Form 944x for 2015

What is the Form 944x For

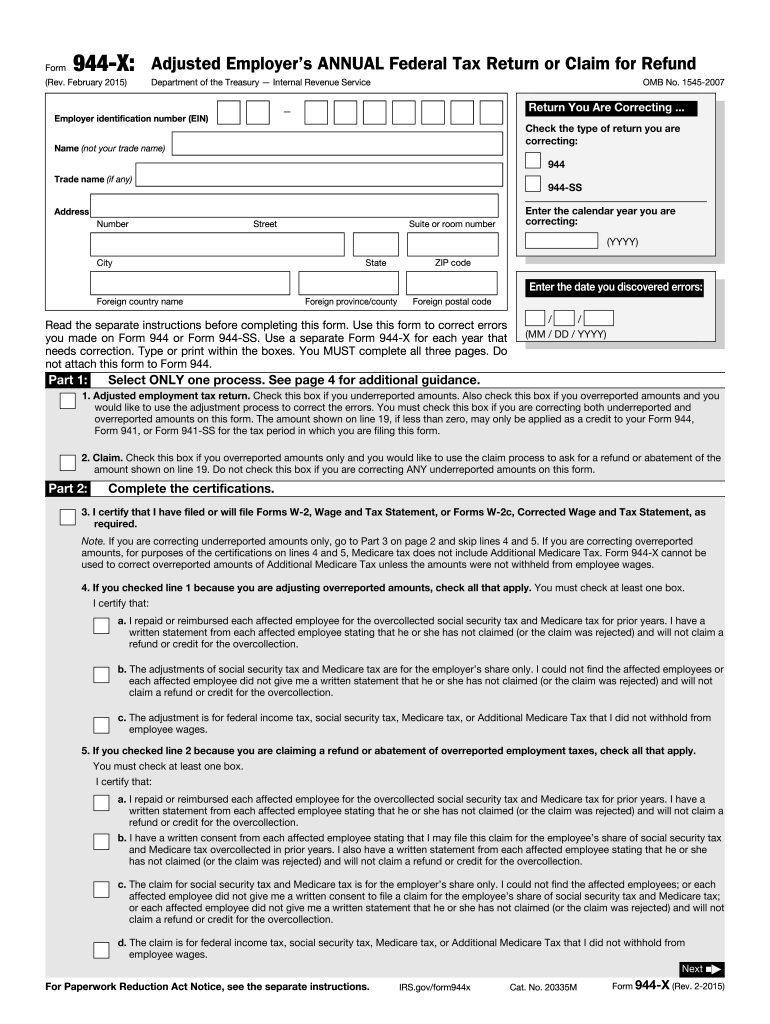

The Form 944x is a correction form used by employers to amend their previously filed Form 944, which is the annual payroll tax return for small businesses. This form is specifically designed for employers who report their annual federal payroll taxes, including Social Security, Medicare, and federal income tax withholding. If an employer discovers errors in their previously submitted Form 944, they must use Form 944x to correct these mistakes and ensure accurate reporting to the IRS.

How to use the Form 944x For

To effectively use the Form 944x, employers should first gather all relevant information regarding the errors made on the original Form 944. This includes identifying the specific line items that require correction. Once the errors are identified, the employer can fill out the Form 944x, providing the correct information in the designated fields. It is essential to clearly indicate the corrections being made, as well as the original amounts, to ensure clarity for IRS review.

Steps to complete the Form 944x For

Completing the Form 944x involves several key steps:

- Obtain a copy of the Form 944x from the IRS website or other reliable sources.

- Review the original Form 944 to identify the errors that need correction.

- Fill out the Form 944x, ensuring that the correct information is entered in the appropriate fields.

- Clearly indicate the original amounts alongside the corrected figures to avoid confusion.

- Sign and date the form to validate the corrections.

- Submit the completed Form 944x to the IRS, either electronically or via mail, according to the IRS guidelines.

Legal use of the Form 944x For

Using the Form 944x is legally required when an employer needs to correct errors on their previously filed Form 944. The IRS mandates accurate reporting of payroll taxes, and failure to correct mistakes can lead to penalties or legal issues. By submitting the Form 944x, employers fulfill their obligation to provide accurate tax information, which helps maintain compliance with federal tax laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 944x is crucial for compliance. Generally, the Form 944 must be filed annually by January 31 of the following year. If corrections are necessary, the Form 944x should be submitted as soon as the errors are identified. Employers should be aware that there is no specific deadline for filing the Form 944x, but timely corrections are encouraged to avoid potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Form 944x can be submitted to the IRS through various methods. Employers may choose to file electronically using the IRS e-file system, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the appropriate IRS address specified in the form instructions. In-person submissions are generally not accepted for this form. Employers should ensure they follow the submission guidelines to avoid delays in processing.

Quick guide on how to complete form 944x for 2015

Complete Form 944x For effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 944x For on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The simplest way to modify and eSign Form 944x For without hassle

- Find Form 944x For and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to deliver your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 944x For to ensure effective communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 944x for 2015

Create this form in 5 minutes!

How to create an eSignature for the form 944x for 2015

How to generate an eSignature for your Form 944x For 2015 online

How to generate an electronic signature for the Form 944x For 2015 in Google Chrome

How to generate an eSignature for putting it on the Form 944x For 2015 in Gmail

How to create an eSignature for the Form 944x For 2015 straight from your smartphone

How to make an eSignature for the Form 944x For 2015 on iOS devices

How to create an eSignature for the Form 944x For 2015 on Android OS

People also ask

-

What is Form 944x For and why do I need it?

Form 944x For is used to correct errors made on Form 944, which reports annual Federal Insurance Contributions Act (FICA) taxes. Businesses need this form to ensure accurate tax reporting and compliance with IRS regulations. By using airSlate SignNow, you can easily eSign and submit Form 944x For electronically, streamlining your tax correction process.

-

How does airSlate SignNow simplify the process of signing Form 944x For?

airSlate SignNow simplifies the signing process for Form 944x For by providing an intuitive interface that allows users to easily upload, fill out, and eSign their documents. With our platform, you can manage your forms securely and send them for signatures seamlessly, ensuring a hassle-free experience.

-

What features does airSlate SignNow offer for managing Form 944x For?

airSlate SignNow offers key features for managing Form 944x For, including document templates, cloud storage, and audit trails. These features ensure that your forms are consistent, securely stored, and that you can track the signing process effectively, enhancing your overall workflow.

-

Is there a cost associated with using airSlate SignNow for Form 944x For?

Yes, there is a cost associated with using airSlate SignNow, but our pricing plans are designed to be cost-effective for businesses of all sizes. Our subscription options provide access to essential features needed for managing Form 944x For efficiently, with transparent pricing that scales with your usage.

-

Can I integrate airSlate SignNow with other software to manage Form 944x For?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, such as CRMs and accounting tools, to help you manage Form 944x For more efficiently. This integration allows for automated workflows and better data management, saving you time and reducing errors.

-

What are the benefits of using airSlate SignNow for Form 944x For?

Using airSlate SignNow for Form 944x For offers numerous benefits, including improved efficiency, enhanced security, and reduced paper usage. Our platform allows you to complete tax corrections quickly and securely while maintaining compliance with IRS requirements.

-

How secure is my data when using airSlate SignNow for Form 944x For?

Your data is highly secure when using airSlate SignNow for Form 944x For. We employ advanced encryption protocols and comply with industry standards to protect your sensitive information. This ensures that your documents and signatures remain confidential and secure throughout the process.

Get more for Form 944x For

Find out other Form 944x For

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online