944x 2018

What is the 944x?

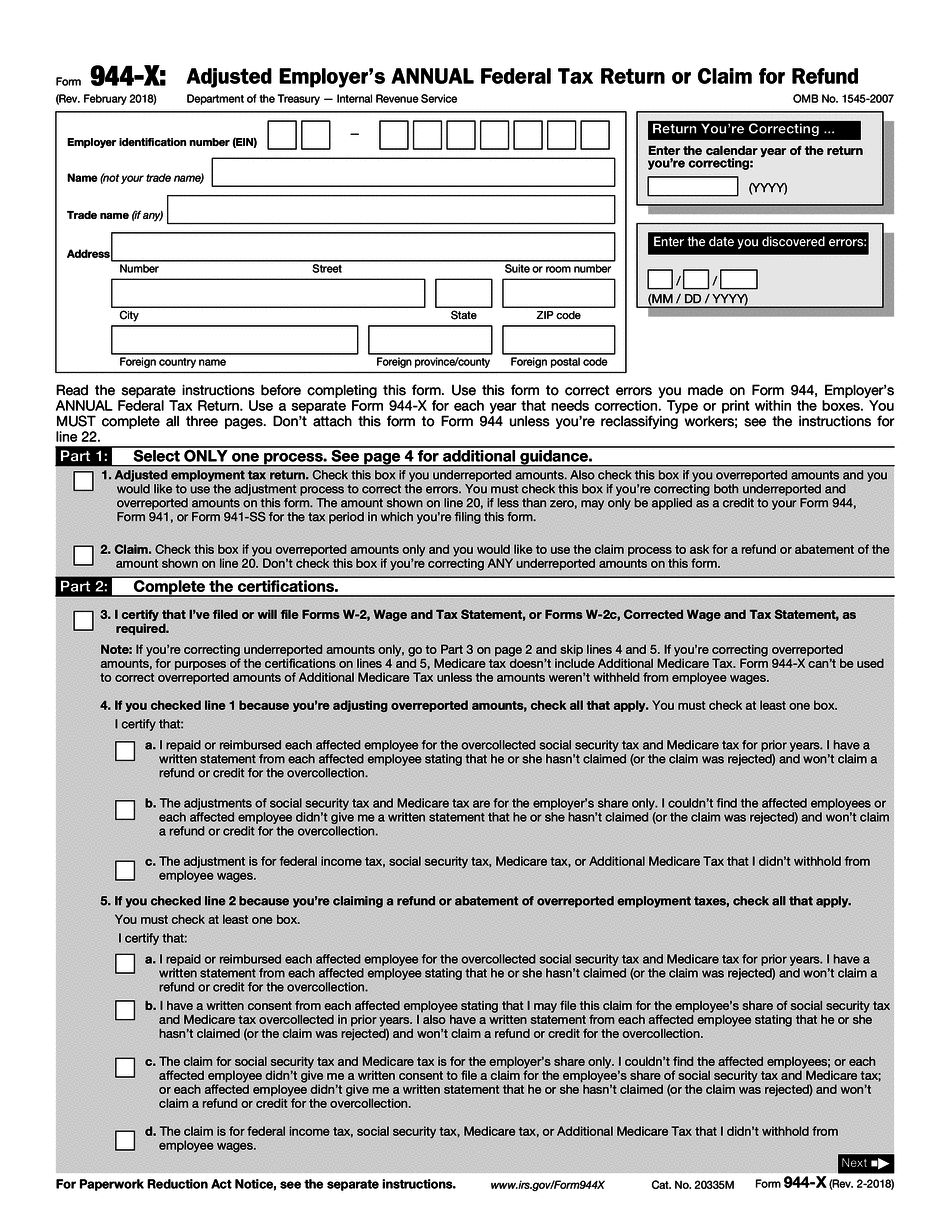

The 944x is an IRS form used to amend the previously filed Form 944, which is designed for employers who report annual payroll taxes. This form allows businesses to correct errors or make changes to their payroll tax filings for a specific tax year. It is essential for ensuring that the reported information is accurate, as inaccuracies can lead to penalties or issues with tax compliance.

Steps to complete the 944x

Completing the 944x involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation related to the original Form 944 submission. Next, clearly indicate the tax year for which you are amending the return. Fill out the form with the corrected information, ensuring that all figures are accurate. Be sure to explain the reason for the amendment in the designated section. Finally, review the completed form for any errors before submitting it to the IRS.

Legal use of the 944x

The 944x must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to the guidelines set forth by the IRS regarding amendments to tax filings. The form should be submitted within the appropriate time frame, typically within three years of the original filing date. Utilizing a reliable eSignature platform can help ensure that the submission process is secure and compliant with legal standards.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 944x. These guidelines include instructions on how to fill out each section of the form, as well as the necessary documentation to accompany the amendment. It is crucial to follow these instructions closely to avoid delays or rejections of the amended return. The IRS also outlines the penalties for non-compliance, emphasizing the importance of accurate reporting.

Filing Deadlines / Important Dates

Timeliness is critical when submitting the 944x. The IRS requires that amended returns be filed within three years from the original filing date of the Form 944. Additionally, it is important to be aware of any specific deadlines related to the tax year being amended. Missing these deadlines could result in penalties or the inability to correct errors in the original filing.

Required Documents

When filing the 944x, certain documents may be required to support the amendment. This includes copies of the original Form 944, any relevant payroll records, and documentation that substantiates the changes being made. Having these documents ready can facilitate a smoother filing process and help ensure that the IRS has all necessary information to process the amendment efficiently.

Form Submission Methods (Online / Mail / In-Person)

The 944x can be submitted through various methods, depending on the preferences of the filer. It can be mailed directly to the IRS at the address specified for Form 944 submissions. Additionally, businesses may have the option to submit the form electronically through approved e-filing systems. Each method has its own processing times, so it is advisable to choose the method that best meets your needs for timely submission.

Quick guide on how to complete 944x

Complete 944x effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, edit, and electronically sign your documents promptly without delays. Manage 944x on any platform with airSlate SignNow apps for Android or iOS and enhance any document-centered workflow today.

The easiest way to modify and eSign 944x with ease

- Find 944x and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new copies. airSlate SignNow fulfills your document management requirements in a few clicks from any device of your choice. Edit and eSign 944x and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 944x

Create this form in 5 minutes!

How to create an eSignature for the 944x

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

How to generate an eSignature for a PDF file on Android devices

People also ask

-

What is 944 x and how does it relate to airSlate SignNow?

944 x refers to the robust features and capabilities offered by airSlate SignNow for electronic signatures and document management. With this solution, businesses can efficiently send, sign, and manage documents while ensuring security and compliance. By simplifying the eSigning process, airSlate SignNow enhances productivity and streamlines workflows.

-

What are the pricing plans available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Whether you're a small startup or a large enterprise, you can choose from flexible subscription options. The pricing includes various features that support document eSigning and management, ensuring businesses can leverage the full power of the 944 x solutions.

-

What features does airSlate SignNow provide?

airSlate SignNow provides a comprehensive suite of features, including eSigning, document templates, and real-time tracking of signed documents. With its user-friendly interface, the platform supports seamless document workflows while enhancing compliance and security. These innovative features inherently embody the advantages of the 944 x framework for effective business communication.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can signNowly reduce turnaround times for document signing and approval processes. The platform’s integration of 944 x features allows for improved efficiency, cost savings, and greater accuracy in handling critical documents. Ultimately, it empowers teams to be more productive and responsive.

-

Does airSlate SignNow integrate with other tools and platforms?

Yes, airSlate SignNow integrates seamlessly with popular productivity tools and software, enhancing your existing workflows. This includes integrations with CRM systems, cloud storage, and communication platforms. By leveraging the 944 x integration capabilities, businesses can synchronize their operations more effectively.

-

Is airSlate SignNow secure for handling sensitive information?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your sensitive information is protected with industry-standard encryption and secure data storage. The platform meets stringent regulations, creating a trustworthy environment for managing documents with the 944 x eSignature capabilities.

-

Can I customize my document templates in airSlate SignNow?

Yes, airSlate SignNow allows users to create and customize document templates to streamline the signing process. This feature provides flexibility, enabling companies to tailor documents according to their specific needs. Customized templates are a crucial aspect of the 944 x functionality for efficient document management.

Get more for 944x

- Florida peer services handbook florida department of form

- Address city amp state form

- Spr participant contact form program enrollment

- This form must be typed sacoreccom

- Cps reimbursement form

- Application for plan examination for derry township form

- Lausd parking form

- Community choices waiver provider manual lamedicaidcom form

Find out other 944x

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free