Filing Information for Individual Income Tax Marylandtaxes Gov 2022

Understanding Form N-139

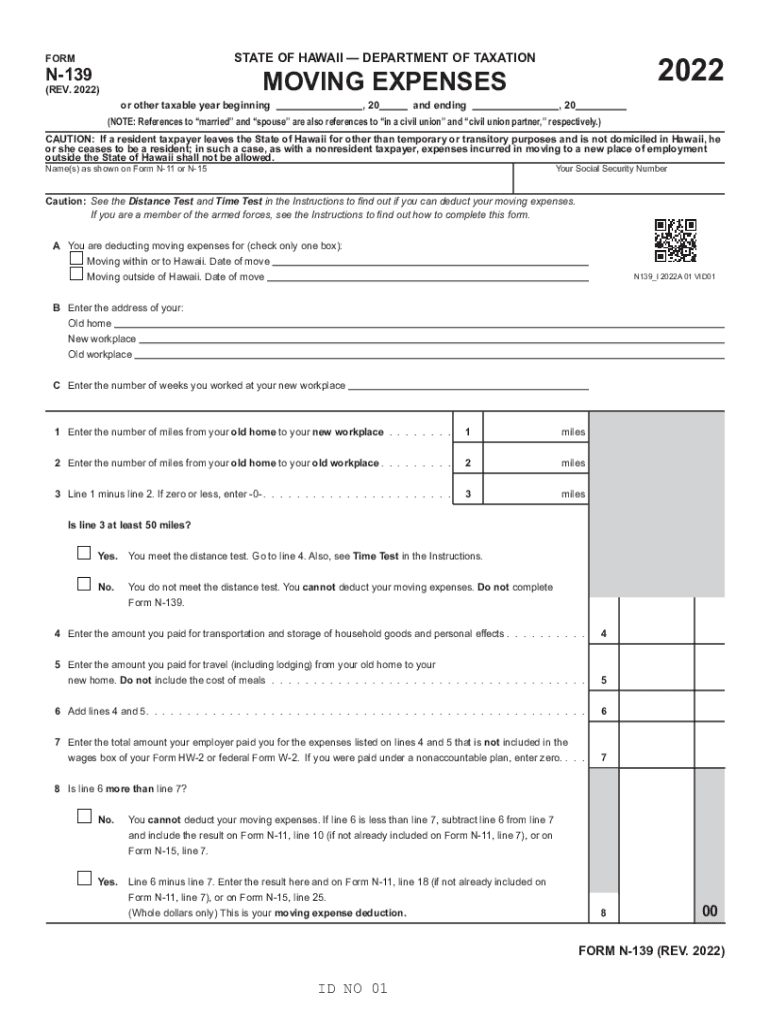

Form N-139, also known as the Hawaii Moving Expenses Form, is specifically designed for taxpayers who are relocating and wish to claim moving expenses on their state tax return. This form allows eligible individuals to document their moving costs and potentially reduce their taxable income. It is essential to understand the specific requirements and regulations governing this form to ensure compliance and maximize potential benefits.

Steps to Complete Form N-139

Completing Form N-139 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to your moving expenses, including receipts and invoices. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Then, detail your moving expenses in the designated sections, ensuring that you categorize them correctly. Finally, review the form for completeness and accuracy before submitting it with your state tax return.

Key Elements of Form N-139

Form N-139 includes several important sections that taxpayers must complete. These sections typically cover personal identification information, a detailed breakdown of moving expenses, and a calculation of the total deductible amount. It is crucial to provide accurate figures and supporting documentation to substantiate your claims. Additionally, the form may require you to certify that the expenses were incurred due to a job-related move, which is a critical eligibility criterion.

Legal Use of Form N-139

The legal use of Form N-139 is governed by state tax laws, which outline the eligibility criteria for claiming moving expenses. To qualify, taxpayers must demonstrate that their move was necessary for employment purposes and that the expenses incurred meet the state's definitions of allowable moving costs. Understanding these legal parameters is essential to avoid potential penalties or issues with tax compliance.

Filing Deadlines for Form N-139

It is important to be aware of filing deadlines associated with Form N-139 to ensure timely submission. Generally, the form should be filed along with your Hawaii state tax return, which is typically due on April 20th for most taxpayers. If you are unable to meet this deadline, consider applying for an extension, but be mindful that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Who Issues Form N-139

Form N-139 is issued by the Hawaii Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. For any questions or clarifications regarding the form, you can contact the department directly or consult their official website for additional resources and guidance.

Examples of Using Form N-139

Taxpayers may find various scenarios where Form N-139 is applicable. For instance, if an individual relocates from the mainland United States to Hawaii for a new job, they can use this form to claim eligible moving expenses. Additionally, a person who moves within the state for employment reasons may also benefit from filing Form N-139. Documenting these expenses accurately can lead to significant tax savings for eligible individuals.

Quick guide on how to complete filing information for individual income tax marylandtaxesgov

Prepare Filing Information For Individual Income Tax Marylandtaxes gov effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Filing Information For Individual Income Tax Marylandtaxes gov on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to adjust and eSign Filing Information For Individual Income Tax Marylandtaxes gov effortlessly

- Find Filing Information For Individual Income Tax Marylandtaxes gov and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Filing Information For Individual Income Tax Marylandtaxes gov and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct filing information for individual income tax marylandtaxesgov

Create this form in 5 minutes!

How to create an eSignature for the filing information for individual income tax marylandtaxesgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form n 139 and its purpose?

Form n 139 is used for specific administrative purposes related to tax filings and compliance. It facilitates the accurate collection of necessary information by businesses to ensure they meet legal obligations. This form is essential for seamless interactions with tax authorities.

-

How does airSlate SignNow facilitate the signing of form n 139?

airSlate SignNow offers a user-friendly platform that allows businesses to upload and send form n 139 for electronic signatures. Our secure eSigning technology ensures that all signatures are legally binding and maintain the integrity of the document. Users can track the signing process in real-time to ensure a smooth workflow.

-

Can I integrate other applications with airSlate SignNow for form n 139?

Yes, airSlate SignNow provides robust integrations with various applications, enhancing your workflow, especially for handling form n 139. You can easily connect with popular platforms like Google Drive, Salesforce, and many others. This integration capability streamlines your operations, making document management more efficient.

-

What are the pricing options for using airSlate SignNow for form n 139?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including a subscription model. This model ensures that organizations can handle form n 139 signing and document management without breaking the bank. You can choose a plan based on the number of users or documents processed.

-

What features does airSlate SignNow provide for managing form n 139?

airSlate SignNow includes features like template creation, bulk sending, and automated reminders specifically designed for form n 139. These features help streamline the signing process, minimize delays, and reduce human error. The platform also offers extensive customization options to fit your business needs.

-

Is airSlate SignNow secure for storing form n 139?

Absolutely! airSlate SignNow prioritizes data security, ensuring that your form n 139 and other documents are protected. We employ advanced encryption methods and comply with industry standards to safeguard sensitive information. This means your documents are both secure and accessible when needed.

-

How can businesses benefit from using airSlate SignNow for form n 139?

Businesses can signNowly benefit from using airSlate SignNow for form n 139 by improving efficiency and reducing turnaround times. The ease of eSigning allows for quicker processing, which is vital for meeting deadlines. Additionally, our platform minimizes the likelihood of errors, ensuring compliance with regulatory requirements.

Get more for Filing Information For Individual Income Tax Marylandtaxes gov

- Siding contract for contractor south dakota form

- Refrigeration contract for contractor south dakota form

- Drainage contract for contractor south dakota form

- Foundation contract for contractor south dakota form

- Plumbing contract for contractor south dakota form

- Brick mason contract for contractor south dakota form

- Roofing contract for contractor south dakota form

- Electrical contract for contractor south dakota form

Find out other Filing Information For Individual Income Tax Marylandtaxes gov

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document