Form 944x for 2013

What is the Form 944x For

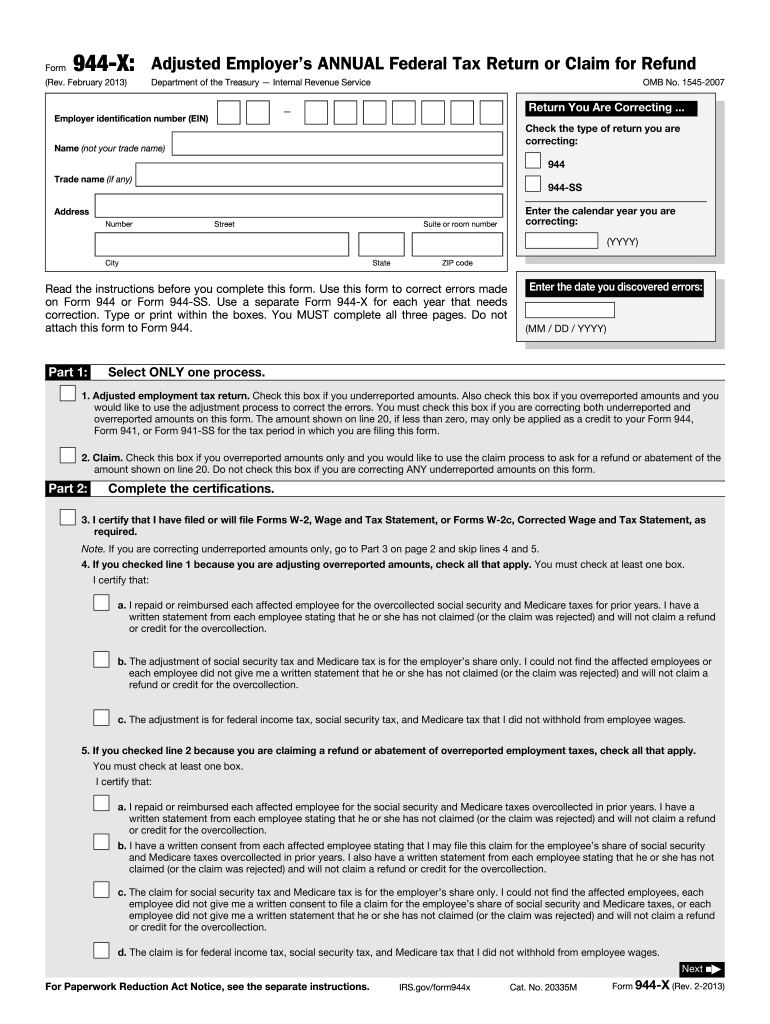

The Form 944x is a correction form used by employers in the United States to amend errors made on the annual Form 944, which is the Employer's Annual Federal Tax Return. This form is specifically designed for small businesses that report their payroll taxes annually rather than quarterly. The 944x allows employers to correct mistakes related to tax amounts, employee wages, and other essential details that may affect their tax liability and compliance with federal regulations.

How to use the Form 944x For

To use the Form 944x effectively, employers must first identify the errors on their original Form 944. Once the mistakes are recognized, they can complete the 944x by providing accurate information in the designated fields. This includes correcting any discrepancies in reported wages, taxes withheld, and any other relevant data. After filling out the form, employers should submit it to the IRS, ensuring that they follow the guidelines for submission to avoid further complications.

Steps to complete the Form 944x For

Completing the Form 944x involves several key steps:

- Review the original Form 944 to identify the errors that need correction.

- Obtain a copy of the Form 944x from the IRS website or other official sources.

- Fill out the form by entering the correct information in the appropriate sections.

- Provide a clear explanation of each correction made in the designated area.

- Double-check all entries for accuracy before submission.

- Submit the completed Form 944x to the IRS, ensuring it is sent to the correct address.

Legal use of the Form 944x For

The legal use of the Form 944x is crucial for maintaining compliance with federal tax laws. Employers must ensure that any corrections made are accurate and reflect true information to avoid potential penalties. The IRS accepts the Form 944x as a legitimate means of correcting previously filed tax returns, provided that it is completed correctly and submitted within the specified time frame. Failure to do so may result in fines or other legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 944x are aligned with the original Form 944 submission dates. Employers must file the Form 944 by January 31 of the following year for the previous tax year. If corrections are necessary, the Form 944x should be submitted as soon as the errors are discovered, ideally within three years of the original filing date. Timeliness is essential to avoid penalties and ensure compliance with IRS regulations.

Penalties for Non-Compliance

Employers who fail to file the Form 944 or the Form 944x correctly and on time may face various penalties. These can include fines for late filing, interest on unpaid taxes, and potential audits by the IRS. Additionally, inaccuracies in reported information can lead to further scrutiny and complications in future filings. It is important for employers to address any errors promptly to mitigate these risks.

Quick guide on how to complete form 944x for 2013

Finalize Form 944x For effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can locate the right form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, alter, and electronically sign your documents promptly without delays. Manage Form 944x For on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to alter and electronically sign Form 944x For with ease

- Obtain Form 944x For and then click Retrieve Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Finish button to save your modifications.

- Choose how you wish to send your form, either by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Form 944x For and ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944x for 2013

Create this form in 5 minutes!

How to create an eSignature for the form 944x for 2013

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is Form 944x For and how does it work?

Form 944x For is used by employers to correct errors on previously filed Form 944, the Employer's Annual Federal Tax Return. It allows businesses to adjust the reported amounts for payroll taxes, ensuring compliance with IRS regulations. By using airSlate SignNow, you can quickly eSign and submit Form 944x For, making the process seamless and efficient.

-

How can airSlate SignNow help with Form 944x For submissions?

airSlate SignNow simplifies the process of submitting Form 944x For by enabling you to create, send, and eSign necessary corrections digitally. Our intuitive platform streamlines the workflow, reducing the time and effort required to manage your payroll tax forms. With secure storage and easy access, you can ensure that your submissions are accurate and timely.

-

Is there a cost associated with using airSlate SignNow for Form 944x For?

Yes, airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. You'll find a variety of options to fit your needs, whether you're a small business or a large enterprise. By using airSlate SignNow for Form 944x For, you can save on printing and mailing costs, making it a cost-effective choice.

-

What features does airSlate SignNow include for managing Form 944x For?

airSlate SignNow includes features like customizable templates, in-app signing, and real-time tracking for Form 944x For. These tools help you manage your documents efficiently, ensuring that all corrections are made swiftly and accurately. Additionally, you will benefit from automated reminders and secure document storage.

-

Can I integrate airSlate SignNow with other software for Form 944x For?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and accounting software. This allows you to easily import and manage your Form 944x For documents alongside your other business tools. Utilizing these integrations enhances productivity and keeps your workflows organized.

-

What are the benefits of using airSlate SignNow for Form 944x For?

Using airSlate SignNow for Form 944x For brings signNow advantages, including increased accuracy, reduced processing time, and enhanced security. You can easily track the status of your submissions in real-time, ensuring compliance with IRS requirements. Moreover, our platform's user-friendly interface makes it accessible for everyone, regardless of technical expertise.

-

How secure is my data when using airSlate SignNow for Form 944x For?

airSlate SignNow prioritizes the security of your data through advanced encryption and secure storage practices. When you submit Form 944x For through our platform, you can be confident that your sensitive information is protected from unauthorized access. We also comply with industry standards to ensure your peace of mind.

Get more for Form 944x For

- Tenants maintenance repair request form indiana

- Guaranty attachment to lease for guarantor or cosigner indiana form

- Amendment to lease or rental agreement indiana form

- Warning notice due to complaint from neighbors indiana form

- Lease subordination agreement indiana form

- Apartment rules and regulations indiana form

- Agreed cancellation of lease indiana form

- Amendment of residential lease indiana form

Find out other Form 944x For

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors