State Earned Income Tax Credit 2023

What is the State Earned Income Tax Credit

The State Earned Income Tax Credit (EITC) is a tax benefit designed to assist low- to moderate-income working individuals and families. This credit reduces the amount of tax owed and may result in a refund. It is based on earned income and family size, making it particularly beneficial for those who may struggle to meet their financial obligations. The EITC aims to incentivize work and alleviate poverty by providing additional financial support to eligible taxpayers.

Eligibility Criteria

To qualify for the State Earned Income Tax Credit, taxpayers must meet specific eligibility requirements. Generally, these include:

- Having earned income from employment or self-employment.

- Meeting income limits, which vary based on filing status and the number of qualifying children.

- Being a resident of the state where the credit is claimed.

- Filing a tax return, even if no tax is owed.

It is essential for applicants to review the state-specific guidelines to ensure they meet all criteria before applying.

Steps to Complete the State Earned Income Tax Credit

Completing the State Earned Income Tax Credit involves several steps:

- Gather necessary documentation, including W-2 forms and proof of income.

- Determine eligibility based on income and family size.

- Complete the appropriate tax forms, including the State EITC form.

- Submit the tax return by the state’s filing deadline.

Following these steps can help ensure that taxpayers receive the credit they qualify for without unnecessary delays.

Form Submission Methods

Taxpayers have several options for submitting their State Earned Income Tax Credit forms. These methods include:

- Online submission through state tax websites or authorized e-filing services.

- Mailing a paper return to the appropriate state tax office.

- In-person submission at designated tax offices or community assistance centers.

Each method has its advantages, and taxpayers should choose the one that best fits their needs and circumstances.

Required Documents

When applying for the State Earned Income Tax Credit, taxpayers must prepare certain documents. Commonly required documents include:

- Proof of earned income, such as W-2 forms or pay stubs.

- Identification documents, including Social Security numbers for all qualifying children.

- Any relevant tax forms, such as the state-specific EITC form.

Having these documents ready can streamline the application process and help avoid delays.

Who Issues the Form

The State Earned Income Tax Credit form is typically issued by the state’s department of revenue or taxation. This agency is responsible for administering tax laws and ensuring compliance. Taxpayers can usually find the form on the official state tax website, where they can also access additional resources and guidance related to the credit.

Quick guide on how to complete state earned income tax credit

Complete State Earned Income Tax Credit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage State Earned Income Tax Credit on any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign State Earned Income Tax Credit with ease

- Obtain State Earned Income Tax Credit and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you want to send your form: by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign State Earned Income Tax Credit and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state earned income tax credit

Create this form in 5 minutes!

How to create an eSignature for the state earned income tax credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

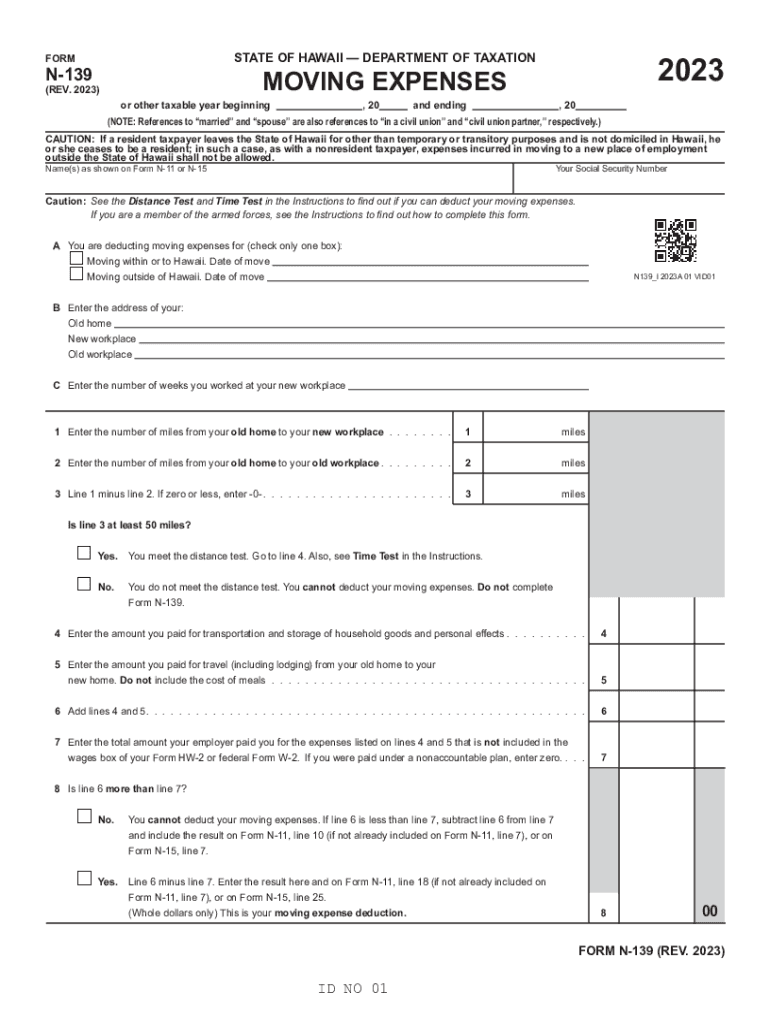

What is the purpose of form N 139?

Form N 139 is designed for individuals to request a tax refund claim withholding. It allows taxpayers to ensure they receive the correct amount of tax refund based on their income and withholdings during the tax year.

-

How can airSlate SignNow help me with form N 139?

airSlate SignNow provides an efficient platform to eSign and send your form N 139 securely. With its user-friendly interface, you can complete and submit your tax documents quickly, ensuring compliance and reducing delays in processing.

-

Is airSlate SignNow cost-effective for sending form N 139?

Yes, airSlate SignNow is a cost-effective solution for businesses needing to send form N 139 and other documents. Our pricing plans are designed to suit various business sizes, making electronic signatures accessible without breaking the budget.

-

What features does airSlate SignNow offer for form N 139?

airSlate SignNow offers features like secure eSigning, document templates, and automated reminders for your form N 139. These tools simplify the signing process, ensuring you can manage your documents efficiently.

-

Can I integrate airSlate SignNow with other applications for form N 139?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to streamline the submission of form N 139. Integrating with your existing tools can enhance productivity and document management.

-

What are the benefits of using airSlate SignNow for tax documents like form N 139?

The primary benefits of using airSlate SignNow for tax documents like form N 139 include increased efficiency, reduced paper usage, and improved security. Our platform ensures that your sensitive information is protected while simplifying the entire signing process.

-

Is airSlate SignNow user-friendly for filing form N 139?

Yes, airSlate SignNow is designed with user experience in mind. Even if you're not tech-savvy, you can easily navigate through the process of preparing and submitting form N 139 without any hassle.

Get more for State Earned Income Tax Credit

Find out other State Earned Income Tax Credit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors