Mi Sales Tax Form 3421

What is the Mi Sales Tax Form 3421

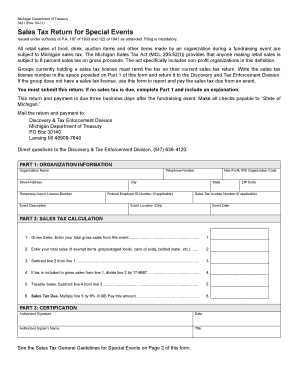

The Mi Sales Tax Form 3421 is a document used by businesses in Michigan to report and remit sales tax to the state. This form is essential for ensuring compliance with Michigan's sales tax regulations. It captures details about taxable sales, exemptions, and the total sales tax owed. Completing this form accurately is crucial for maintaining good standing with the Michigan Department of Treasury.

How to use the Mi Sales Tax Form 3421

Using the Mi Sales Tax Form 3421 involves filling out specific sections that detail your business's sales activities. Start by entering your business information, including your name, address, and sales tax identification number. Next, report your total sales, including any exempt sales. Calculate the sales tax owed based on the applicable rates. Finally, ensure that all figures are accurate before submitting the form to the state.

Steps to complete the Mi Sales Tax Form 3421

Completing the Mi Sales Tax Form 3421 requires several steps:

- Gather necessary financial records, including sales receipts and exemption certificates.

- Fill in your business information, including name, address, and sales tax ID.

- Report total sales and any exempt sales in the designated sections.

- Calculate the sales tax due based on the reported totals.

- Review the form for accuracy, ensuring all entries are correct.

- Submit the completed form electronically or via mail, following the guidelines provided by the Michigan Department of Treasury.

Legal use of the Mi Sales Tax Form 3421

The Mi Sales Tax Form 3421 is legally recognized as a valid document for reporting sales tax in Michigan. To ensure its legal standing, it must be completed accurately and submitted in accordance with state regulations. Utilizing a reliable digital platform for completion and submission can enhance the form's integrity, as it provides secure eSignature options and maintains compliance with relevant eSignature laws.

Form Submission Methods

The Mi Sales Tax Form 3421 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Completing and submitting the form electronically through the Michigan Department of Treasury's website.

- Mail: Printing the completed form and sending it via postal service to the designated address.

- In-Person: Delivering the form directly to a local Michigan Department of Treasury office.

Filing Deadlines / Important Dates

Filing deadlines for the Mi Sales Tax Form 3421 are critical for compliance. Businesses must be aware of the due dates, which typically align with the sales tax reporting period. Common deadlines include:

- Monthly filers: Due on the 20th of the month following the reporting period.

- Quarterly filers: Due on the 20th of the month following the end of the quarter.

- Annual filers: Due on January 31 of the following year.

Quick guide on how to complete mi sales tax form 3421

Handle Mi Sales Tax Form 3421 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Mi Sales Tax Form 3421 across any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The easiest method to modify and electronically sign Mi Sales Tax Form 3421 with ease

- Obtain Mi Sales Tax Form 3421 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as an original wet ink signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Mi Sales Tax Form 3421 to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Mi Sales Tax Form 3421?

The Mi Sales Tax Form 3421 is a document used by businesses in Michigan to report and pay sales tax. It's essential for compliance with state tax regulations and ensures that your business remains in good standing. Utilizing airSlate SignNow streamlines the process of managing and submitting the Mi Sales Tax Form 3421 electronically.

-

How can airSlate SignNow help with the Mi Sales Tax Form 3421?

airSlate SignNow allows businesses to easily fill out and eSign the Mi Sales Tax Form 3421 from any device. The platform simplifies document management, reducing the time needed to prepare and submit your form. Plus, it provides a secure way to store and share your submitted forms.

-

Is there a cost associated with using airSlate SignNow for the Mi Sales Tax Form 3421?

Yes, using airSlate SignNow involves a subscription fee which varies depending on the plan you choose. However, the cost is often outweighed by the time and resources saved when managing the Mi Sales Tax Form 3421. Additionally, the ease of use and added features can enhance overall business efficiency.

-

Can I integrate airSlate SignNow with other software for managing the Mi Sales Tax Form 3421?

Absolutely! airSlate SignNow offers various integrations with popular business software, allowing seamless management of the Mi Sales Tax Form 3421 within your existing workflows. This connectivity ensures that you can automate processes and reduce manual data entry, saving you valuable time.

-

What features does airSlate SignNow offer for handling the Mi Sales Tax Form 3421?

airSlate SignNow provides features such as templates for the Mi Sales Tax Form 3421, custom branding, and audit trails for tracking document changes. These functionalities ensure accuracy and compliance while enhancing your document signing experience. Furthermore, its user-friendly interface helps streamline your workflow.

-

How secure is airSlate SignNow when using the Mi Sales Tax Form 3421?

Security is a top priority for airSlate SignNow. When handling the Mi Sales Tax Form 3421, your data is encrypted and stored securely, ensuring that sensitive information remains protected. The platform also complies with industry standards, providing you with peace of mind when conducting business transactions.

-

Can I access my Mi Sales Tax Form 3421 from mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to access and manage your Mi Sales Tax Form 3421 on-the-go. Whether you're at the office or out in the field, you can easily fill out, eSign, and submit your form anytime, anywhere. This flexibility is ideal for busy professionals.

Get more for Mi Sales Tax Form 3421

- Small business accounting package vermont form

- Company employment policies and procedures package vermont form

- Vt child form

- Newly divorced individuals package vermont form

- Contractors forms package vermont

- Power of attorney for sale of motor vehicle vermont form

- Wedding planning or consultant package vermont form

- Hunting forms package vermont

Find out other Mi Sales Tax Form 3421

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later