Form 944x for 2012

What is the Form 944x For

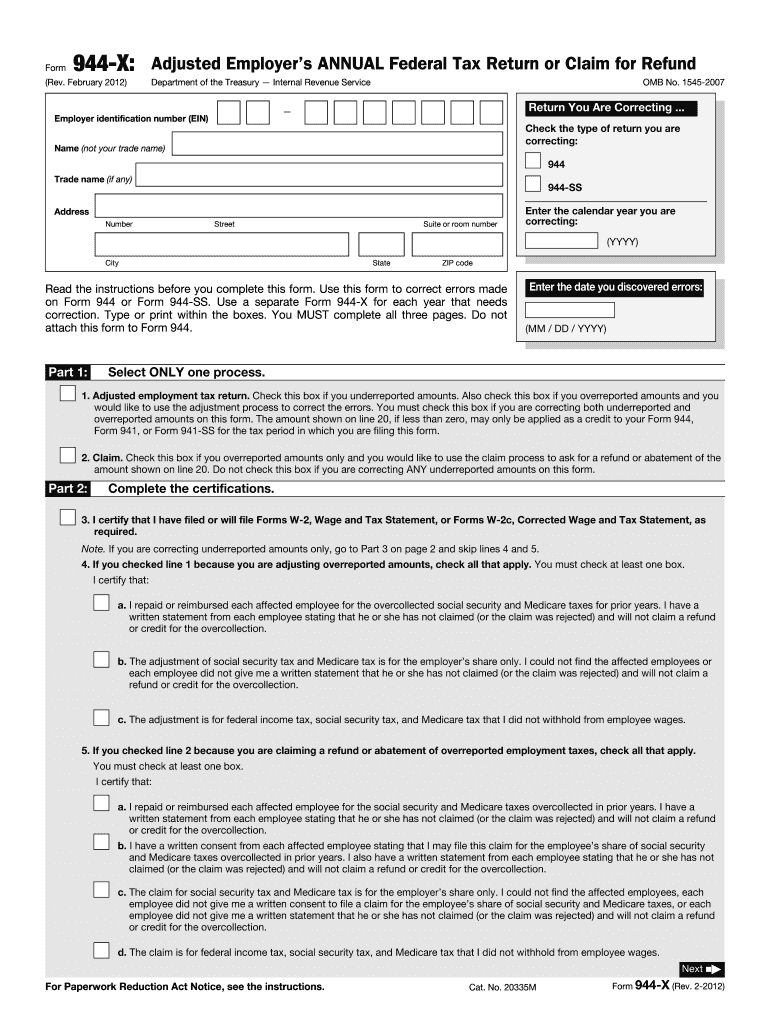

The Form 944x is a correction form used by employers to amend their previously filed Form 944, which is the annual return for reporting payroll taxes. This form is specifically designed for employers whose annual payroll tax liability is less than one thousand dollars. The 944x allows employers to correct any errors made in the original filing, ensuring accurate reporting of wages and taxes withheld. It is essential for maintaining compliance with IRS regulations and for avoiding potential penalties associated with incorrect filings.

How to use the Form 944x For

To use the Form 944x, employers should first identify the specific errors in their previously filed Form 944. Common corrections include adjustments to reported wages, tax amounts, or employee information. After identifying the necessary changes, employers should complete the Form 944x, ensuring that all corrections are clearly indicated. It is important to include an explanation of the corrections made, as this can help the IRS understand the context of the changes. Once completed, the form should be submitted to the IRS according to the guidelines provided.

Steps to complete the Form 944x For

Completing the Form 944x involves several key steps:

- Review the original Form 944 for errors.

- Obtain the Form 944x from the IRS website or through your tax professional.

- Fill out the form, clearly indicating the corrections needed.

- Provide a detailed explanation for each correction in the designated section.

- Double-check all information for accuracy before submission.

- Submit the completed Form 944x to the IRS, either electronically or by mail.

Legal use of the Form 944x For

The legal use of Form 944x is governed by IRS guidelines, which dictate that employers must file this form to correct any inaccuracies in their original Form 944 submission. It is crucial for employers to ensure that all corrections comply with federal tax laws to avoid penalties. The form must be signed and dated by an authorized representative of the business, which adds a layer of legal validity to the corrections being made. Adhering to these guidelines ensures that the amended return is recognized as legally binding.

Filing Deadlines / Important Dates

Filing deadlines for the Form 944x are critical to avoid penalties. Employers must submit the Form 944x as soon as they discover an error in their original Form 944. The IRS recommends filing the correction in the same tax year as the original form to ensure timely processing. If the correction involves a significant change that affects the employer's tax liability, it is advisable to file the 944x promptly to mitigate potential penalties or interest charges.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 944x. The form can be filed electronically through the IRS e-file system, which is the preferred method for many due to its speed and efficiency. Alternatively, employers can mail a paper version of the form to the appropriate IRS address, which can be found on the IRS website. In-person submission is generally not available for this form, making electronic filing or mailing the primary methods for submission.

Quick guide on how to complete form 944x for 2012

Complete Form 944x For effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 944x For on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Form 944x For effortlessly

- Locate Form 944x For and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to share your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 944x For and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944x for 2012

Create this form in 5 minutes!

How to create an eSignature for the form 944x for 2012

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the Form 944x For, and how can it help my business?

The Form 944x For is an amended version of the IRS Form 944, designed to correct any errors made in previous filings. This form is essential for businesses to ensure compliance and accurate reporting. By using airSlate SignNow, you can easily eSign and send your Form 944x For, streamlining the correction process and avoiding potential penalties.

-

How much does it cost to use airSlate SignNow for Form 944x For?

airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses handling documents like the Form 944x For. Our plans are competitively priced and designed to provide value through features such as eSigning and document management. You can choose a plan that fits your budget without compromising on essential functionalities.

-

What features does airSlate SignNow offer for managing the Form 944x For?

AirSlate SignNow includes a range of features for managing the Form 944x For, such as customizable templates, electronic signatures, and secure cloud storage. These tools simplify the submission process and enhance document organization. With airSlate SignNow, you can ensure your Form 944x For is handled efficiently and securely.

-

Can I integrate airSlate SignNow with my current software for Form 944x For?

Yes, airSlate SignNow offers seamless integrations with various platforms, enabling you to manage your Form 944x For alongside your existing software. Whether you use CRM systems, cloud storage, or accounting software, our integrations ensure a smooth workflow. This makes it easier to keep all documents streamlined and accessible.

-

How long does it take to eSign and send the Form 944x For with airSlate SignNow?

Using airSlate SignNow, you can eSign and send your Form 944x For in just minutes. Our user-friendly interface allows for quick completion, reducing the time spent on paperwork. Businesses can benefit from this swift process, ensuring compliance deadlines are met with confidence.

-

Is airSlate SignNow secure for sending sensitive documents like Form 944x For?

Absolutely, airSlate SignNow prioritizes security when handling sensitive documents such as the Form 944x For. We use advanced encryption technologies and comply with industry regulations to safeguard your information. Rest assured, your documents will remain confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 944x For compared to traditional methods?

Using airSlate SignNow for Form 944x For offers numerous benefits over traditional methods, such as speed, efficiency, and reduced paperwork. eSigning eliminates the need for physical signatures, drastically shortening the turnaround time. Additionally, digital document management reduces clutter and helps you maintain organized records.

Get more for Form 944x For

Find out other Form 944x For

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free