Form N 139, Rev , Moving Expenses 2024-2026

What is the Form N-139, Rev. Moving Expenses

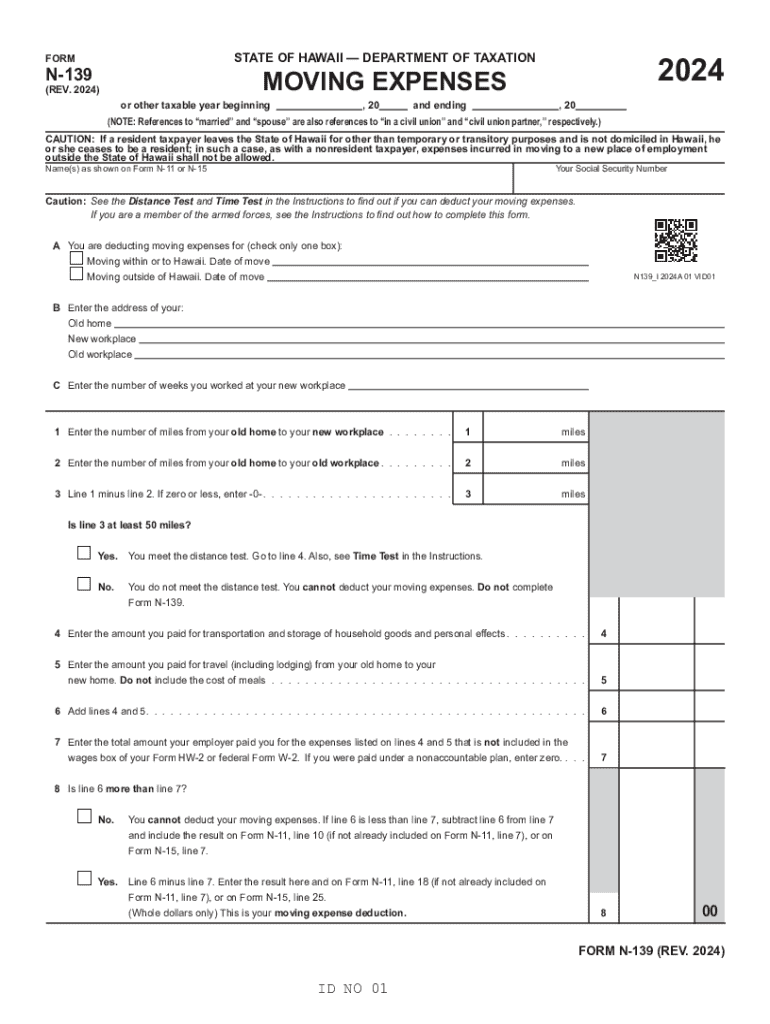

The Form N-139, Rev. is a specific document used in Hawaii for claiming moving expenses. This form is particularly relevant for individuals who have relocated for work or other qualifying reasons. It allows taxpayers to report their moving costs and potentially receive a tax deduction for these expenses. Understanding the purpose of this form is essential for anyone looking to benefit from the moving expense deduction in Hawaii.

How to Use the Form N-139, Rev. Moving Expenses

Using the Form N-139, Rev. involves several steps to ensure accurate completion. First, gather all necessary documentation related to your moving expenses, such as receipts and invoices. Next, fill out the form with your personal information, including your name, address, and Social Security number. Be sure to detail your moving expenses accurately, categorizing them as required. Finally, review the completed form for any errors before submission to ensure compliance with state guidelines.

Steps to Complete the Form N-139, Rev. Moving Expenses

Completing the Form N-139, Rev. requires careful attention to detail. Follow these steps:

- Collect all relevant moving expense documentation.

- Enter your personal information at the top of the form.

- List all eligible moving expenses in the designated sections.

- Calculate the total expenses and ensure they align with your documentation.

- Sign and date the form before submission.

Key Elements of the Form N-139, Rev. Moving Expenses

The Form N-139, Rev. includes several key elements that are crucial for proper completion. These elements consist of personal identification fields, sections for detailing moving expenses, and a summary area for total expenses. Additionally, the form may require taxpayers to provide explanations for certain expenses to ensure they meet eligibility criteria. Familiarity with these elements can help streamline the filing process.

Eligibility Criteria for the Form N-139, Rev. Moving Expenses

To qualify for using the Form N-139, Rev., individuals must meet specific eligibility criteria. Generally, this form is intended for those who have moved due to a new job or job transfer, or for other valid reasons as defined by state regulations. It is important to review these criteria to ensure that all reported expenses are eligible for deduction. Failure to meet eligibility requirements can result in denied claims.

Form Submission Methods for the N-139, Rev. Moving Expenses

Once the Form N-139, Rev. is completed, it can be submitted through various methods. Taxpayers can file the form online via the state’s tax portal, mail it to the appropriate tax office, or submit it in person at designated locations. Each submission method has its own processing times and requirements, so it is advisable to choose the method that best suits your needs while ensuring timely filing.

Create this form in 5 minutes or less

Find and fill out the correct form n 139 rev moving expenses

Create this form in 5 minutes!

How to create an eSignature for the form n 139 rev moving expenses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 139 Hawaii and how can airSlate SignNow help?

Form 139 Hawaii is a document used for various administrative purposes in the state. airSlate SignNow simplifies the process of filling out and eSigning this form, ensuring that you can complete it quickly and efficiently from anywhere.

-

Is there a cost associated with using airSlate SignNow for form 139 Hawaii?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while ensuring you have all the necessary features to manage form 139 Hawaii effectively.

-

What features does airSlate SignNow offer for managing form 139 Hawaii?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage form 139 Hawaii and streamline your document workflow.

-

Can I integrate airSlate SignNow with other applications for form 139 Hawaii?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to enhance your workflow when handling form 139 Hawaii. This integration helps you connect with tools you already use, making the process more efficient.

-

What are the benefits of using airSlate SignNow for form 139 Hawaii?

Using airSlate SignNow for form 139 Hawaii offers numerous benefits, including time savings, improved accuracy, and enhanced security. With its user-friendly interface, you can complete and send your forms with confidence.

-

How secure is airSlate SignNow when handling form 139 Hawaii?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When you use airSlate SignNow for form 139 Hawaii, you can trust that your information is safe and secure.

-

Can I access form 139 Hawaii on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage form 139 Hawaii on the go. This flexibility ensures that you can complete your documents anytime, anywhere.

Get more for Form N 139, Rev , Moving Expenses

- Cumulus soaring form

- Primary producer declaration accountant template form

- Why wait fast access to private treatment with bmi healthcare form

- Financial evaluation for parents and grandparents sponsorship form

- Adult travel document application for stateless and protected form

- Nova scotia birth certificate application pdf form

- Instructions for more complete instructions and definitions refer to the user guide form

- Main roads accreditation roadworthiness checklist form

Find out other Form N 139, Rev , Moving Expenses

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple