Form N 139, Rev , Moving Expenses Hawaii Gov 2021

What is the Hawaii Form N-139?

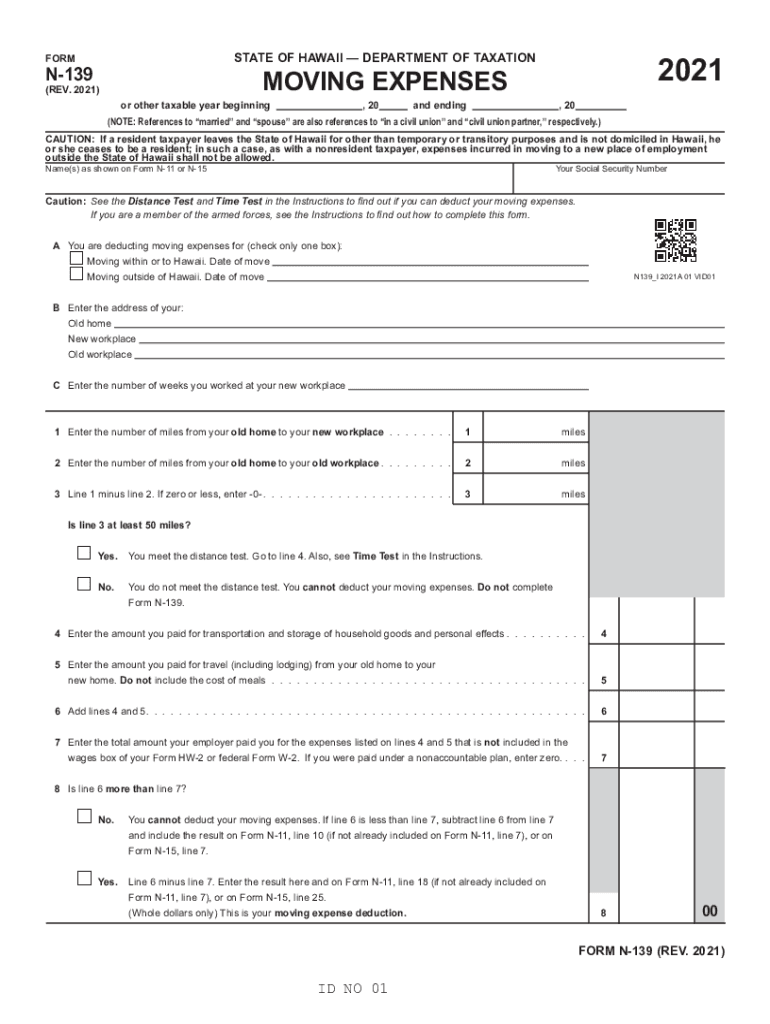

The Hawaii Form N-139, also known as the Hawaii state tax form for moving expenses, is a document used by individuals who have incurred moving expenses related to their employment. This form allows taxpayers to claim deductions for eligible moving costs, which can help reduce their overall tax liability. The form is particularly relevant for those relocating to or from Hawaii for work-related purposes, ensuring that they can benefit from the state’s tax provisions concerning moving expenses.

How to Obtain the Hawaii Form N-139

The Hawaii Form N-139 can be obtained through the official Hawaii Department of Taxation website. It is available for download in a printable format, allowing users to fill it out manually. Additionally, individuals may request a physical copy by contacting the Department of Taxation directly. It is essential to ensure that you are using the most recent version of the form to comply with current tax regulations.

Steps to Complete the Hawaii Form N-139

Filling out the Hawaii Form N-139 involves several key steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Document your moving expenses, ensuring you have receipts or records for all eligible costs.

- Calculate the total amount of your moving expenses and enter this figure in the appropriate section of the form.

- Review your completed form for accuracy and ensure all required fields are filled out.

- Sign and date the form before submitting it to the appropriate tax authority.

Legal Use of the Hawaii Form N-139

The Hawaii Form N-139 is legally binding when completed accurately and submitted in accordance with state tax laws. To ensure compliance, taxpayers must adhere to the guidelines set forth by the Hawaii Department of Taxation regarding eligible moving expenses. It is crucial to maintain supporting documentation, as this may be required in the event of an audit or review by tax authorities.

Eligibility Criteria for the Hawaii Form N-139

To qualify for deductions using the Hawaii Form N-139, certain eligibility criteria must be met:

- The move must be related to a change in employment or job location.

- Taxpayers must have incurred eligible moving expenses, which may include transportation and storage costs.

- The move must occur within one year of starting a new job or being transferred to a new location.

Form Submission Methods for the Hawaii Form N-139

The Hawaii Form N-139 can be submitted through various methods:

- By mail: Send the completed form to the address specified on the form or the Hawaii Department of Taxation.

- In-person: Deliver the form directly to a local tax office if preferred.

- Online: Check if electronic filing options are available for the current tax year, as this may streamline the submission process.

Quick guide on how to complete form n 139 rev 2021 moving expenses hawaiigov

Effortlessly Prepare Form N 139, Rev , Moving Expenses Hawaii gov on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly option compared to traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Form N 139, Rev , Moving Expenses Hawaii gov across any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Form N 139, Rev , Moving Expenses Hawaii gov without hassle

- Obtain Form N 139, Rev , Moving Expenses Hawaii gov and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as an ink signature.

- Review all details and click on the Done button to save your adjustments.

- Choose how you want to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form N 139, Rev , Moving Expenses Hawaii gov and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form n 139 rev 2021 moving expenses hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 139 rev 2021 moving expenses hawaiigov

The best way to make an electronic signature for your PDF document online

The best way to make an electronic signature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The way to generate an e-signature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The way to generate an e-signature for a PDF file on Android OS

People also ask

-

What is the Hawaii Form N 139?

Hawaii Form N 139 is a state tax form used for non-residents or part-year residents to calculate their income tax obligations in Hawaii. It helps individuals report their income earned within the state accurately. Utilizing airSlate SignNow can simplify the signing and sharing process of this document.

-

How can airSlate SignNow assist with completing the Hawaii Form N 139?

airSlate SignNow offers an intuitive platform for filling out and electronically signing the Hawaii Form N 139. With its user-friendly interface, you can easily navigate through the form, ensuring all required fields are completed accurately. This reduces errors and expedites the filing process.

-

Is there a cost associated with using airSlate SignNow for the Hawaii Form N 139?

Yes, using airSlate SignNow involves a subscription fee, which varies based on the plan you choose. However, given its features and efficiency, many users find it to be a cost-effective solution for handling documents like the Hawaii Form N 139. Check our pricing page for specific details.

-

What are the key features of airSlate SignNow for handling the Hawaii Form N 139?

airSlate SignNow includes features like electronic signatures, document templates, and secure cloud storage, making it ideal for managing the Hawaii Form N 139. These tools streamline the process of completing and storing your tax documents, ensuring they are easily accessible when you need them.

-

Can I integrate airSlate SignNow with other applications to facilitate the Hawaii Form N 139?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and Microsoft Office. This means you can easily import or export the Hawaii Form N 139 from your preferred software, enhancing your workflow and productivity.

-

What benefits does airSlate SignNow offer when completing tax forms like the Hawaii Form N 139?

Using airSlate SignNow for tax documents such as the Hawaii Form N 139 offers multiple benefits, including time savings, reduced paper clutter, and improved document tracking. The electronic process also enhances security and ensures compliance with regulations for electronic signatures.

-

Is airSlate SignNow compliant with state regulations for the Hawaii Form N 139?

Yes, airSlate SignNow adheres to all state regulations regarding electronic signatures and document handling for the Hawaii Form N 139. This compliance ensures that your signed documents are legally valid and can be submitted without any issues.

Get more for Form N 139, Rev , Moving Expenses Hawaii gov

- Legal last will and testament form for divorced person not remarried with adult children maryland

- Maryland legal marriage form

- Legal last will and testament form for divorced person not remarried with no children maryland

- Legal last will and testament form for divorced person not remarried with minor children maryland

- Legal last will and testament form for domestic partner with adult children maryland

- Legal will form 497310626

- Legal last will and testament form for domestic partner with minor children maryland

- Legal last will and testament form for divorced person not remarried with adult and minor children maryland

Find out other Form N 139, Rev , Moving Expenses Hawaii gov

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT