Instructions for Form 945 X Rev February IRS Gov 2014

What is the Instructions For Form 945 X Rev February IRS gov

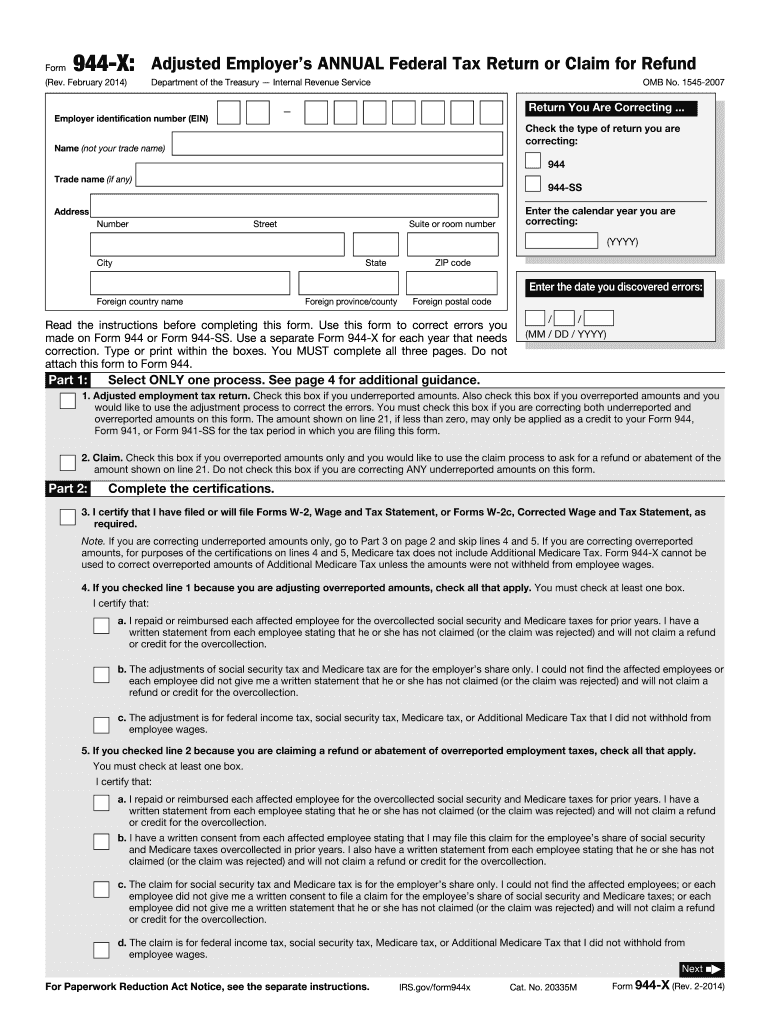

The Instructions For Form 945 X Rev February is a document provided by the IRS to guide taxpayers in correcting errors on their previously filed Form 945, which is used to report withheld federal income tax. This form is essential for employers who need to amend their annual returns regarding nonpayroll withholding. Understanding these instructions is crucial for ensuring compliance with federal tax regulations and avoiding potential penalties.

Steps to complete the Instructions For Form 945 X Rev February IRS gov

Completing the Instructions For Form 945 X Rev February involves several key steps. First, gather all relevant documents, including the original Form 945 and any supporting information related to the errors being corrected. Next, carefully read through the instructions to understand the specific corrections required. Fill out the form accurately, ensuring that all information aligns with the original submission and the corrections being made. Finally, review the completed form for accuracy before submission.

Legal use of the Instructions For Form 945 X Rev February IRS gov

The legal use of the Instructions For Form 945 X Rev February is significant for ensuring that all corrections made to the original Form 945 comply with IRS regulations. It is important to follow the guidelines provided in the instructions to maintain the legal validity of the corrections. Failure to adhere to these guidelines can result in penalties or legal issues, emphasizing the necessity of understanding and applying the instructions correctly.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions For Form 945 X Rev February are crucial for compliance. Generally, the amended form must be filed within three years from the date of the original filing or within two years from the date the tax was paid, whichever is later. Keeping track of these dates helps avoid unnecessary penalties and ensures timely processing of the corrections.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Instructions For Form 945 X Rev February can be done through various methods. Taxpayers can choose to file the form online using approved e-filing services, which can expedite processing. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location. In-person submissions are typically not available for this form, making online and mail submissions the primary options.

Penalties for Non-Compliance

Non-compliance with the Instructions For Form 945 X Rev February can lead to significant penalties. If the corrections are not filed timely or accurately, the IRS may impose fines or interest on any unpaid taxes. Understanding the potential consequences of non-compliance underscores the importance of following the instructions closely to avoid financial repercussions.

Quick guide on how to complete instructions for form 945 x rev february 2014 irsgov

Easily prepare Instructions For Form 945 X Rev February IRS gov on any device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, as you can easily access the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Instructions For Form 945 X Rev February IRS gov on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Instructions For Form 945 X Rev February IRS gov effortlessly

- Find Instructions For Form 945 X Rev February IRS gov and click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight important sections of your documents or mask sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Instructions For Form 945 X Rev February IRS gov to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 945 x rev february 2014 irsgov

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 945 x rev february 2014 irsgov

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

How to make an electronic signature for a PDF document on Android

People also ask

-

What are the Instructions For Form 945 X Rev February IRS gov?

The Instructions For Form 945 X Rev February IRS gov provide guidelines for correcting mistakes made on previously filed IRS Form 945. This form is essential for employers who need to report and pay withheld federal taxes. Understanding these instructions can ensure compliance and avoid potential penalties.

-

How can airSlate SignNow assist with the completion of Form 945 X?

airSlate SignNow simplifies the process of filling out the Instructions For Form 945 X Rev February IRS gov by allowing users to electronically complete and eSign their documents. With our intuitive interface, you can easily navigate the form and ensure all necessary corrections are made efficiently. This saves time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for IRS forms?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses of all sizes. Pricing is competitive and provides access to a user-friendly platform that streamlines the process of handling the Instructions For Form 945 X Rev February IRS gov. Investing in our solution can save you money in the long run by improving compliance and operational efficiency.

-

What features does airSlate SignNow offer for managing IRS documents?

Our platform includes features designed specifically for managing IRS documents like the Instructions For Form 945 X Rev February IRS gov. Users can easily create templates, track document statuses, and securely store completed forms. Additionally, the platform allows for seamless eSigning, which enhances the user experience and speeds up the submission process.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow seamlessly integrates with a wide range of applications, enhancing your workflow when handling documents related to Instructions For Form 945 X Rev February IRS gov. These integrations can connect your current systems with our platform, allowing for a more cohesive user experience and improved efficiency. Popular integrations include CRM systems, cloud storage solutions, and more.

-

What are the benefits of using airSlate SignNow for IRS forms?

Using airSlate SignNow for IRS forms like the Instructions For Form 945 X Rev February IRS gov offers numerous benefits. It streamlines the eSigning process, enhances compliance through accurate document handling, and reduces the time spent on administrative tasks. Additionally, our platform is cost-effective, making it an ideal solution for businesses.

-

Can airSlate SignNow help with electronic filing of IRS forms?

While airSlate SignNow facilitates the completion and eSigning of IRS forms, it is important to note that electronic filing must be done through the IRS website or authorized e-file providers. However, our platform enhances your experience with the Instructions For Form 945 X Rev February IRS gov by allowing you to prepare your documents efficiently and accurately before submitting them.

Get more for Instructions For Form 945 X Rev February IRS gov

- Verification of creditors matrix indiana form

- Verification of creditors matrix indiana 497307019 form

- Correction statement and agreement indiana form

- Indiana closing form

- Flood zone statement and authorization indiana form

- Name affidavit of buyer indiana form

- Name affidavit of seller indiana form

- Non foreign affidavit under irc 1445 indiana form

Find out other Instructions For Form 945 X Rev February IRS gov

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe