Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return or Claim for Refund 2011

What is the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

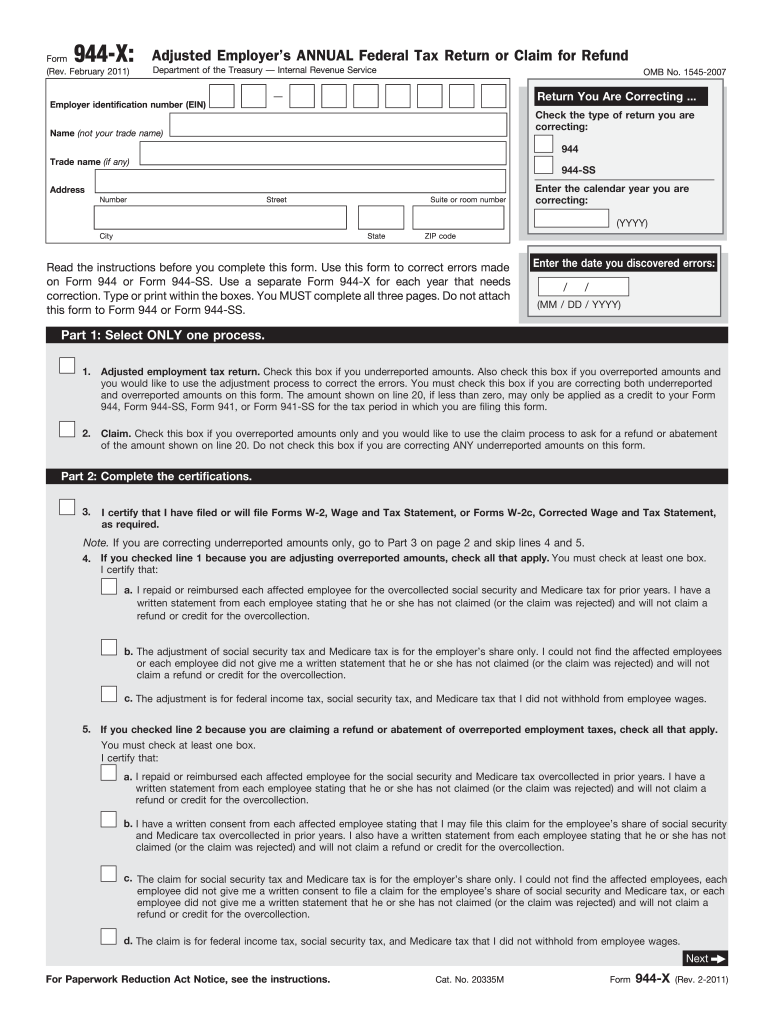

The Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund is a crucial document used by employers in the United States to correct errors made on a previously submitted Form 944. This form allows employers to adjust their reported federal tax liabilities, ensuring compliance with IRS regulations. It is specifically designed for small employers who report their annual payroll taxes. The adjustments may relate to overreported or underreported amounts, allowing for accurate tax filings and potential refunds.

Steps to complete the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

Completing the Form 944 X involves several important steps to ensure accuracy and compliance. Begin by obtaining the correct version of the form from the IRS website or authorized sources. Next, review your original Form 944 to identify the discrepancies that need correction. Fill out the 944 X by providing the necessary information, including your employer identification number (EIN), the tax year, and the specific adjustments being made. Ensure that you clearly indicate the amounts being corrected and provide explanations for each adjustment. Finally, double-check all entries for accuracy before submitting the form to the IRS.

How to obtain the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

The Form 944 X can be obtained directly from the IRS website. Employers can navigate to the forms section to download the latest version of the form. It is important to ensure that you are using the most current version to avoid any compliance issues. Additionally, forms can be requested through IRS customer service if needed. Employers should also keep in mind that the form is available in both digital and paper formats, allowing for flexible options based on preference.

Legal use of the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

The legal use of the Form 944 X is governed by IRS regulations, which stipulate that employers must accurately report their payroll taxes. This form serves as a legal means to rectify any errors in previously submitted tax returns, ensuring that employers remain compliant with federal tax laws. Proper completion and submission of the form can prevent potential penalties and interest charges associated with incorrect filings, making it an essential tool for maintaining good standing with the IRS.

Filing Deadlines / Important Dates

Employers must adhere to specific filing deadlines when submitting the Form 944 X. Generally, the form should be filed as soon as discrepancies are identified to minimize any potential penalties. The IRS recommends that employers file the corrected form within three years of the original filing date. It is crucial to stay informed about any changes in deadlines or requirements by regularly checking the IRS website or consulting with a tax professional.

Form Submission Methods (Online / Mail / In-Person)

The Form 944 X can be submitted to the IRS through various methods, including online and mail options. While electronic submission may not be available for this specific form, employers can complete it digitally and print it for mailing. The completed form should be sent to the appropriate IRS address based on the employer's location. In-person submissions are generally not recommended for this type of form, as mailing is the standard procedure.

Quick guide on how to complete form 944 x rev february 2011 adjusted employers annual federal tax return or claim for refund

Prepare Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund seamlessly on any device

Digital document management has gained traction with organizations and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to modify and eSign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund effortlessly

- Locate Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944 x rev february 2011 adjusted employers annual federal tax return or claim for refund

Create this form in 5 minutes!

How to create an eSignature for the form 944 x rev february 2011 adjusted employers annual federal tax return or claim for refund

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund is used by employers to correct errors on previously filed Form 944. It allows employers to report adjustments for the federal tax return or claim refunds for overpaid taxes. Understanding how to accurately fill this form is crucial to ensure compliance with the IRS.

-

How can airSlate SignNow assist with Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

airSlate SignNow streamlines the process of completing and submitting the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund by allowing users to easily fill out templates and securely sign documents online. This simplifies the workflow and ensures that all necessary signatures are collected efficiently.

-

What are the pricing options for airSlate SignNow when using it for tax forms like Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

airSlate SignNow offers flexible pricing plans which provide access to features tailored for handling important documents, including Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund. Users can choose from various subscription tiers based on their business needs, ensuring an affordable solution for document management.

-

Are there any limits on the number of documents I can send using airSlate SignNow for Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

With airSlate SignNow, users can enjoy unlimited document sending depending on the selected plan. This is particularly beneficial for businesses frequently processing documents like the Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund, ensuring that operations run smoothly without interruptions.

-

What are the key features of airSlate SignNow that help with Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

Key features of airSlate SignNow include customizable templates, electronic signing, and audit trails that offer security and transparency. These features are particularly useful when working with essential documents like Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund, ensuring accuracy and compliance during the submission process.

-

Can I integrate airSlate SignNow with other software for managing Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

Yes, airSlate SignNow offers integrations with various business applications that can help streamline the management of Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund. This allows users to improve efficiency by connecting their existing workflows and leveraging data across platforms.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund?

Absolutely, airSlate SignNow takes security seriously and employs industry-standard encryption and compliance protocols. This ensures that sensitive documents, including Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund, are protected during the signing and submission process.

Get more for Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- Quitclaim deed from individual to two individuals in joint tenancy indiana form

- Indiana notice 497306774 form

- Quitclaim deed by two individuals to husband and wife indiana form

- Warranty deed from two individuals to husband and wife indiana form

- Quitclaim deed two individuals or husband and wife as grantors both by attorney in fact to an individual grantee indiana form

- Warranty deed two individuals or husband and wife as grantors both by attorney in fact to an individual grantee indiana form

- Two individualshusband and wife to one individuals form

- Quitclaim deed from a limited liability company to an individual indiana form

Find out other Form 944 X Rev February Adjusted Employer's Annual Federal Tax Return Or Claim For Refund

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation