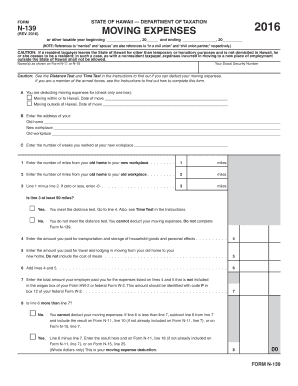

Form N 139, Rev , Moving Expenses Forms 2016

What is the Form N-139, Rev , Moving Expenses Forms

The Form N-139, Rev , Moving Expenses Forms is a tax document used by individuals who are claiming moving expenses as a deduction on their federal tax returns. This form allows taxpayers to report eligible moving costs incurred during a job-related relocation. It is essential for ensuring that the expenses claimed meet the criteria set forth by the IRS. Understanding the purpose of this form is crucial for individuals looking to maximize their tax benefits related to moving expenses.

How to use the Form N-139, Rev , Moving Expenses Forms

To effectively use the Form N-139, Rev , Moving Expenses Forms, individuals should first gather all relevant documentation regarding their moving expenses. This includes receipts for transportation, storage, and travel. Once the necessary information is collected, taxpayers can fill out the form by entering their personal details, moving expenses, and any other required information. After completing the form, it should be reviewed for accuracy before submission to ensure compliance with IRS guidelines.

Steps to complete the Form N-139, Rev , Moving Expenses Forms

Completing the Form N-139 involves several key steps:

- Gather all necessary documentation, including receipts and invoices related to the move.

- Fill in personal information such as name, address, and Social Security number.

- Detail the moving expenses incurred, categorizing them as necessary.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate the information provided.

Legal use of the Form N-139, Rev , Moving Expenses Forms

The legal use of the Form N-139 is strictly governed by IRS regulations. Taxpayers must ensure that the moving expenses claimed are eligible under the current tax laws. This includes verifying that the move was job-related and that the expenses are substantiated with proper documentation. Failure to comply with these legal requirements may result in penalties or disallowance of the claimed expenses.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Form N-139. Generally, the form must be submitted along with the individual's federal tax return by the tax filing deadline, which is typically April 15 of each year. However, if additional time is needed, taxpayers may file for an extension, allowing for a later submission date. Keeping track of these deadlines is essential to avoid late penalties.

Required Documents

When completing the Form N-139, certain documents are required to substantiate the moving expenses claimed. These documents may include:

- Receipts for moving services, such as moving company invoices.

- Travel expenses documentation, including gas receipts or airfare tickets.

- Records of temporary lodging costs incurred during the move.

Having these documents readily available will facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete form n 139 rev 2016 moving expenses forms 2016

Your assistance manual on how to prepare your Form N 139, Rev , Moving Expenses Forms

If you’re curious about how to finalize and submit your Form N 139, Rev , Moving Expenses Forms, here are some brief guidelines on how to simplify tax declaration.

To begin, all you need is to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that allows you to adjust, compose, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, while being able to revisit and edit information as required. Streamline your tax administration with advanced PDF modification, eSigning, and intuitive sharing.

Follow the instructions below to finalize your Form N 139, Rev , Moving Expenses Forms in just a few minutes:

- Create your account and start handling PDFs within minutes.

- Utilize our catalog to find any IRS tax form; browse through various versions and schedules.

- Select Get form to access your Form N 139, Rev , Moving Expenses Forms in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any inaccuracies.

- Save changes, print your copy, send it to your intended recipient, and download it onto your device.

Utilize this manual to electronically submit your taxes with airSlate SignNow. Please be aware that submitting on paper may lead to return mistakes and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 139 rev 2016 moving expenses forms 2016

FAQs

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

For the new 2016 W8-BEN-E form to be filled out by companies doing business as a seller on the Amazon USA website, do I fill out a U.S. TIN, a GIIN, or a foreign TIN?

You will need to obtain an EIN for the BC corporation; however, I would imagine a W8-BEN is not appropriate for you, if you are selling through Amazon FBA. The FBA program generally makes Amazon your agent in the US, which means any of your US source income, ie anything sold to a US customer is taxable in the US. W8-BEN is asserting that you either have no US sourced income or that income is exempt under the US/Canadian tax treaty. Based on the limited knowledge I have of your situation, but if you are selling through the FBA program, I would say you don’t qualify to file a W8-BEN, but rather should be completing a W8-ECI and your BC corporation should be filing an 1120F to report your US effectively connected income.

-

I made a mistake in filling the JEE 2016 application form. It got changed to B.Arch from B.Tech on clicking the review button. How to fix this ?

Yes in the correction window, it is editable. Infact all the options ( except change in exam center location and online to offline mode ) can be changed. This is for all those who might have done or will do some mistake. But the images correction is separate from data and if there is no problem with images (which JEE has not figured out) then you cannot change them in any case (not even in correction window).I have already done correction today (JEE mains 2016-17) so thought to complete my part.

-

When the forms of DU Medical College 2016 will be out and how to apply for it ?

I can't tell you the dates but i can tell that You have to download form from FMSC website, fill it, get it filled and attested by your school as a proof of your schooling from delhi. And after that you have to go to DU north campus Patel Chest Institute, FMSC has their office in the building, you submit your form over there and they will give you the confirmation slip

-

How will neet 2016 be conducted? What will happen to the students who filled only state pmt/amu/aiims form but not aipmt?

According to news, aipmt conducte in two phase. First phase will conduct on 1 may for students who already filled the aipmt form. Second phase will conduct on 24 July for students who didn't fill form of aipmt. cbse will also take forms for students who didn't fill previous forms. So don't take tension. And if you were preparing only for state so now try to study ncert because in 2nd phase most of the students were not preparing for Aipmt. Rank will announce by percentile method so equality will maintain. And 2 nd phase students will take benefits also because topper students will give exam on 1st may. So do your best. All the best

-

Who do I use as my custodial parent on my FAFSA forms? I'm 17 years old (senior in HS) currently filling out my FAFSA forms. I lived with my mom for 7 years after my parents divorced but I just recently moved to my Dad's in December of 2016.

Per 20 USC 1087oo(f)(1), the parent responsible for completing the Free Application for Federal Student Aid (FAFSA) is the parent with whom the student lived the most during the 12 months ending on the date the FAFSA was filed.Since there are an odd number of days in the year, this should be definitive. However, there are some circumstances in which it is not. For example, leap years have an even number of days and there may be an even number of days in circumstances involving a recent divorce.If so, then it is based on the parent who provided more support to the student during the 12 months ending on the date the FAFSA was filed.If this is not definitive, then it is based on the parent who provided more support to the student during the most recent calendar year during which either parent provided any support.If this does not determine which parent is responsible for completing the FAFSA, the college financial aid administrator gets to choose. In most cases, the financial aid administrator will choose the parent with the greater income.College financial aid administrators can ask for a copy of the divorce decree and child custody arrangement to verify that the parent completing the FAFSA is the correct parent. They will make you count the days (actually, nights) and compare it to the child custody arrangement. Also, they will look at where the student goes to school and if it corresponds to the parent’s address.

-

How do I create forms for MySQL database? I have created a small database in Access and I’m planning to move to MySQL, but I am able to create only tables so far. How do I create forms for users to fill out the tables?

You can't directly. MySQL is the data engine, and has no user interface capabilities.To do this, you must write an application of some kind.You might write a desktop windows app using C# and its UI framework. Or maybe a Java desktop app using JavaFX for the UI and JDBC to connect to MySQLYou might write a web application, and then have a browser based interface.Whatever you do, what gets sent to MySQL will be SQL commands.It's more difficult than access for sure. And you have to consider the effects of multiple users editing the same data at the same time.

Create this form in 5 minutes!

How to create an eSignature for the form n 139 rev 2016 moving expenses forms 2016

How to make an electronic signature for the Form N 139 Rev 2016 Moving Expenses Forms 2016 online

How to make an eSignature for the Form N 139 Rev 2016 Moving Expenses Forms 2016 in Google Chrome

How to make an eSignature for putting it on the Form N 139 Rev 2016 Moving Expenses Forms 2016 in Gmail

How to generate an eSignature for the Form N 139 Rev 2016 Moving Expenses Forms 2016 right from your smartphone

How to generate an electronic signature for the Form N 139 Rev 2016 Moving Expenses Forms 2016 on iOS

How to generate an electronic signature for the Form N 139 Rev 2016 Moving Expenses Forms 2016 on Android

People also ask

-

What is Form N 139, Rev, Moving Expenses Forms?

Form N 139, Rev, Moving Expenses Forms is a document used for claiming moving expenses when relocating for work. This form allows individuals to itemize their moving costs and seek reimbursement. Understanding how to complete this form is crucial for ensuring you receive the maximum eligible deductions on your taxes.

-

How can airSlate SignNow assist with Form N 139, Rev, Moving Expenses Forms?

airSlate SignNow streamlines the process of completing and signing Form N 139, Rev, Moving Expenses Forms. Our platform provides easy-to-use templates that guide you in filling out the necessary information accurately. With features like eSigning and instant document sharing, airSlate SignNow makes managing your moving expenses forms efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for Form N 139, Rev, Moving Expenses Forms?

Yes, using airSlate SignNow comes with a subscription cost that varies based on the selected plan. However, our pricing structure is designed to be cost-effective, especially for businesses frequently managing documents like Form N 139, Rev, Moving Expenses Forms. You can choose a plan that best suits your needs and budget.

-

What key features does airSlate SignNow offer for handling moving expenses forms?

airSlate SignNow offers various features tailored for handling moving expenses forms, including customizable templates, secure eSigning capabilities, and document tracking. This ensures that your Form N 139, Rev, Moving Expenses Forms are completed accurately and promptly. Additionally, users benefit from automated reminders for pending signatures.

-

Can I integrate airSlate SignNow with other software for managing Form N 139, Rev, Moving Expenses Forms?

Absolutely! airSlate SignNow seamlessly integrates with multiple software solutions, enhancing your workflow for managing Form N 139, Rev, Moving Expenses Forms. Whether you use CRM tools or accounting software, our integrations help streamline your document management process.

-

What are the benefits of using airSlate SignNow for my moving expenses documentation?

Using airSlate SignNow for your moving expenses documentation, including Form N 139, Rev, Moving Expenses Forms, provides flexibility and convenience. With our platform, you can easily prepare, sign, and send documents from anywhere, anytime. This not only saves time but also helps ensure that your forms are processed correctly and quickly.

-

Is airSlate SignNow compliant with legal standards for eSigning Form N 139, Rev, Moving Expenses Forms?

Yes, airSlate SignNow is compliant with applicable eSignature laws, meaning that your signed Form N 139, Rev, Moving Expenses Forms hold legal validity. Our platform adheres to the requirements of the ESIGN Act and UETA. This ensures that your documents are legally binding and accepted by governmental bodies and organizations.

Get more for Form N 139, Rev , Moving Expenses Forms

- Aquaculture questioniare form 4 5 audit reports mass

- Old national bank deposit slip form

- Travel insurance form sample 40417726

- Section 34 consent form alberta health and wellness

- Copyright ownership and license agreement form

- Fillable online tax ny it 242 new york state department of form

- Seizure ihp safety plan form

- Resident landlord tenancy agreement template form

Find out other Form N 139, Rev , Moving Expenses Forms

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors