Form N 139, Rev , Moving Expenses Hawaii Gov 2013

What is the Form N-139, Rev , Moving Expenses Hawaii gov

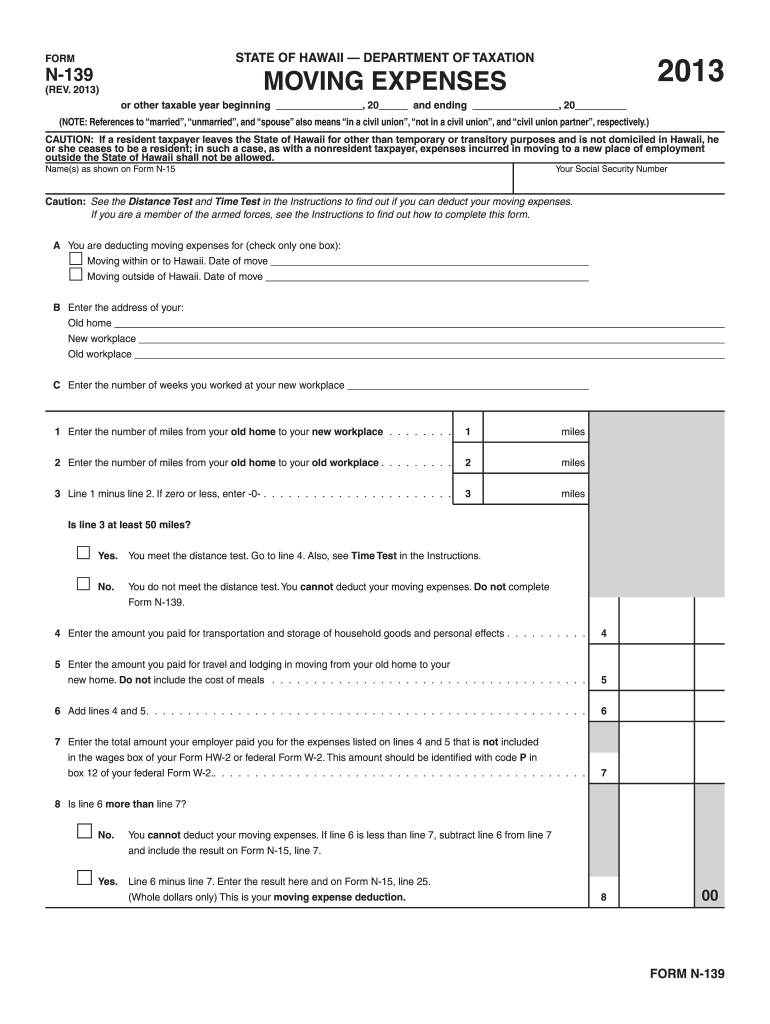

The Form N-139, Rev , Moving Expenses is a tax form used by residents of Hawaii to claim deductions for moving expenses incurred during a job-related relocation. This form is specifically designed to assist taxpayers in reporting eligible moving costs to the state government. It is essential for individuals who have moved for work purposes to accurately complete this form to ensure they receive the appropriate tax benefits. The form includes sections for detailing the new job location, the previous residence, and the specific expenses incurred during the move.

How to use the Form N-139, Rev , Moving Expenses Hawaii gov

To effectively use the Form N-139, Rev , Moving Expenses, taxpayers should first gather all necessary documentation related to their move. This includes receipts for moving services, transportation costs, and any temporary lodging expenses. Once the documentation is ready, individuals can fill out the form by entering their personal information, detailing the moving expenses, and ensuring that all calculations are accurate. After completing the form, it should be reviewed for any errors before submission to avoid delays in processing.

Steps to complete the Form N-139, Rev , Moving Expenses Hawaii gov

Completing the Form N-139 involves several key steps:

- Gather all relevant documents, including receipts and proof of employment at the new location.

- Fill out personal information, including your name, address, and Social Security number.

- Detail the moving expenses, categorizing them as necessary, such as transportation and storage costs.

- Calculate the total moving expenses and ensure they comply with state regulations.

- Review the completed form for accuracy before submission.

Legal use of the Form N-139, Rev , Moving Expenses Hawaii gov

The legal use of the Form N-139 is governed by state tax regulations in Hawaii. Taxpayers must ensure that the expenses claimed are legitimate and directly related to their job relocation. This form must be submitted within the designated filing period to be considered valid. Additionally, it is crucial to retain all supporting documents for potential audits by the state tax authority, as improper claims can lead to penalties.

Eligibility Criteria

To be eligible to use the Form N-139, individuals must meet specific criteria. They must have moved due to a job change or new employment, and the move must be closely related to the start of the new job. The distance between the old and new residence must also meet the minimum requirements set by the state. Furthermore, only certain expenses are deductible, so it is important to understand what qualifies under Hawaii tax law.

Form Submission Methods (Online / Mail / In-Person)

The Form N-139 can be submitted through various methods. Taxpayers have the option to file the form online through the Hawaii Department of Taxation's website, which provides a convenient way to submit documents digitally. Alternatively, the completed form can be mailed to the appropriate tax office or submitted in person at designated locations. Each submission method has its own processing times, so individuals should choose the one that best fits their needs.

Quick guide on how to complete form n 139 rev 2013 moving expenses hawaiigov

Your assistance manual on how to prepare your Form N 139, Rev , Moving Expenses Hawaii gov

If you’re curious about how to generate and submit your Form N 139, Rev , Moving Expenses Hawaii gov, here are several straightforward instructions to simplify your tax filing process.

To begin, you simply need to create your airSlate SignNow account to alter the way you manage documents online. airSlate SignNow is a very user-friendly and robust document solution that enables you to modify, produce, and finalize your tax documents with ease. Through its editor, you can toggle between text, check boxes, and eSignatures, returning to amend responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the steps below to finish your Form N 139, Rev , Moving Expenses Hawaii gov in a few minutes:

- Create your account and start handling PDFs within minutes.

- Utilize our directory to locate any IRS tax form; navigate through variants and schedules.

- Click Obtain form to access your Form N 139, Rev , Moving Expenses Hawaii gov in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper may increase return errors and delay refunds. Before e-filing your taxes, be sure to check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form n 139 rev 2013 moving expenses hawaiigov

Create this form in 5 minutes!

How to create an eSignature for the form n 139 rev 2013 moving expenses hawaiigov

How to create an electronic signature for your Form N 139 Rev 2013 Moving Expenses Hawaiigov online

How to create an eSignature for the Form N 139 Rev 2013 Moving Expenses Hawaiigov in Chrome

How to make an eSignature for putting it on the Form N 139 Rev 2013 Moving Expenses Hawaiigov in Gmail

How to create an electronic signature for the Form N 139 Rev 2013 Moving Expenses Hawaiigov from your smart phone

How to make an eSignature for the Form N 139 Rev 2013 Moving Expenses Hawaiigov on iOS devices

How to create an electronic signature for the Form N 139 Rev 2013 Moving Expenses Hawaiigov on Android

People also ask

-

What is Form N 139, Rev , Moving Expenses Hawaii gov.?

Form N 139, Rev , Moving Expenses Hawaii gov. is a state tax form used to claim a deduction for moving expenses incurred by Hawaii residents. This form can help you recoup some of the costs associated with moving for a new job. Understanding the requirements for this form is crucial to maximize your tax benefits.

-

How can airSlate SignNow assist with Form N 139, Rev , Moving Expenses Hawaii gov.?

airSlate SignNow offers a seamless platform to facilitate the signing and sending of Form N 139, Rev , Moving Expenses Hawaii gov. With our user-friendly interface, you can easily gather signatures, ensuring that your documents are processed quickly and efficiently, which is essential during tax season.

-

Is there a cost associated with using airSlate SignNow for Form N 139, Rev , Moving Expenses Hawaii gov.?

Pricing for airSlate SignNow varies based on subscription plans, but we offer competitive pricing to suit different business needs. You can access features that simplify the eSigning process for Form N 139, Rev , Moving Expenses Hawaii gov. without breaking the bank, ensuring you get excellent value for your investment.

-

What features does airSlate SignNow offer for managing documents like Form N 139, Rev , Moving Expenses Hawaii gov.?

airSlate SignNow includes features like templates for recurring documents, secure document storage, and real-time tracking of signatures. These tools streamline the process for Form N 139, Rev , Moving Expenses Hawaii gov., ensuring you can manage your moving expense claims efficiently and confidently.

-

What benefits can I expect when using airSlate SignNow for Form N 139, Rev , Moving Expenses Hawaii gov.?

By using airSlate SignNow for Form N 139, Rev , Moving Expenses Hawaii gov., you'll benefit from increased efficiency and reduced paperwork. Our platform minimizes delays, ensuring that your moving expense claims are processed without hassles or unnecessary complications, helping you focus on your new job.

-

Can I integrate airSlate SignNow with other tools for Form N 139, Rev , Moving Expenses Hawaii gov.?

Yes, airSlate SignNow integrates seamlessly with a variety of business applications, enhancing your workflow when dealing with Form N 139, Rev , Moving Expenses Hawaii gov. By linking your existing tools, you can streamline document management and eSigning processes further, making your operations more efficient.

-

Is it easy to use airSlate SignNow for someone unfamiliar with Form N 139, Rev , Moving Expenses Hawaii gov.?

Absolutely! airSlate SignNow is designed for ease of use, even for individuals unfamiliar with Form N 139, Rev , Moving Expenses Hawaii gov. Our intuitive interface and helpful resources make it simple to guide users through the signing process, ensuring they can complete their documents with confidence.

Get more for Form N 139, Rev , Moving Expenses Hawaii gov

Find out other Form N 139, Rev , Moving Expenses Hawaii gov

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo