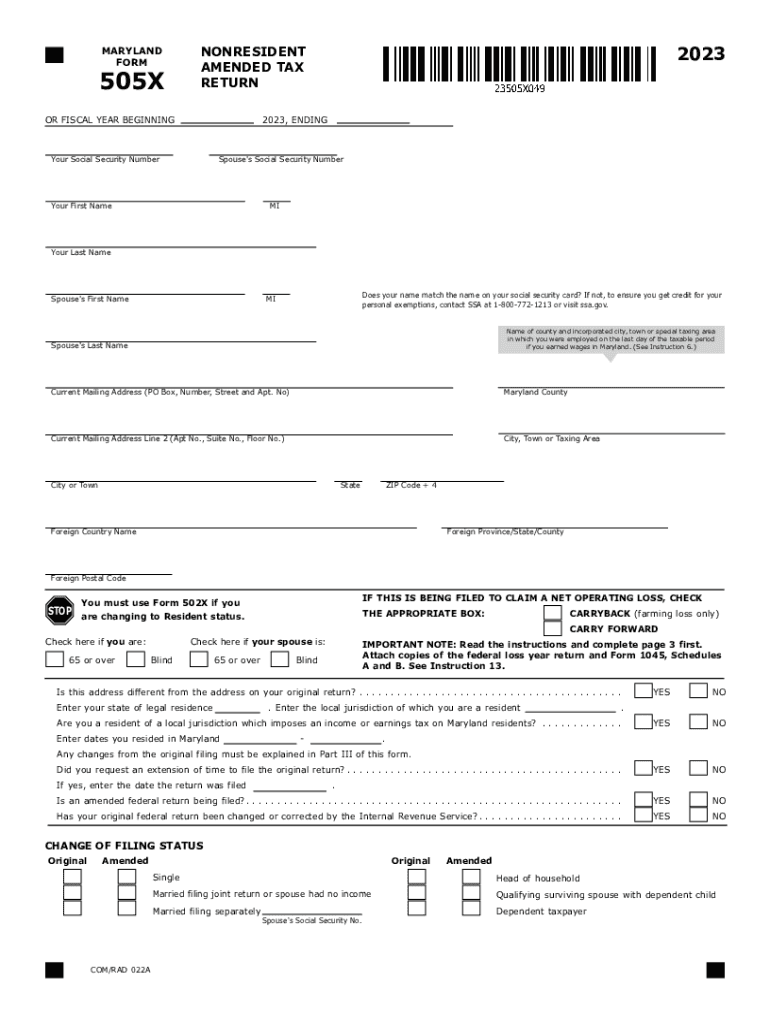

The 505X Non-Resident Amended Tax Return is a specific tax form used by non-residents of Maryland to amend previously filed income tax returns. This form allows taxpayers to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that the tax records accurately reflect the taxpayer's financial situation and comply with state tax laws.

Steps to Complete the 505X Non-Resident Amended Tax Return

Completing the 505X Non-Resident Amended Tax Return involves several key steps:

- Gather all relevant documents, including your original tax return and any supporting documentation for the changes you wish to make.

- Carefully fill out the 505X form, ensuring that all corrections are clearly indicated. Be sure to provide explanations for each change in the designated section.

- Calculate any adjustments to your tax liability based on the amendments made. This may involve recalculating your income, deductions, and credits.

- Review the completed form for accuracy and completeness before submission.

- Submit the amended return to the Maryland Comptroller's office by mail or through the appropriate electronic channels, if available.

Key Elements of the 505X Non-Resident Amended Tax Return

The 505X form includes several important sections that taxpayers must complete:

- Identification Information: This section requires your name, address, and Social Security number or Individual Taxpayer Identification Number.

- Original Return Information: Provide details from your original tax return, including the tax year and amounts reported.

- Amendment Details: Clearly state the changes being made, including new figures and explanations for each adjustment.

- Signature: The form must be signed and dated to validate the submission.

Eligibility Criteria for Filing the 505X Non-Resident Amended Tax Return

To be eligible to file the 505X Non-Resident Amended Tax Return, you must meet the following criteria:

- You must have previously filed a Maryland non-resident income tax return.

- The amendments must pertain to the same tax year as the original return.

- Any adjustments made should be based on valid reasons, such as correcting income, deductions, or claiming missed credits.

Filing Deadlines for the 505X Non-Resident Amended Tax Return

It is important to be aware of the filing deadlines for the 505X form. Generally, the amended return must be filed within three years from the original due date of the return or within two years from the date the tax was paid, whichever is later. Adhering to these deadlines helps avoid potential penalties and ensures that your amendments are processed in a timely manner.

How to Obtain the 505X Non-Resident Amended Tax Return

The 505X Non-Resident Amended Tax Return can be obtained through the Maryland Comptroller's office. Taxpayers can access the form online via the official website or request a physical copy by contacting the office directly. It is advisable to ensure that you are using the most current version of the form to avoid any issues during the filing process.

Quick guide on how to complete 505x non resident amended tax return 505x non resident amended tax return

Effortlessly Prepare 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers a convenient and sustainable substitute to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Way to Edit and eSign 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return Seamlessly

- Find 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature utilizing the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to finalize your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return and guarantee excellent communication at any phase of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 505x non resident amended tax return 505x non resident amended tax return

Create this form in 5 minutes!

How to create an eSignature for the 505x non resident amended tax return 505x non resident amended tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 505x 2023 and how does it relate to airSlate SignNow?

505x 2023 refers to the latest version of airSlate SignNow that enhances the electronic signature and document management experience. This update focuses on improved usability and performance, ensuring that businesses can seamlessly send and eSign documents with greater efficiency.

-

What are the key features of 505x 2023?

The 505x 2023 version of airSlate SignNow includes enhanced document editing tools, advanced security features, and integration capabilities with popular software. Users will also benefit from mobile accessibility, making it easier to manage eSignatures on-the-go.

-

How does pricing work for 505x 2023?

Pricing for the 505x 2023 version of airSlate SignNow is designed to be cost-effective, with multiple subscription plans available to fit various business needs. Each plan offers different features, ensuring that businesses can choose the best option that aligns with their budget and requirements.

-

What are the benefits of using airSlate SignNow 505x 2023?

Using airSlate SignNow 505x 2023 allows businesses to streamline their document workflows by reducing paper usage and speeding up the signing process. This not only lowers operational costs but also improves customer satisfaction through faster transactions.

-

Can 505x 2023 integrate with other software applications?

Yes, airSlate SignNow 505x 2023 offers a variety of integrations with common business applications such as Salesforce, Google Workspace, and Microsoft 365. These integrations facilitate a more cohesive workflow, making it easier for teams to collaborate and manage their documents.

-

Is there a mobile app for 505x 2023?

Absolutely! airSlate SignNow 505x 2023 comes with a mobile app that allows users to manage their documents and eSign from their smartphones or tablets. This feature ensures that you remain productive while on the move, providing flexibility in your business operations.

-

What types of businesses can benefit from 505x 2023?

Any business that requires document management and electronic signatures can benefit from airSlate SignNow 505x 2023. Whether you are a small startup or a large enterprise, this solution scales to meet your needs, improving efficiency across various industries.

Get more for 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return

- Person acknowledged form

- A corporation form

- Sample consulting agreement iowa state extension form

- 300 required supplements notice of appeal missouri courts form

- Control number ky ed1014 form

- How to fill out a request for payment forservicee or form

- Form 1 arkansas workers compensation commission

- There should be at least a president and a secretary form

Find out other 505X Non Resident Amended Tax Return 505X Non Resident Amended Tax Return

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now